Featured Funds Service

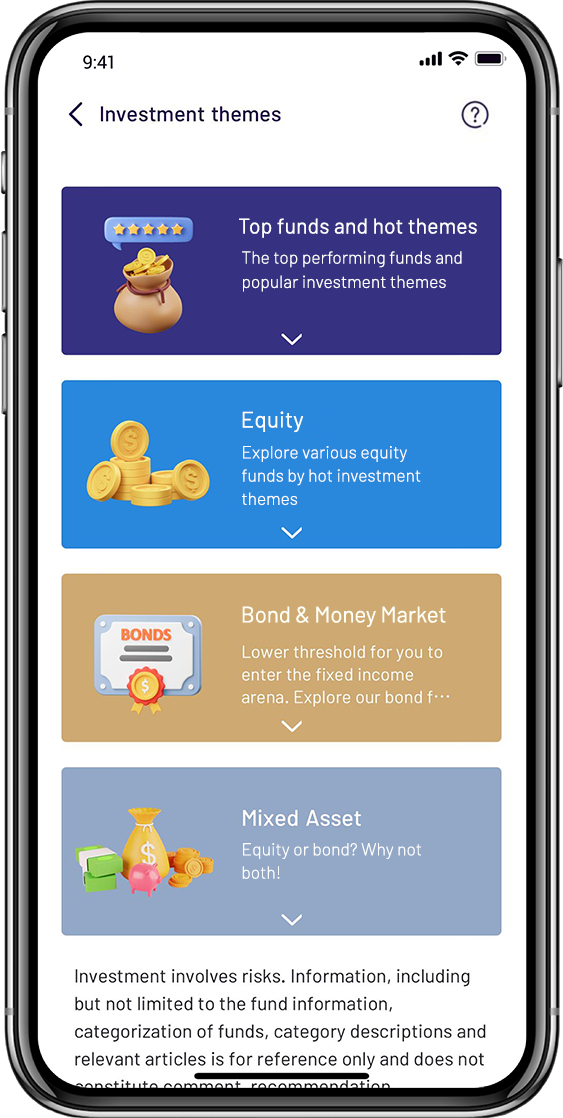

All-weather, unlimited $0 subscription/switching fees!

Click HERE for details of【WeLab Money Plus】

Partnering with the top global fund houses (Including: AllianzGI, Blackrock, Fidelity, Invesco, Janus Henderson, JPMorgan Asset Management, PIMCO, Schroder, Value Partners), Welab Bank sources over 150 Featured Funds on shelf, with one click, you may invest into the most popular mutual funds, dividend funds, bond funds, etc. and easily benefit from the market dynamics.

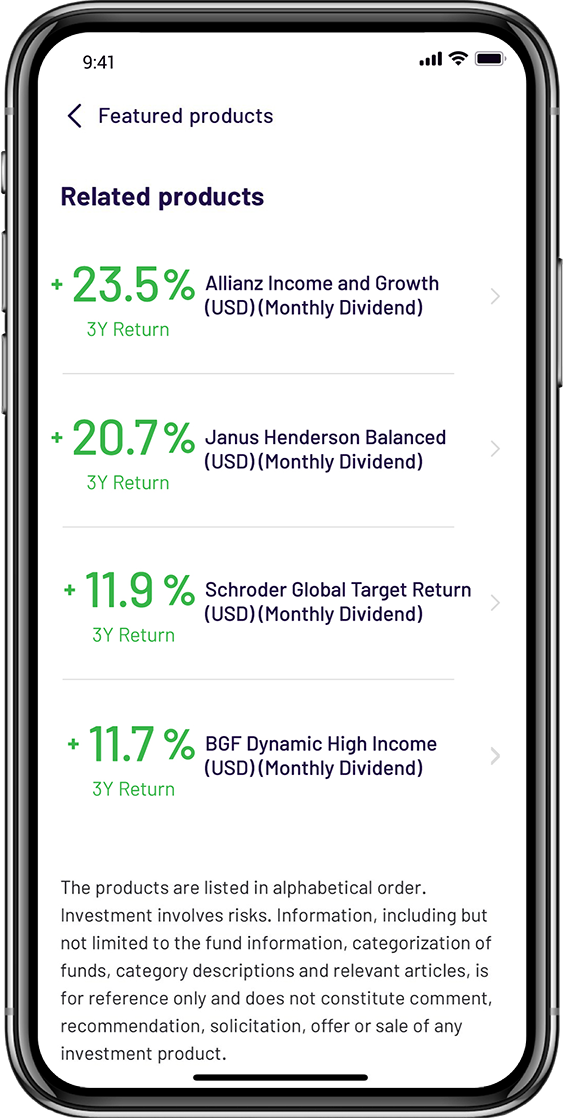

You may skip complicated research, WeLab Bank sources market’s popular investment ideas and hot funds (e.g. dividend funds, bond funds, etc.)^ for you so you can make smarter investing decisions, faster, easier1.

We know the fee is a hurdle. In WeLab Bank, we waived all of your subscription fee, and will only charge a single monthly fee of 0.1%3. Saving close to 85% transaction cost4!

| Traditional fee structure-charge subscription fee for each order | Use our WeLab Bank Featured Funds (Assume the fund value remains HKD 100,000 throughout the period) | |

|---|---|---|

| Scenario 1: Assume HKD100,000 investment, reallocate your holding each quarter for the next 3 quarters. (Selling all of the existing holding, reinvesting into another fund) | Total transaction cost: HKD8,000 (subscription fee: 4 orders x 2% charges) | Total transaction cost: HKD1,200 (Save 85%) platform fee is 0.1% x HKD100,000 x 12 months |

| Scenario 2: Assume HKD100,000 investment, Selling all in 3 months | Total transaction cost: HKD2,000 (subscription fee: 1 order x 2% charges) | Total transaction cost: HKD300 (Save 85%) platform fee is 0.1% x HKD100,000 x 3 months |

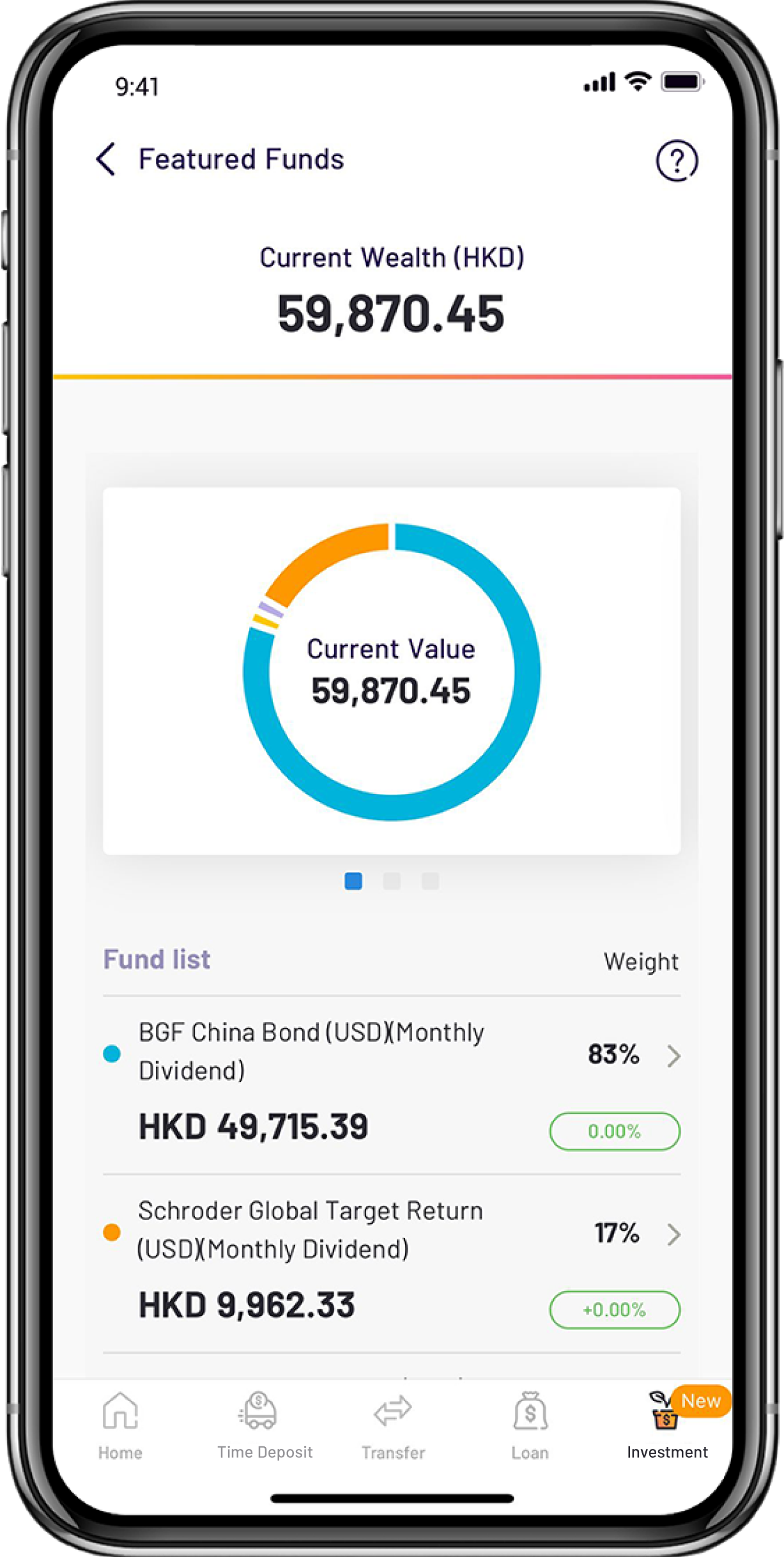

Skipping hours of research, through the simplest customer journey, you can invest into multiple mutual funds, dividend funds and bond funds more easily.

WeLab Bank collaborates with AllianzGI to build "GoWealth Digital Advisory" with the revolutionary wealthtech. Enjoy the diversified fund portfolio customized for you, and always keep your investment goal on track with our smart alert5.

This webpage is for information only and does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.

Investment involves risk. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Part of your investment may not be able to liquidate immediately under certain market situation. Please refer to our Wealth Management Services Terms (including relevant risk disclosures) and relevant fund offering documents for more details of our services as well as the nature and risks of the relevant products.

The investment decision is yours but you should not invest in these product(s) nor services unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives.

Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s).

If you have any inquiries on the nature and risks involved in this webpage, relevant product(s) and services, trading or investment funds, etc, you should seek advice from independent financial adviser.

The information contained on this Website should not be construed as a distribution, an offer to sell, or a solicitation to buy any securities in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction. If you are outside of Hong Kong, please inform yourself about and observe any relevant restrictions. By proceeding with a purchase, you are representing and warranting that you are either resident in Hong Kong or the applicable laws and regulations of your jurisdiction allow you to access the information in this Website or our App and make the purchase.

This webpage is issued by Welab Bank Limited. The contents of this webpage have not been reviewed by the Securities and Futures Commission in Hong Kong.

In case of any discrepancy between the English and the Chinese versions of this webpage, the English version shall prevail.

The screen displays, the images and the return figures herein are for illustration only. Advertising effect is applied in the screen display above, which may not reflect the actual situation.

^Depending on the share class of the funds in a category, if the majority share class of the funds in the category is dividend, we will display the annualized dividend yield of the fund with the highest annualized dividend yield in the category; if the majority share class of the funds in the category is accumulation, we will display the total return of the fund with the highest total return. You can log in to our Featured Fund Services to view the annualized dividend yield (if applicable) and return figures of each fund. The above figures are provided by Morningstar Asia Limited and are for reference only. We do not take responsibility for and do not endorse the accuracy of such information. Past performance is not indicative of future performance.

#It is the estimated time for completing the application and opening of the Investment Account only, actual time may vary depending on various factors.

*WeLab Money Plus refers to the theme of the Money Market Funds with same trade day settlement in WeLab Bank’s Feature Funds service. Same day settlement is only applicable for orders of Money Plus placed before the cut-off time (i.e. 9 a.m. Hong Kong Time) on a trade day. Among the WeLab Money Plus on our platform, Value Partners USD Money Market Fund Class B (HKD)(Accumulation) has the highest 1-year return +4.57% (as of 31 May 2025). The fund incepted on 22 Nov, 2023 with cumulative performance of +7.31%.

(1) We categorise the funds into different investment themes set by us based on the funds' information and provide theme descriptions. Information relevant to the funds and categorisation is for reference only and does not constitute a solicitation, offer or investment advice.

(2) Relevant information is for reference only and does not constitute a solicitation, offer or investment advice.

(3) The fund platform fee of a month is an aggregate amount of the daily fee within the month. Daily fee is calculated based on the daily market value of all your settled fund holdings in HKD (or HKD equivalent based on daily reference rate) under Featured Funds Services, excluding all money market fund holdings, multiplied by the fund platform fee monthly rate and divided by the number of calendar days of the month. For fund asset class information, please refer to the fund details page in WeLab Bank app.

(4) Assuming the subscription fee rate is 2%, customers who use our Featured Funds Services can save 85% of transaction costs in the above two examples compared with the traditional charging model charging with subscription fee. The examples above are for illustration purposes only. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s).

(5) You may set up your investment goal via our Digital Wealth Advisory Services on the WeLab Bank app, including the relevant investment horizon and one-time investment and monthly investment amounts. Our algorithm will recommend you a model portfolio based on your investment goal as well as your relevant personal circumstances. If you accept the recommendation, we will follow your instruction to process your one-time investment, and invest the monthly investment amount set by you in the model portfolio each month automatically. We will provide you various types of alerts/notifications, including but not limited to alerts/notifications about the status of your investment goal. However, such alerts/notifications are not investment advice. You may view the status of your investment goal and edit your investment goal on the WeLab Bank app according to your needs. The services are not discretionary asset management services. Any recommendation provided under the services is not a guarantee that you will achieve your investment goal.