Best FX Rates in Town¹! AI finds the best deal for you!

Looking for the best rate in town? WeLab Bank has you covered! Enjoy bank's cost price2 and $0 handling fee3 when exchanging HKD for foreign currencies, plus our AI compares rates for you and guarantees the best rate in town4! We offer the best value for exchanging and remitting money!

![[Exclusive Offer] Best FX Rate¹ + HKD 50 Cash Rebate* 🌍](/uploads/test1_04f65cf556.png)

[Exclusive Offer] Best FX Rate¹ + HKD 50 Cash Rebate* 🌍

📅 Promotion Period: Mar 1 – May 31, 2026 (inclusive)

💴Reward: During the Promotion Period, Eligible customers who successfully exchange Eligible Foreign Currency equivalent in a single transaction of HKD 20,000 or above will receive a cash rebate of HKD 50*.

✅ Eligible customers refer to those who have not conducted any foreign exchange transactions through the “Foreign exchange” function in the WeLab Bank App between 1 June 2025 and 28 February 2026.

⚠️ Limited quota, first come, first served!

See how much WeLab Bank can help you save!💰

| Loading... |

WeLab Global Wallet Debit Card has been fully upgraded✨

Before your trip, exchange popular currencies at the lowest FX rate1 and cost price2. If your balance runs low after departure, Auto Top‑up will instantly exchange the amount needed to complete your overseas transactions, so you can continue your journey with peace of mind🌍✈️!

🤖 Find the lowest rate with AI⁵

Want to exchange foreign currencies anytime but skip the hassle of comparison? Let WeLab Bank’s AI check the best rate for you⁵! With 10 major currencies available, we give you the lowest rate in town¹. Money saved, time saved!

Best Rate in Town¹ + Bank's cost price²

We use our bank’s cost price as FX rates. When exchanging HKD to foreign currency, there is no mark-up, just the best deal in town¹!

💰 Best Rate Guarantee⁴

Customer successfully converts HKD 100,000 or above to an Eligible Foreign Currency⁶ in a single transaction through the “Foreign Exchange” function via the WeLab Bank App, and within 5 minutes of completing that transaction, you find a Third-Party FX Quote⁷ under which you could have used less HKD to buy the same amount of Eligible Foreign Currency⁶, we will rebate the difference⁴.

$0 WeLab Handling Fee³

Whether you are investing or paying tuition fees, WeLab offers $0 Handling fee³! With one app, you can exchange and remit money at ease. No hidden fees, save more with us!

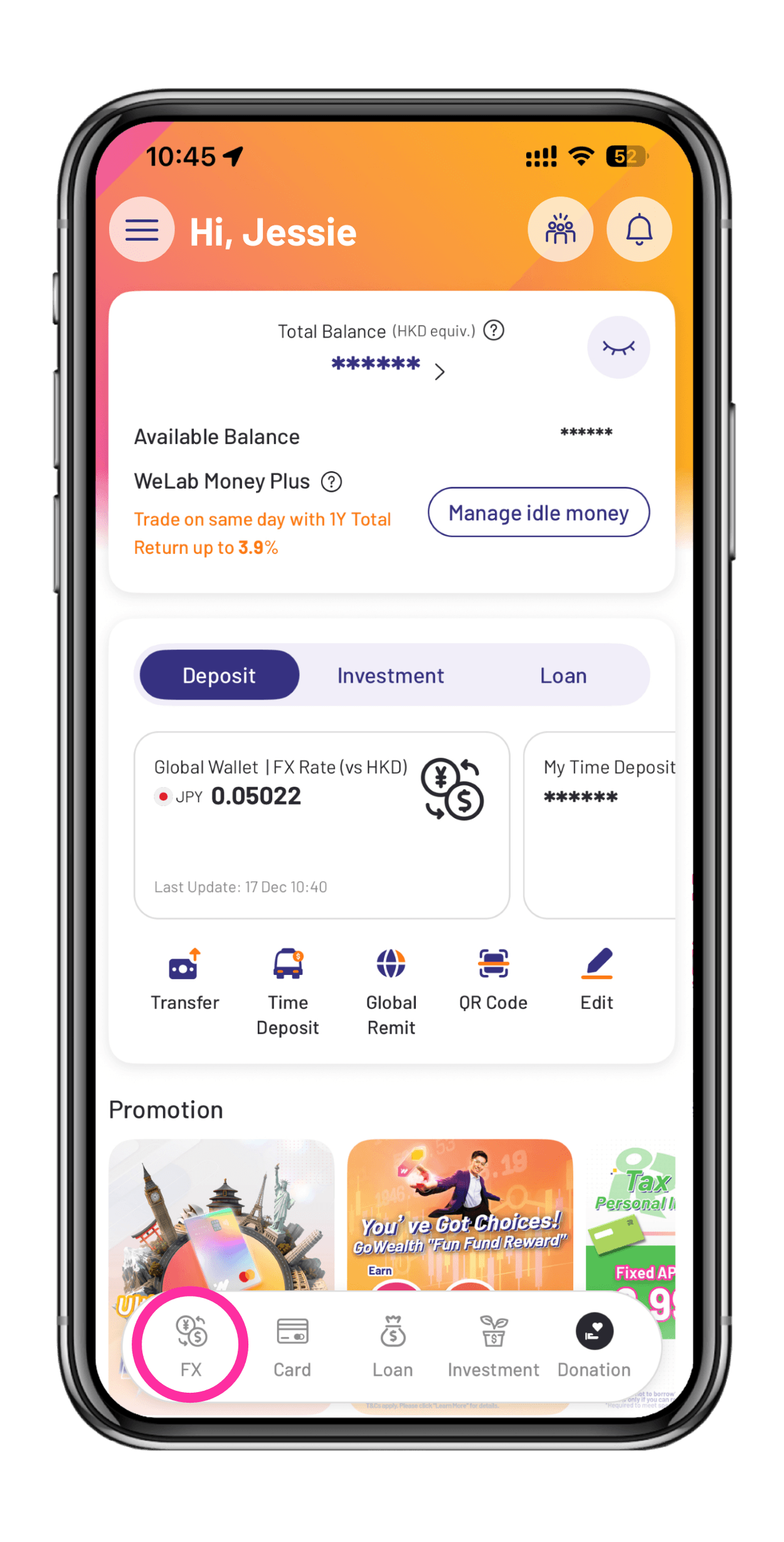

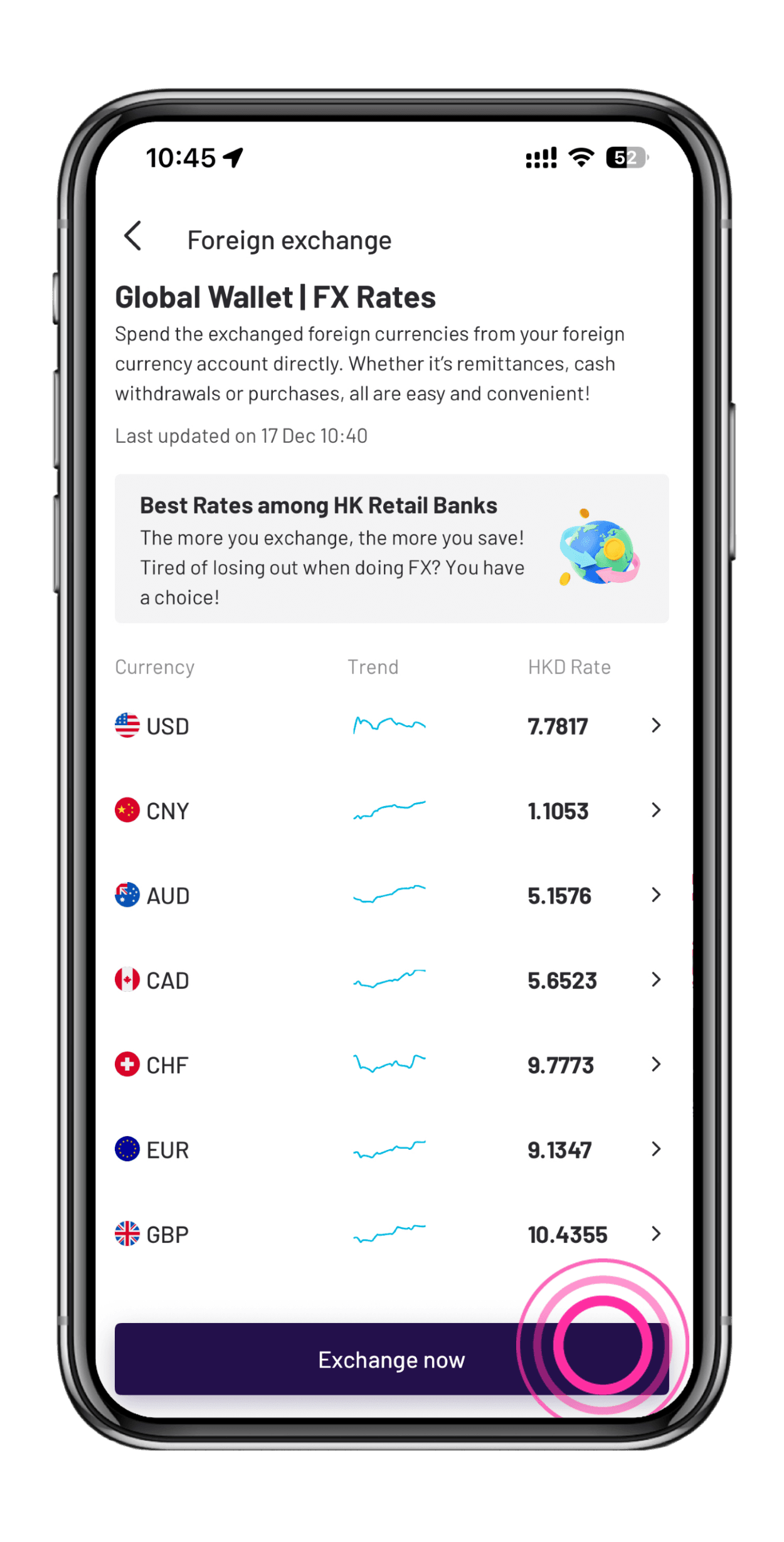

Just a few clicks to exchange currency using WeLab Bank App

Reminder: Get ready with sufficient funds in your account for making currency exchange anytime, anywhere, to handle your financial needs at ease. Check out the demo below:

Log in

Log in WeLab Bank App, go to “FX”.

The screen displays and images on this website are for illustrative purpose only. Please refer to the information displayed in the WeLab Bank App on the transaction day.

Get Started

Download our app and experience banking built for our century.

Want to know more? We’ve got answers!

What is the currency trading hour?

The foreign exchange services are available 24 hours from Monday to Sunday except system maintenance hours, which would be further advised.

How to Claim Your Rebate⁴

Send an email to [email protected] from an email address registered with WeLab Bank to submit a claim to WeLab Bank within 24 hours after completing the Eligible FX Transaction, and provide the basic information of the Eligible FX Transaction and the Third-Party FX Quote⁷, and the email must include:

- The reference number of the Eligible FX Transaction conducted at WeLab Bank, which can be found on the transaction completion page or in the transaction details;

- Name of the third-party bank;

- Date and time of the Third-Party FX Quote⁷, which shows that the Eligible Customer finds the quote within 5 minutes after completing the Eligible FX Transaction;

- HKD-sell amount and Eligible-Foreign-Currency-buy amount⁶ of the Third-Party FX Quote⁷, including all applicable fees and other costs (calculated based on HKD), and such Eligible-Foreign-Currency-buy amount⁶ should be identical to the Eligible-Foreign-Currency-buy amount6 of the Eligible FX Transaction; and

- Mobile app or online banking screenshot of the Third-Party FX Quote⁷, which should show the details of the Third-Party FX Quote⁷ set out in paragraphs (3) and (4) above (quote date can be skipped, but the time of the Third-Party FX Quote⁷ and/or the system time of the Eligible Customer’s mobile device or computer should be displayed).

Remarks:

Disclaimer

- Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses.

- The screen displays and the images of the website are for illustrative purpose only. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction.

- The information provided on the website is for general information only without warranty of any kind and may be changed at any time without prior notice.