What is a Tax Season Loan?

A tax season loan is a type of personal instalment loan specifically designed to meet the tax payment needs in Hong Kong from October to April each year. Its main purpose is to help borrowers spread out their tax payments and reduce financial stress through lower interest rates.What Are the Benefits of Tax Season Loans? But Watch Out for Pitfalls!

✅ 1. Attractive Interest Rates – But Read the Fine PrintTax season loans usually offer lower interest rates than standard personal loans. However, the advertised “as low as X%” rates often apply only to specific customers or large loan amounts. Always ask about the requirements for the promotional rate and confirm the actual approved rate for your case—don’t rely solely on marketing slogans.✅ 2. Flexible Use of Funds – But Don’t Overborrow

Although called a “tax season loan,” the funds aren’t limited to tax payments. You can use them for other financial needs like home renovations, paying off credit cards, consolidating high-interest debt, or seizing market opportunities . However, the low interest rates can tempt people to borrow impulsively. Always assess your repayment ability and timeline to avoid overborrowing.✅ 3. Fast Approval is Tempting – But May Affect Your Credit Score

Many tax season loan applications are now digital, with same-day approval and disbursement. However, financial institutions will check your credit report during the application, leaving a “hard inquiry” record. This may temporarily lower your credit score. If you’re planning to apply for other loans or credit cards soon, be cautious.

Three Key Factors to Compare in Tax Season Loans

💡 Promotional Interest Rates & Eligibility Requirements

Different banks or finance companies offer low rates with conditions, such as a minimum loan amount or VIP customer status. Always check the Annual Percentage Rate (APR), which includes all interest, fees, and cashback. It’s the fairest way to compare total loan costs.💡 Repayment Period

Tax season loan terms are usually short. Banks typically offer 12–24 months, while finance companies may offer up to 84 months. Choose a repayment term that suits your financial capacity to avoid budget issues and financial risk.💡 Additional Fees

Some institutions may charge administrative fees, early repayment penalties, or handling fees. Always read the fine print before signing to avoid unexpected costs.Summary: Common Tax Season Loan Misconceptions – FAQ 🔎

Is the lowest interest rate guaranteed?

No. The advertised “as low as X%” rate usually applies only to VIP customers or large loan amounts. Always confirm your actual approved rate.Is there a penalty for early repayment?

Many loan contracts include early repayment penalties, which can limit your flexibility. Always check the terms and conditions to understand your repayment freedom.Are there hidden fees in tax season loans?

Besides interest, there may be annual fees, administrative charges, or handling fees. These affect the actual loan cost. Ask for a full breakdown of all fees.How does it affect my credit score?

Applying for a tax season loan involves a credit check, which may temporarily lower your score. However, timely repayments can help build a good credit history in the long run.Can I apply if I have a poor credit history?

Yes, but approval may come with a higher interest rate than the market average. Be prepared for this possibility.Digital Bank vs Traditional Bank: Which is Better for You?

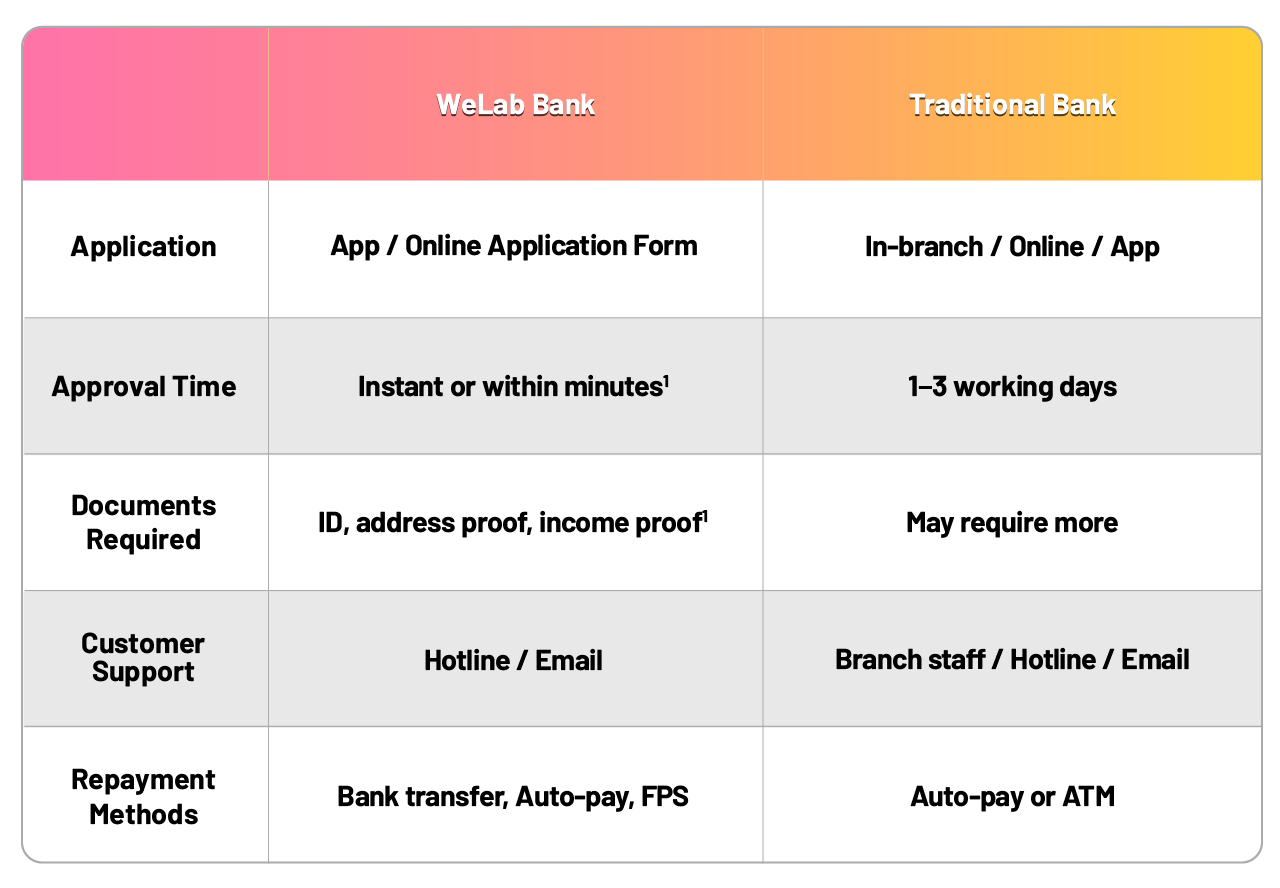

Digital banks offer a faster, more convenient loan experience. From account opening to loan application, approval, and disbursement—everything is done via mobile, with no need to queue or visit a branch.With lower operating costs (no rent or physical branches), digital banks can offer more competitive interest rates, helping you save more.Loan Application Process Comparison: Digital vs Traditional Banks

If you value speed and convenience, digital banks may suit you better. But if you need face-to-face consultation or have complex financial needs, traditional banks might be more appropriate.

If you value speed and convenience, digital banks may suit you better. But if you need face-to-face consultation or have complex financial needs, traditional banks might be more appropriate.👉 Learn more: Bank Loan Comparison

WeLab Bank Tax Season Loan Highlights 💰

WeLab Bank’s personal loan offers an APR as low as 0.75%1, with no need for a million-dollar loan amount—perfect for various financial needs. Key benefits include:- HKD 0 handling fee

- Flexible repayment terms from 6 to 60 months

- No income or address proof required2

During the promotion period, successful applicants can enjoy up to HKD 18,888 cashback4!

👉 Learn more: Tax Season Loan Offers

Borrow Smart, Worry-Free Tax Season!

Tax season loans can be an effective financial tool. When used wisely, they can help you manage cash flow during tax season. By understanding the product features and choosing based on your personal needs, you can find the best plan to ease your financial burden. The key is to study the terms carefully before applying—be a smart borrower!To borrow or not to borrow? Borrow only if you can repay!Remarks:

(1) The annualized percentage rate (“APR”) ranges from 0.65% to 36.00% and loan amount ranges from HKD 10,000 to HKD 1,500,000 with repayment period of 6 to 60 months. Assume the loan amount as HKD 283,000 with tenor of 24 months, the APR will be 0.65% (including a cash rebate of HKD 3,000) or 1.68% (without any cash rebate) and total repayment amount will be HKD 287,924.20. The APR is calculated according to the guidelines issued in respect of the Code of Banking Practice and rounded to the nearest 2 decimal places. The APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualized rate. The final APR offered is subject to the applicant’s application information, personal credit record, and the final approval process.

(2) We reserve the right to request customers to provide additional supporting documents for the loan application. The actual time for the loan approval and the loan disbursement may vary depending on the information provided by the customer and are subject to the credit assessment result. Any loan application is subject to assessment against normal lending criteria.

(3) The estimated period is calculated from the day the loan agreement is signed. The actual approval period and the actual loan disbursement time may vary upon information provided by the applicants.

(4) From now on until 31 December 2025, successful WeLab Bank Personal Loan applicants with an approved loan of minimum of HKD 150,001 amount and tenor of 24 months can enjoy up to HKD 23,888 (for Debt Consolidation Loan applicants) and HKD18,888 (for Personal Instalment Loan applicants) cash rebate if the loan is drawn down within 7 days after approval; The cash rebate amount will be credited into the HKD Core Account on or before 30 April 2026. Please refer to terms and conditions for more details.