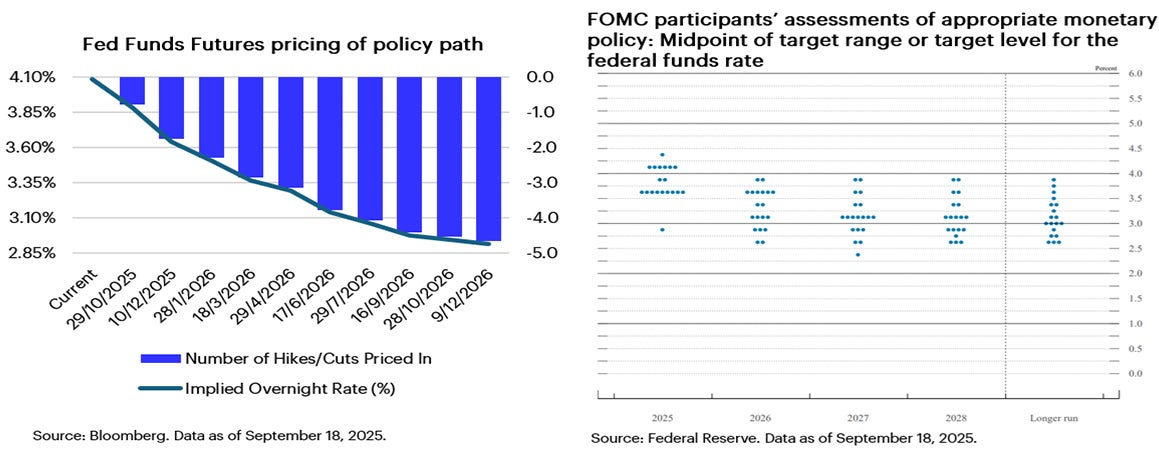

So in this new Fed easing cycle, we believe investors may maintain a well-diversified portfolio while selectively increasing exposure to Emerging Markets (EM) equities and EM local currency bonds.Additionally, we see potential for real estate to outperform in a falling interest rate environment.Fed rate cuts throughout the remainder of the year are likely to weaken the USD while also opening the door for Asian central banks to cut rates further.A weakening USD, easing monetary policies around the APAC region and retreating oil prices have historically been a good environment for EM to out-perform Developed Markets (DM).And with EM equities currently trading at a one-third discount to their DM counterparts, we believe there is good value to be had.Investment risksThe value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.Reference1 Source: Federal Reserve. Data as of September 17, 2025

So in this new Fed easing cycle, we believe investors may maintain a well-diversified portfolio while selectively increasing exposure to Emerging Markets (EM) equities and EM local currency bonds.Additionally, we see potential for real estate to outperform in a falling interest rate environment.Fed rate cuts throughout the remainder of the year are likely to weaken the USD while also opening the door for Asian central banks to cut rates further.A weakening USD, easing monetary policies around the APAC region and retreating oil prices have historically been a good environment for EM to out-perform Developed Markets (DM).And with EM equities currently trading at a one-third discount to their DM counterparts, we believe there is good value to be had.Investment risksThe value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.Reference1 Source: Federal Reserve. Data as of September 17, 2025Open the WeLab Bank App and click Featured Funds to find out more!

Importance Notice This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources(including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences(as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance(CE Number: BOJ558) to conduct Type 1(dealing in securities) and Type 4(advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.