📌Remittance: TT Basics + Overview of Global Remittance Options

Telegraphic Transfer (TT) is a method of transferring funds from one bank account to another via a banking network. Although it used to involve sending instructions via telegram, it’s now fully digital—making it a fast, secure, and globally accepted way to remit money.What is TT used for?

Whether you're an individual or a small business owner, TT is commonly used for interbank or global fund transfers:- 💸 Sending money overseas: e.g., to China, the US, UK, Australia

- 🏦 Transferring funds to overseas banks, especially in foreign currencies (RMB, USD, AUD, GBP)

- 🏠 Paying overseas mortgage, tuition, or investments

- 💼 Handling company payments or collections: e.g., paying overseas suppliers or receiving payments from foreign clients

Benefits of TT

- 🔐 Secure and reliable: Handled directly by banks with clear transaction records

- 🌍 Globally accepted: Supports multiple currencies and is accepted by banks worldwide

- 💰 Ideal for large transactions: Compared to credit cards or e-wallets, it is more suitable for high-value transfers

- 👣 Highly traceable: Each TT has a reference number for tracking

How Many Transfer Methods Are There?

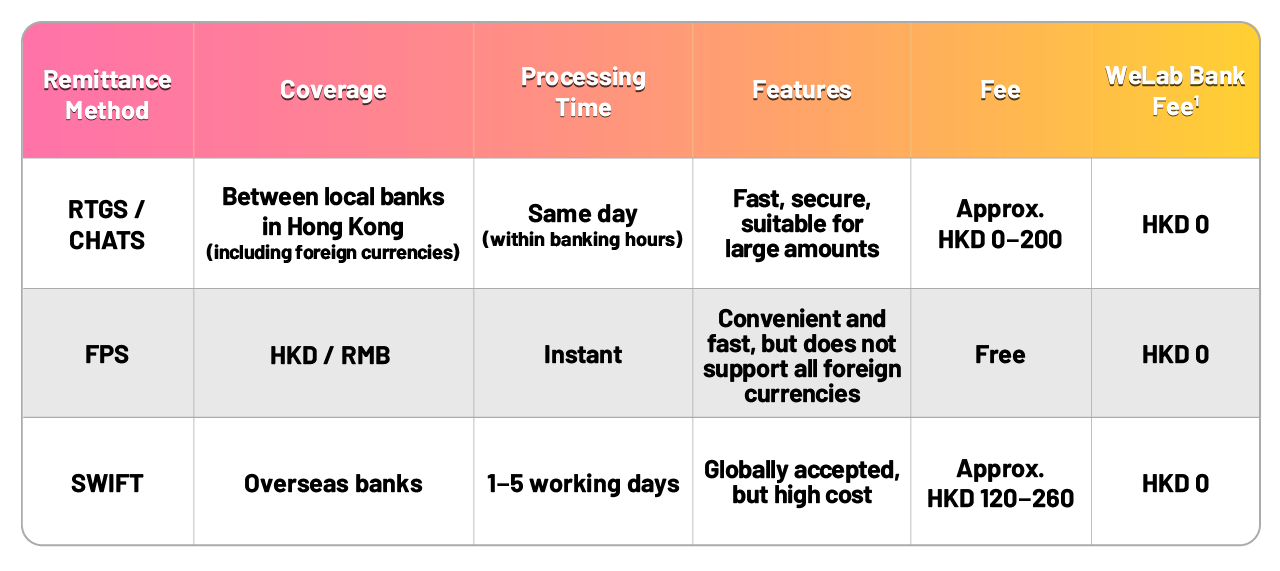

There are several fund transfer options like RTGS, FPS, and SWIFT. While all use banking networks, they differ in fees, processing time, required information, and cut-off times.RTGS / CHATS: RTGS (Real-Time Gross Settlement) is a system for real-time, full-value settlement, and CHATS (Clearing House Automated Transfer System) is Hong Kong’s implementation of RTGS. It supports large-value local interbank transfers for foreign currencies such as HKD, USD and RMB.FPS (Faster Payment System): Launched by the Hong Kong Monetary Authority (HKMA) for instant local transfers in HKD or RMB. Transfers can be made using mobile numbers, email addresses, or ID codes. It operates 24/7 and doesn’t require bank opening hours.SWIFT (International TT):A global banking communication network. Commonly used for remitting to overseas banks (e.g., US, UK, Australia). ✅ Tips:

✅ Tips:- For local HKD/RMB transfers, use WeLab Bank FPS for free, instant transactions.

- For global remittances, use SWIFT—WeLab Bank offers global remittance $0 WeLab handing fee¹.

How Are TT / Global Remittance Fees Calculated? Hong Kong Bank Comparison + Case Studies 🧠

Case 1|Paying UK Tuition for Your Child

✅ Method: SWIFT International TTThings to note:- Prepare the recipient bank’s SWIFT code, account number, and full name

- Allow 1–5 working days for processing

- Fees may include: sending bank fee + intermediary bank fee + receiving bank fee

- Choose between “SHA” (shared fees) or “OUR” (sender pays all)

- During the promotion period, all outbound remittances via the WeLab Bank App are fee-waived¹!

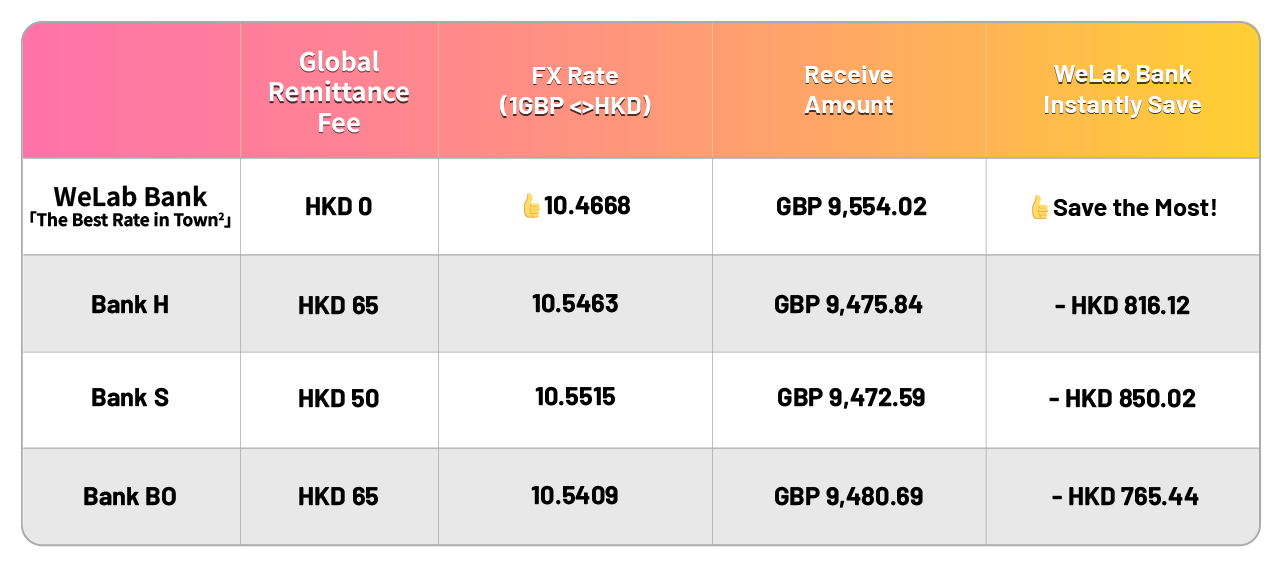

- Example: Sending HKD 100,000 to the UK in GBP for tuition—traditional banks may charge HKD 50+ in fees. With WeLab Bank, global remittance fee is waived¹ and you benefit from “The Best Rate in Town²”, saving around HKD 850³!

💡 Want to Save More on Currency Exchange? Learn About WeLab Bank’s “The Best Rate in Town²”!

WeLab Bank offers the best exchange rate² for foreign currency exchange—no need to compare rates across banks. Save time and money, especially when combined with the $0 global remittance fee¹.Example: If you exchange HKD 100,000 into GBP using Bank S, with an exchange rate of 10.5515, you’ll get approximately GBP 9,472.59. But with WeLab Bank’s exchange rate of just 10.4668, you can get around GBP 9,554.02, with 0 exchange fees, you instantly save GBP 81.43, about HKD 800!Then, if you use WeLab Bank to remit the GBP to the UK for tuition, you’ll enjoy 0 global remittance fee¹, saving another HKD 50 — for a total savings of approximately HKD 850³!Case 2|Transferring USD to Another HK Bank for Time Deposit✅ Method: RTGS / CHATSThings to note:- Prepare recipient bank name and account number

- Confirm cut-off time (usually during banking hours)

- Fees may apply, depending on the bank's policy

- Transferring USD 50,000 to another HK bank for a fixed deposit? Traditional banks may charge fees. With WeLab Bank, you can enjoy 0 fee instantly!

- To learn more about global remittance methods and information, please visit: Guide for Global Remittance

- Only supports HKD and RMB

- Daily transfer limits apply—check if your amount qualifies

- Just 4 steps to complete a global fund transfer 👉 Learn more

- $0 global remittance fee promotion supports more currencies 🎁 👉 See details

- Want to learn more about USD investment trends? 👉 Read this article

Disclaimers:(1) $0 fee refers to foreign currency exchange and outward global remittance fees. Foreign currency exchange is free of charge, while cross-border remittance normally incurs a handling fee, but during the promotional period from now until December 31, 2025, all outbound remittances made through the "Global Remit" feature in the WeLab Bank App will be exempt from such handling fees. The offer is subject to terms and conditions. For details, please refer to: https://welab.app.link/miRtoEtE4Wb(2) The best rates in town comparison is based on the exchange rates collected from the websites, online banking or mobile banking of 28 retail banks in Hong Kong (excluding those that did not provide exchange rates through the aforesaid channels) as of approximately 3:30 pm on 24 September 2025. The rates used in this comparison exclude any special promotions, discounts, offers, membership programs, or other preferential rates (including but not limited to bulk exchange discounts), but include any fees charged by banks for foreign exchange transactions.(3) Maximum savings amount is calculated based on the differences in (i) exchange rates, (ii) currency exchange fees, and (iii) cross-border remittance fees between WeLab Bank and Bank S as of 9:50 AM on October 6, 2025. For example, converting HKD 100,000 to GBP and remitting via S Bank would incur (i) an exchange rate and fee difference of HKD 800 and (ii) a cross-border remittance fee of HKD 50. Customers who choose WeLab Bank for both exchange and remittance can save approximately HKD 850. Actual exchange rates and interest rates may vary due to market fluctuations. Please refer to the rates and interest displayed in the WeLab Bank App on the transaction day.(4) Account opening time may vary depending on network conditions, mobile device, and required documents.(5) Global remittance bank fees (excluding any fees charged by receiving banks or intermediary banks) are compared based on telegraphic transfer and remittance information displayed on major banks’ websites or mobile apps as of 4:15 PM on July 7, 2025. The above information is for reference only and may be subject to change depending on market conditions.Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter any transaction.