Enjoy up to 2% cashback with card transaction🎉

✨ Use your WeLab Mastercard® Debit Card for everyday spending—be it 🛒 grocery shopping, 🛍️ hitting the mall, 🍽️ dining or 🍹 drinking with friends, 🖥️ shopping online, or 📱 making contactless payments with your phone—and earn up to 2% cashback1, helping you save more and spend smarter! 💸

🛍️ Offer Details

📅 From now until December 31, 2025

💵 How to Earn Cashback?

1️⃣ Hold a WeLab Bank eligible account and a WeLab Mastercard® Debit Card

2️⃣ Maintain a daily average available balance of HK$50,000 or above2 in Hong Kong Dollar Core Accounts each month (to enjoy 2% cashback1)

3️⃣ Spend HK$100 or more3 on in-store, online, or mobile payment channel to earn cashback

4️⃣ Eligible spending3 covers a wide range of daily needs to maximize your cashback potential

❗ Exclusions: Bank fees, bill payments, gambling, insurance, rent, Octopus top-ups, etc.4

🛒 WeLab Mastercard® Debit Card, no limits on spending & perfect for every occasion:

📌 Grocery shopping or hitting the mall: Buy groceries and household items while earning cashback 🥬🛍️

📌 Dining or grabbing drinks at coffee shops: Gather with friends and enjoy savings 🍽️☕

📌 Mall shopping: Buy clothing, shoes, or electronics and get cashback 👗👟📱

📌 Online shopping: Shop on e-commerce platforms or brand websites with cashback 🌐💻

📌 Contactless payments: Apple Pay, and more for quick and secure transactions 📱💳

💡 Each eligible transaction3 of HK$100 or more qualifies for cashback. Big or small, every spend counts!

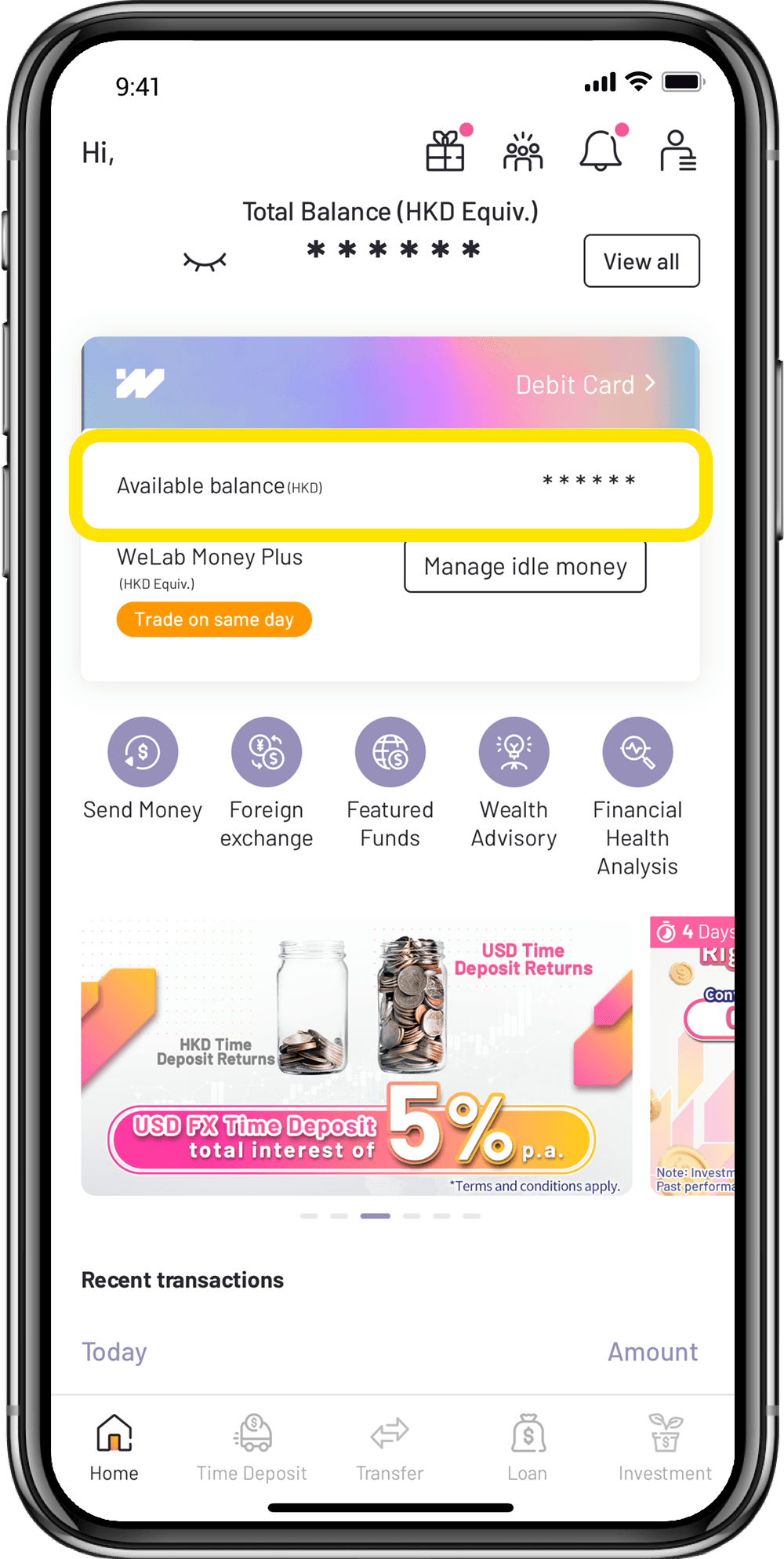

How to find your HKD available balance?

Just a reminder, you can log in to the WeLab Bank App and find your HKD available balance right below the debit card icon

📲 Act Now!

Start earning up to 2% cashback1 with your card transactions. Don’t miss this amazing opportunity!

Want to know more? We've got answers!

What is the promotion period?

The promotion period of WeLab Bank “Foreign Exchange Flash Offer” is from 10 November to 14 November, 2025 (inclusive).

Who is eligible to participate in the promotion?

This promotion is only applicable to customers who hold valid Core Accounts at WeLab

Bank Limited during the Promotion Period.

Remarks

Terms and Conditions apply, please click here for promotion details.

1 During the Promotion Period, each Eligible Cardholder who maintains a Daily Average Available Balance of HKD 50,000 or above in Hong Kong Dollar Core Accounts in a calendar month can enjoy 2% Cash Rebate for Net Spending Amount in each Eligible Spending Transaction of HKD 100 or above conducted with an Eligible Debit Card in the same month that the Deposit Requirement is fulfilled. In the event that the Eligible Cardholder does not fulfil the Deposit Requirement, the Eligible Cardholder can enjoy 1% Cash Rebate for Net Spending Amount in each Eligible Spending Transaction of HKD 100 or above. Each Eligible Cardholder can earn a maximum Cash Rebate amount of HKD 150 in each month during the Promotion Period, and the maximum total Cash Rebate amount for the entire Promotion Period is HKD 900. The Cash Rebate shall be rounded to the nearest cent.

2 “Daily Average Available Balance” refers to the average closing available balance of the Hong Kong Dollar Core Accounts on each calendar day in a calendar month (excluding authorized but not yet settled debit card spending transaction amounts).

3 “Eligible Spending Transactions” include in-store retail purchases, contactless payments, mobile payments and online retail purchases conducted with Eligible Debit Cards via the Mastercard® network. Only Eligible Spending Transactions posted to the Eligible Cardholders’ Eligible Accounts within the first 7 calendar days after the end of the month in which the Eligible Spending Transactions are made will be included in the calculation of the Net Spending Amount.

4 “Ineligible Transactions” include but not limited to bank charges, mail/tax/telephone orders, bill payments, purchase and/or reload of stored value cards (including Octopus top-up transactions via e-wallets or any other means), transactions (including top-up transactions) made via e-wallets in Hong Kong, transactions at non-financial institutions (including purchase of foreign currency, money orders and traveler’s cheques), transactions at financial institutions (including purchase of merchandise and services from banks), wire transfers, betting and gambling transactions, tax payments, autopay and recurring transactions, insurance transactions, rent payments, all unposted/cancelled/refunded transactions, other unauthorized transactions, fraud and abuse transactions, and unsettled transactions due to insufficient balances in Core Accounts.