Why Do Transaction Fees Exist? Breaking Down Common Credit Card Charges in Hong Kong

Credit card networks (like Visa and Mastercard) often impose extra fees depending on the transaction type. Here are the three most common:1️⃣ FCC (Foreign Currency Conversion Fee)The most talked-about overseas transaction fee. When you spend abroad, your bank converts foreign currency into HKD and charges a fee—usually 1% to 2% of the transaction amount.Watch out: Exchange rates and fees aren’t shown instantly. You’ll only see the actual amount after 1–2 business days, and these fees are often hidden in the exchange rate—making your total cost higher than expected.2️⃣ DCC (Dynamic Currency Conversion)When paying overseas, merchants may ask: “Do you want to settle in HKD?” Sounds convenient, but it’s a trap!

- Merchants apply poor exchange rates and add 3%–5% extra fees

- Plus, you’ll pay a 1% Cross-Border Fee (CBF)

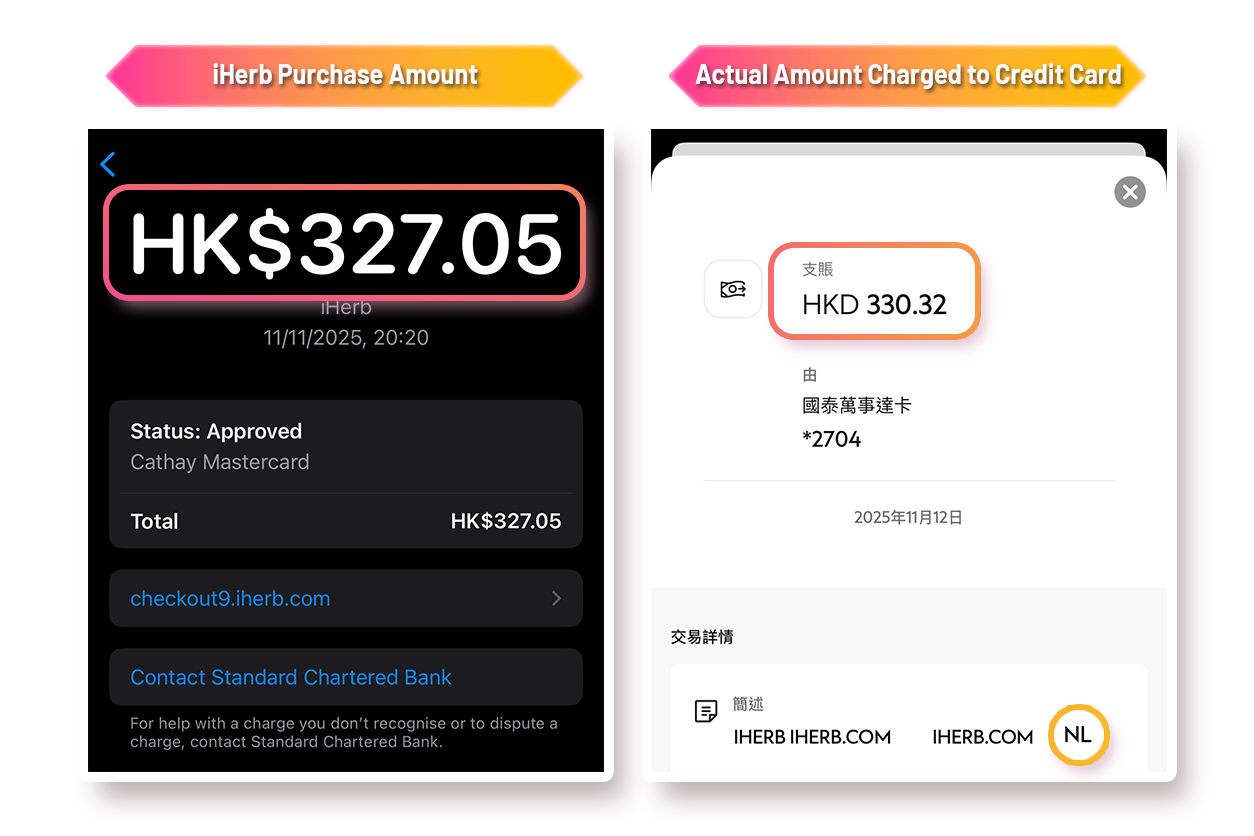

3️⃣ CBF (Cross-Border Fee)The sneaky fee that hits online shopping and everyday spending! Even if you pay in HKD or shop on a Hong Kong site, if the transaction is processed via an overseas server or the merchant is registered abroad, some credit cards may impose 1%–1.95% charge.Common overseas-registered merchants: Uber, Netflix, Spotify, Airbnb, Disney+, YouTube Premium, Google Services, Apple Services, iHerb etc.🔎 Example: iHerb Online Shopping (Paid in HKD, but the merchant is registered overseas)

- iHerb purchase amount: HKD 327.05

- 1% CBF: HKD 3.27

- Total charged on credit card: HKD 330.32 ❗

The screen displays are for illustrative purpose only.Hidden fees aren’t just for travel—they’re everywhere, even in daily online shopping and subscriptions!

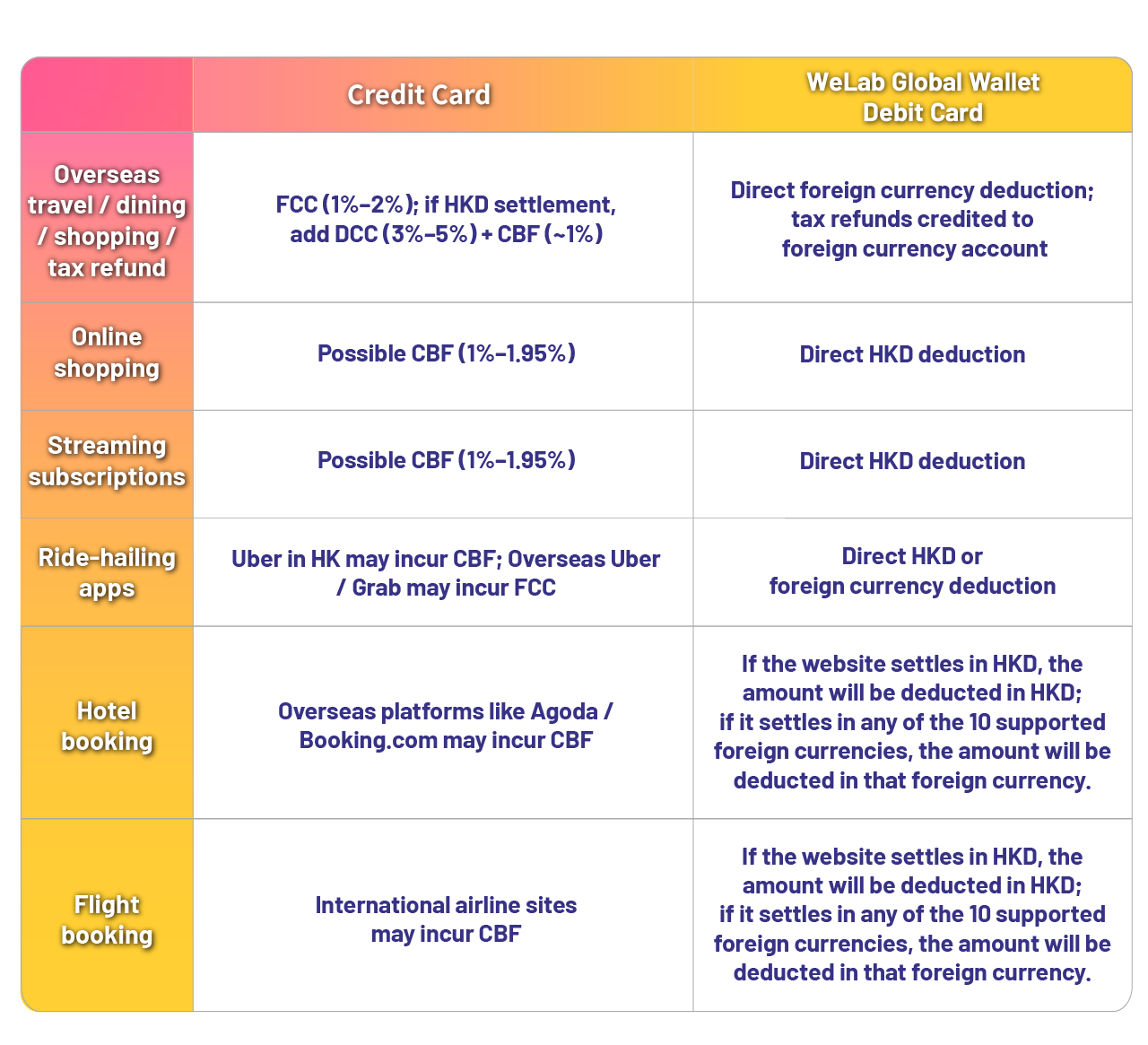

The screen displays are for illustrative purpose only.Hidden fees aren’t just for travel—they’re everywhere, even in daily online shopping and subscriptions!Credit Card vs. WeLab Global Wallet Debit Card: Which Saves More?

- Traditional Credit Cards: May charge FCC, DCC, and CBF for local and overseas transactions. Exchange rates depend on processing time, making cost control difficult.

- WeLab Global Wallet Debit Card: For 11 major currencies, we offer HKD 0 transaction fees¹, foreign currency spending uses your preloaded balance—no hidden charges, maximum savings!

- WeLab Bank helps you lock in exchange rates, so you don’t have to worry about currency fluctuations: Credit cards use the prevailing rate, making costs hard to control; but with WeLab Bank, you can exchange foreign currency in advance—whenever you see a good rate, lock it in anytime and save more on travel and online shopping!

Don’t want to pay extra fees for online shopping, travel, or everyday ride-hailing? Use the WeLab Global Wallet Debit Card! Whether you’re traveling, shopping online, or subscribing to streaming services, you won’t have to worry about hidden charges!

Don’t want to pay extra fees for online shopping, travel, or everyday ride-hailing? Use the WeLab Global Wallet Debit Card! Whether you’re traveling, shopping online, or subscribing to streaming services, you won’t have to worry about hidden charges!Smart Spending Tips: How to Swipe Without Paying Extra

1️⃣ Use AI to Compare Best FX Rates 📱2: Exchange foreign currency when rates are low and store it in your account for future travel or online shopping!👉 Learn More About AI Rate Compare👉AI Foreign Currency Exchange Tutorial2️⃣ Choose Fee-Free Payment Tools 💰: Example: WeLab Global Wallet Debit Card—HKD 0 transaction fees¹ in Japan, Australia, UK, Europe, US, and more.3️⃣ Avoid DCC 🙅♀️: Always pay in local currency—don’t let merchants convert for you.4️⃣ Check Credit Card Terms 📃: Read the terms and review statements regularly to avoid hidden charges.5️⃣ Debit Cards Offer Cash Rebates Too 🤩: Many may think only credit cards have rewards, but WeLab Global Wallet Debit Card offers up to 2% cash rebate3—perfect for travel spending!👉 Learn More About Up to 2% Cash RebateConclusion: Avoid Hidden Fees 🙅♀️ Choose WeLab Global Wallet Debit Card for Smarter Spending!

Transaction fees are everywhere—not just overseas trips, but online shopping, streaming subscriptions, and even local ride-hailing. FCC, DCC, and CBF charges are often hidden in exchange rates, making you pay more without realizing it.Want to stop paying extra? Choose a 0-fee payment tool! With WeLab Global Wallet Debit Card, enjoy HKD 0 transaction fees on 11 major currencies spending¹, direct foreign currency settlement, and hassle-free travel without carrying cash. Perfect for shopping, subscriptions, and everyday spending!🔥Download the WeLab Bank App now—open an account in just 5 minutes4 and start saving today!Remarks:(1) Overseas HKD 0 transaction fees is only applicable for the eligible 11 currencies, including HKD, JPY, USD, RMB, AUD, GBP, EUR, SGD, CAD, CHF and NZD. When making overseas transactions, customers may be offered the option to pay in HKD for foreign currency transactions (Dynamic Currency Conversion, DCC). This option is arranged directly by the overseas merchant and not provided by the card issuer or the Bank.(2) We collect the exchange rates from the websites or apps of the banks set out above using AI (Artificial Intelligence) and determine the best exchange rate for each currency among those banks. These exchange rates do not include any special promotions, discounts, offers, membership programs or other preferential rates (including but not limited to volume discounts), but include any fees charged by any banks when conducting the FX transactions, to facilitate the comparison. The information is for reference only, and the exchange rates are rounded off to 4 decimal places (5 decimal places for JPY). Exchange rates fluctuate according to market conditions. Exchange rates may vary upon conducting actual transactions.(3) During the Promotion Period, each Eligible Cardholder who maintains a Daily Average Available Balance of HKD 50,000 or above in Hong Kong Dollar Core Accounts in a calendar month can enjoy 2% Cash Rebate for Net Spending Amount in each Eligible Spending Transaction of HKD 100 or above conducted with an Eligible Debit Card in the same month that the Deposit Requirement is fulfilled. In the event that the Eligible Cardholder does not fulfil the Deposit Requirement, the Eligible Cardholder can enjoy 1% Cash Rebate for Net Spending Amount in each Eligible Spending Transaction of HKD 100 or above. Each Eligible Cardholder can earn a maximum Cash Rebate amount of HKD 150 in each month during the Promotion Period, and the maximum total Cash Rebate amount for the entire Promotion Period is HKD 900. The Cash Rebate shall be rounded to the nearest cent.(4) Account opening time may vary depending on network conditions, mobile device, and required documents.Disclaimer: The content is for information only. Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction.