2025 JPY / HKD Trend and Market Insights

JPY / HKD exchange rate remains relatively low. According to Yahoo Finance data, it has fallen about 9.45% over the past six months¹, making it still a favorable time for Hong Kong people to exchange yen for travel or investment!The yen’s weakness is not due to a single factor but a combination of conditions, such as:- Widening US-Japan Interest Rate Gap Weakens Yen’s Safe-Haven Role²

- Bank of Japan’s (BOJ) Loose Policy Limits Yen’s Rebound²

Investment Options Amid JPY / HKD Decline

Yen depreciation not only makes travel cheaper but also offers diverse investment opportunities:- Foreign Exchange (FX) Investment: Buying yen and waiting for a rebound is the most direct strategy, but beware of exchange rate volatility. The fx market is highly volatile, and short-term trends are hard to predict. Avoid investing large sums at once and keep an eye on US-Japan interest rate gaps and policy changes, as these affect yen recovery speed.

- Japanese Stocks / Funds: Yen weakness benefits Japanese exporters, making their products more competitive globally. However, stock and fund performance depends on global economic conditions, policies, and market sentiment—exchange rates are just one factor. Investors should consider multiple aspects before deciding.

- Japanese Real Estate: Yen depreciation makes Japanese property more attractive to Hong Kong buyers. But overseas property investment isn’t just about price—you must consider tax costs, legal procedures, and property management. While returns are possible, risks and costs cannot be ignored. Consult professionals and adopt a long-term strategy.

Risks of Investing in Japanese Real Estate

Yen weakness makes Japanese property look appealing, but overseas investment involves hidden costs and challenges:- Tax Burden

- Legal and Loan Restrictions

- Management and Cash Flow Needs

Guide to Large FX Transactions – WeLab Bank Money-Saving Tips You Need!

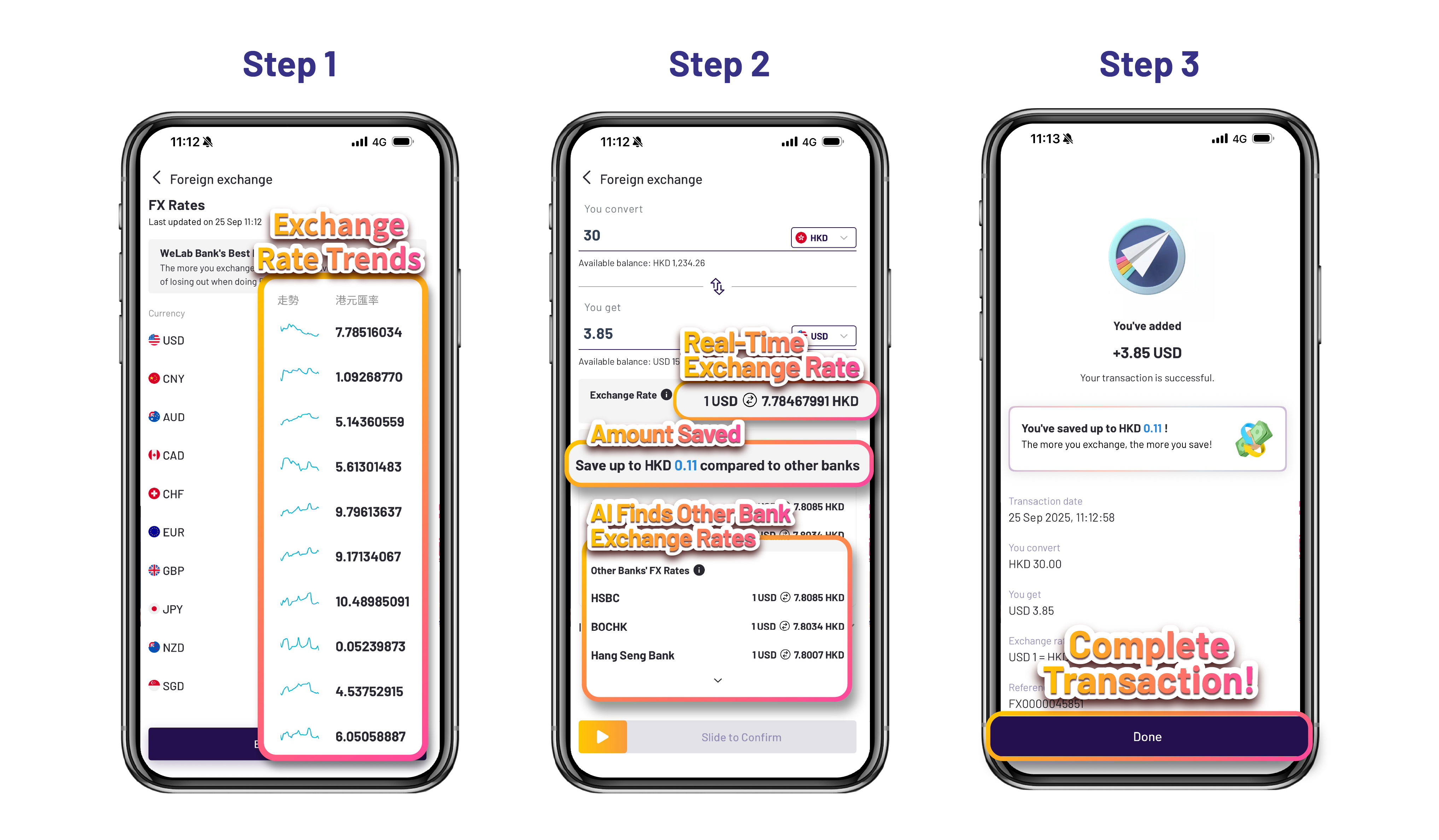

Want the best rates for foreign currency exchange to invest in Japan? With exchange rate fluctuations, traditional methods may not be the most cost-effective—especially for large transactions where fees and spreads matter.WeLab Bank App helps you save time and money in just 3 steps:Step 1: Open WeLab Bank App, go to “Transfer & FX,” select “Foreign Exchange,” and choose “JPY.”Step 2: Enter the HKD amount you want to exchange. The app instantly shows the total JPY amount, compares rates with other banks, and displays your maximum savings—see how much you save at a glance!Example: For HKD 1,000,000, WeLab Bank’s selling rate is 0.04948, giving you about JPY 20,208,266. Compared to Bank H’s rate of 0.04991, you can save HKD 8,447.996!✅ With the Best Rate Guarantee7, you save even more!During the promotion period, eligible customers who exchange HKD 100,000 or more in a single transaction via the WeLab Bank App’s “Foreign Exchange” is eligible for this guarantee: If within 5 minutes after the transaction, you find a third-party bank offering a better rate (i.e., less HKD for the same amount of foreign currency), WeLab Bank will refund the difference—ensuring you get the best rate on the market!👉 Learn more about Best Rate Guarantee7!Step 3: Confirm the amount and complete the transaction—JPY is instantly credited to your account! The screen displays are for illustrative purpose only.Want to know how WeLab Bank uses AI to help you save more on FX? 👉Learn more

The screen displays are for illustrative purpose only.Want to know how WeLab Bank uses AI to help you save more on FX? 👉Learn moreConclusion – JPY / HKD Downtrend Brings Both Opportunities and Risks

JPY / HKD hits record lows, with WeLab Bank offering as low as 4.95 per 100 yen⁸. For Hong Kong people, it’s a “sweet spot” for travel, shopping, and even investing. But opportunities come with risks—whether FX, stocks, funds, or overseas property, you must consider market volatility, policy changes, and hidden costs. Remember, investing should never be impulsive—base decisions on your financial situation and seek professional advice for a solid plan.If you’re ready to exchange currency or make large transactions, WeLab Bank App helps you save time and money with real-time rates, transparent comparisons, and instant execution—making it easy to seize opportunities from yen’s decline!🔥 Download WeLab Bank App now—open an account in just 5 minutes9 and exchange smartly!Remarks:(1) The above information covers the period from May 20, 2025, to November 20, 2025. The data is provided by a third-party platform (https://hk.finance.yahoo.com/quote/JPYHKD%3DX/). Some figures have been rounded to two decimal places and are for reference only.(2) Source: InvestBrother “2025日圓走勢分析:2025年Yen會繼續跌?一文看懂關鍵因素與換錢攻略”(3) Source: Japan-Property “日本房產稅全解析:外國房主必知重點”(4) Source: Japan-Property “日外國人在日本如何申請房屋或投資貸款”(5) Source: Japan-Property “日本購買房產指南”(6) Maximum savings amount is calculated based on the differences in exchange rates between WeLab Bank and Bank H as of 12:01 PM on November 20, 2025. For example, customers who choose WeLab Bank for converting HKD 1,000,000 to JPY can save approximately HKD 8,447.99. Actual exchange rates and interest rates may vary due to market fluctuations. Please refer to the rates and interest displayed in the WeLab Bank App on the transaction day.(7)During the Promotion Period, if an Eligible Customer successfully converts HKD 100,000 or above to an Eligible Foreign Currency in a single transaction through the “Foreign Exchange” function via the WeLab Bank App and find a Third-Party FX Quote under which the Eligible Customer could have used less HKD to buy the same amount of Eligible Foreign Currency within 5 minutes of completing the Eligible FX Transaction, WeLab Bank will rebate the difference between the sell-HKD amount of the Eligible FX Transaction and the sell-HKD amount of the Third-Party FX Quote. Each Eligible Customer can only enjoy the rebate for one Eligible FX Transaction every 12 calendar months (based on the transaction date of the Eligible FX Transaction). The maximum Rebate Amount is HKD 100. Terms and conditions apply, please refer here for details: https://welab.app.link/40fTs7hE4Wb(8) Based on the exchange rate for WeLab Bank as of 12:01 PM on November 20, 2025.(9) Account opening time may vary depending on network conditions, mobile device, and required documents.Disclaimer: The content is for information only. Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction.