The Growing Demand for HKD to USD Exchange

In today’s uncertain global economy, the USD is considered a relatively stable, safe-haven currency. On top of that, USD time deposit rates are generally higher than HKD rates, making it an attractive option for better returns. More Hongkongers are also investing globally—in U.S. stocks, ETFs, and overseas properties. Taking all these factors into account, exchanging HKD to USD has become not just a financial strategy, but also an important part of asset allocation and risk management.Common Reasons Hongkongers Choose USD

- 📉 USD at the weak side:

Recently, the US dollar has weakened, and many Hongkongers see this as a good time to exchange into USD. When the USD is relatively low compared to the HKD, the cost of exchange is naturally lower — meaning you can get more USD with fewer HKD. - 📈 Investment Opportunities:

The U.S. stock market continues to attract interest, with many Hongkongers investing in popular stocks, mutual funds, or using ETFs to diversify risk. Some are also considering overseas property as a long-term investment. That’s why exchanging into USD is often a key first step. Choosing a platform with competitive exchange rates, $0 FX and cross-border transfer fees is crucial, as it directly affects your investment cost and potential returns. - 💼 Diversified Asset Allocation & Savings:

Although the HKD is backed by a Linked Exchange Rate System (LERS), there are still potential risks. With the HKD strengthening recently, the exchange rate for USD is relatively favorable, making it a possible option for diversifying assets. Converting part of your funds into USD savings may also offer the opportunity to enjoy higher interest rates on USD time deposits — which could be suitable for long-term savings or retirement planning.

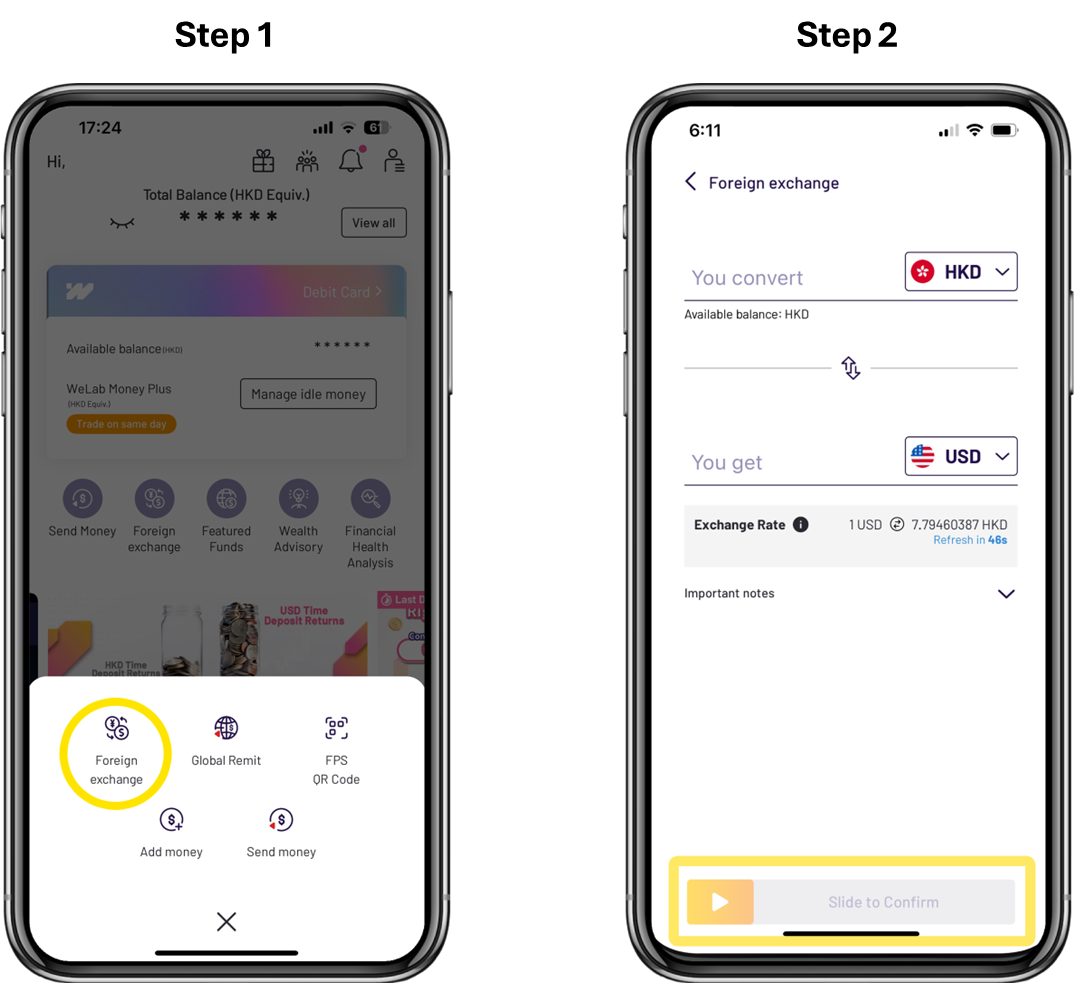

How to Exchange USD with WeLab Bank in Just 2 Steps

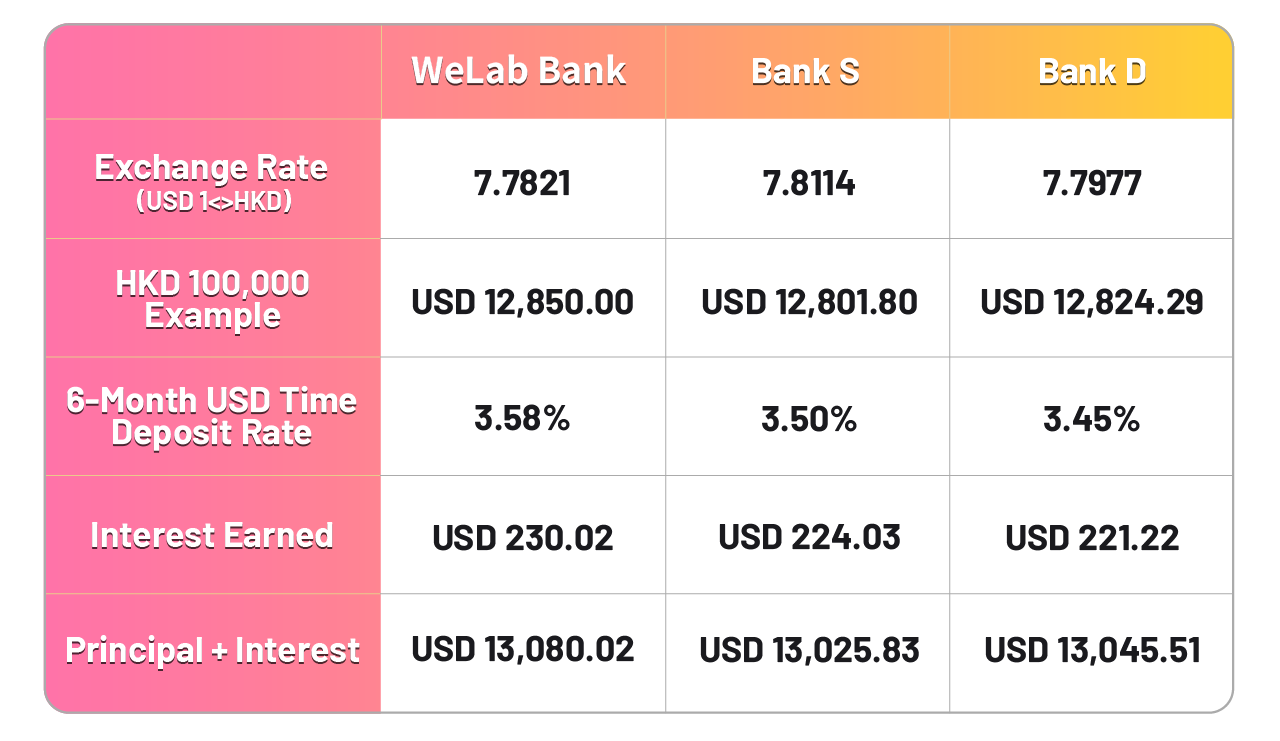

Want to exchange USD using WeLab Bank? It’s as easy as two simple steps—no queues, no fees, and you get WeLab Bank’s best rates, helping you save both money and time!For example, if you exchange HKD 100,000 into USD:- At Bank S, the USD selling rate is 7.8114, which gives you around USD 12,801.80.

- At WeLab Bank, the rate is 7.7821, giving you around USD 12,850.00.

That’s a difference of USD 48.2, meaning you could save up to HKD 373.681 by using WeLab Bank!

Open the WeLab Bank App, select “Transfer” on the homepage, and go to “Foreign Exchange.” You’ll see your HKD balance and available foreign currencies, including USD.Step 2:

Enter the amount of HKD you want to exchange, select USD as the target currency, and the system will instantly show the latest rate. Confirm the rate, swipe to complete the transaction, and your USD will be deposited into your account—ready for saving and investing.

For illustrative purposes only

For illustrative purposes onlyWant Your USD to Grow After Exchange? WeLab Bank Offers Smart Parking Options for Your Funds

If you don’t have immediate investment plans after exchanging USD, you can consider “parking” your funds temporarily — let your money keep working for you. Aside from investing in U.S. stocks, WeLab Bank offers a range of lower-risk, stable-return financial options to support short- to mid-term fund management. All these options can be accessed directly through the app — simple, fast, and ideal for users who want to grow their funds without complicated steps.✅ Time Deposits

WeLab Bank offers USD time deposit options with interest rates generally higher than HKD time deposits. Flexible deposit terms are available — you can choose based on your needs, such as 1 month, 3 months, 6 months, or 12 months, and enjoy stable returns.- Example: Exchanging HKD 100,000 into USD

While comparing with Bank D, using WeLab Bank for USD exchange and with a 6-month deposits can earn you an extra USD 34.511 (HKD 267.54) — helping you grow your money smarter!

While comparing with Bank D, using WeLab Bank for USD exchange and with a 6-month deposits can earn you an extra USD 34.511 (HKD 267.54) — helping you grow your money smarter!✅ WeLab Money Plus

WeLab Money Plus is a money market fund designed for same-day settlement. If you’ve exchanged USD but don’t have immediate investment plans, you can consider parking your idle funds temporarily — giving your money a chance to keep working for you. Compared to regular savings accounts, money market funds offer higher liquidity and are less affected by market volatility. For users who prefer a more stable approach to wealth management, this could be a potentially steady-return option.✅ Featured Funds Service

If you’re looking for potentially higher returns, you can consider investing in funds through the Featured Funds Service. WeLab Bank App offers a variety of popular investment themes, allowing you to easily invest in top-performing funds, dividend funds, and bond funds managed by leading global fund houses. You can choose based on your own risk tolerance. Best of all, there’s $0 subscription fee and no cost for buying or selling, making it a truly low-barrier entry with flexible fund usage.Whether you're saving or investing, USD has long been an important part of wealth planning for Hongkongers. With WeLab Bank, you can enjoy competitive exchange rates, $0 FX and cross-border transfer fees*, and manage everything in one app — making it easier to park your USD funds and find the right way to grow your money.Ultimate Foreign Currency Exchange Hack – Earn the Spread with One App

- WeLab Bank Best Rate^ AI Exchange Rates at a Glance

- Zero Fee on Cross-Border Transfers*

- Security

Disclaimers:^Terms and conditions apply. Please refer to Compare the best exchange rates with AI for details.*From now until December 31, 2025, all outward remittance successfully made through the “Global Remit” function in the WeLab Bank App can enjoy WeLab Bank remittance handling fee waivers. Terms and conditions apply: https://welab.app.link/e/aNd7u0OM5Ub(1) The example uses exchange rates and time deposit interest rates announced by Bank S, Bank D, and WeLab Bank at 2:14 PM on September 15, 2025, rounded to four decimal places for easier comparison. Actual exchange rates and annual deposit interest rates may vary due to market fluctuations. Please refer to the rates shown in the WeLab Bank App on the day of transaction for the most accurate information.(2) WeLab Bank is a member of the Deposit Protection Scheme. Eligible deposits taken by this Bank are protected by the Scheme up to a limit of HKD 800,000 per depositor.Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter any transaction.