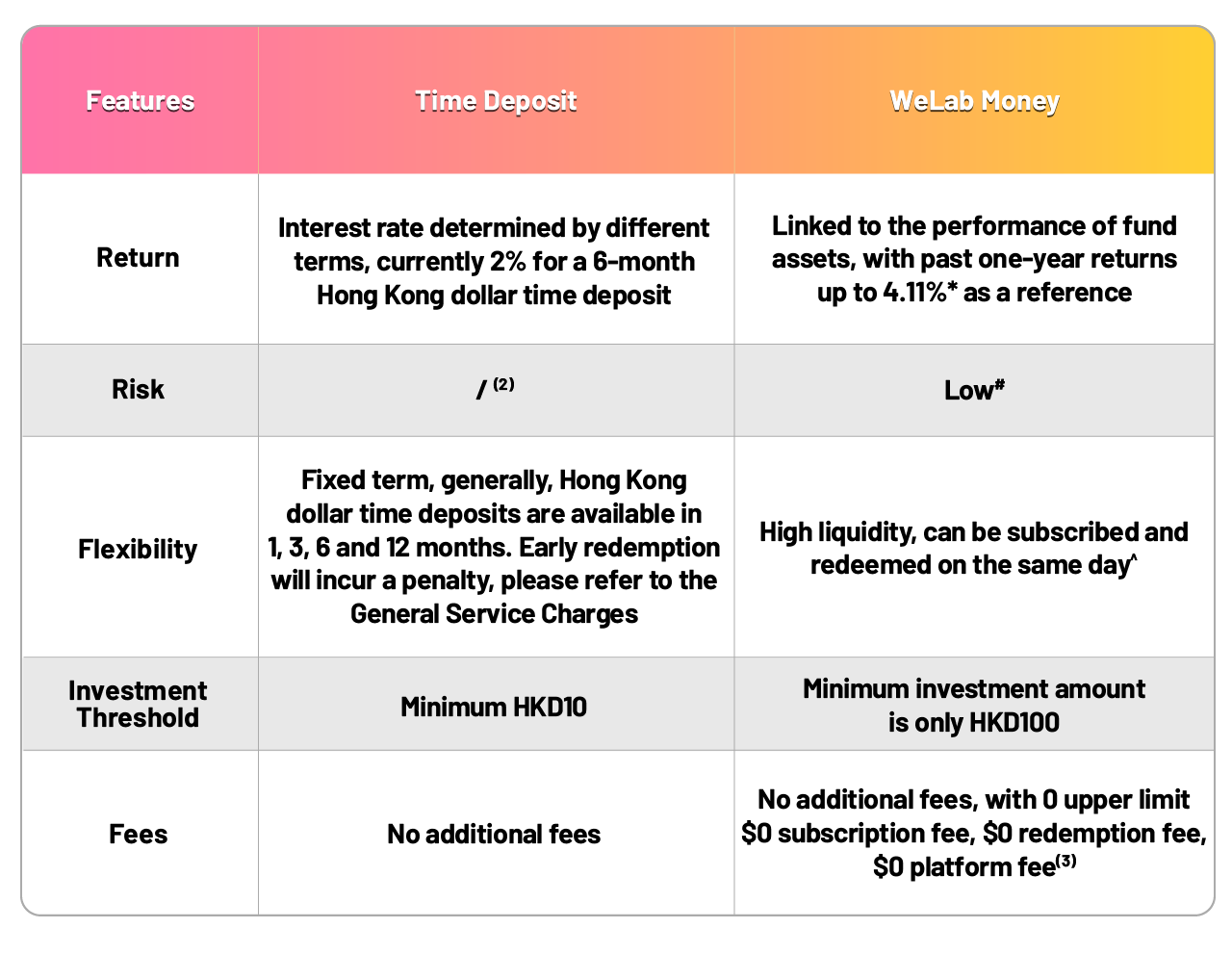

If you are looking for a low-risk option that also offers attractive returns with a certain degree of flexibility, without having to lock up your funds for a month or two, then WeLab Money Plus is the right choice for you.What is WeLab Money Plus?

WeLab Money Plus refers to the same-day settlement money market fund theme within WeLab Bank’s self-select fund service^. It invests in short-term, high-credit-rated debt instruments, such as treasury bills, commercial paper, and bank certificates of deposit, etc. Its objective is to provide stable returns while maintaining high liquidity.Time Deposit vs. WeLab Money Plus: Comprehensive Comparison

General Service charge: Support | WeLab BankWeLab Money Plus Features:

General Service charge: Support | WeLab BankWeLab Money Plus Features:- Returns: While WeLab Money Plus's returns are not guaranteed and are subject to market interest rates, WeLab Money Plus's past one-year performance shows return as high as +4.11%, and since its inception, returns have been as high as +7.71%*.

- Flexibility: A major advantage of WeLab Money Plus is its ability to be subscribed and redeemed on the same day, without a fixed term, making it convenient for you to flexibly use your funds to meet unexpected financial needs.

- Risk(4): WeLab Money Plus's fund invests primarily in short-term US dollar-denominated and settled deposits and high-quality money market instruments, making it relatively lower risk than other types of funds.

- Customers Seeking Higher Potential Returns: If you're looking for an option that can provide higher potential returns, WeLab Money Plus can be one of the choices.

- Customers Who Value Fund Liquidity: If you need flexible funds, WeLab Money Plus can provide higher liquidity.

- Customers with Lower Risk Tolerance: WeLab Money Plus has a relatively lower risk(4) than other types of funds, making it suitable for customers who seek stable returns.

Money market funds provide another low-risk investment option. It not only helps you pursue better potential returns but also offers higher fund flexibility. We hope this article provides you with a more comprehensive perspective to help you make more informed financial strategies. If you have any questions, please feel free to contact us.For more details: WeLab Money Plus

Open an Account Now and Grow Your Wealth!

Download Now | WeLab BankRemarks:

*Past performance is not indicative of future indicator. Among the WeLab Money Plus on our platform, Value Partners USD Money Market Fund Class B (USD)(Accumulation) has the highest 1-year return +4.11%. The fund incepted on 22 Nov, 2023 with cumulative performance of +7.71%, as of 31 August 2025.

^WeLab Money Plus refers to the theme of the Money Market Funds with same trade day settlement in WeLab Bank’s Feature Funds service. Same-day subscription or redemption of funds applies only to WeLab Money Plus transaction instructions successfully submitted before the WeLab Money Plus transaction cut-off time (9:00 am Hong Kong time). Accumulating yields refer to the distribution to accumulating funds (non-distributing funds); the income or yields distributed to the fund will not be distributed but will increase the net asset value per share of the fund accordingly.

#Money market funds are not the same as time deposits and are not protected by the Hong Kong Deposit Protection Scheme. Fund values can fluctuate and may fall in value, and investors may lose some or all of their investment amount. Investors should not make investment decisions based solely on this webpage. Investors should review the fund prospectus and product key information document to understand the risks and details.(1) As of August 29, 2025, the HKD GoSave 2.0 time deposit annual interest rate provided is for reference only.

(2) The Deposit Protection Scheme is a scheme to protect the interests of depositors. When a deposit-taking member bank of the Scheme goes bankrupt, the Scheme will compensate depositors, with a maximum coverage of HK$800,000. The Hong Kong Deposit Protection Scheme is established under the Deposit Protection Scheme Ordinance (the "Scheme Ordinance"). All types of deposits placed with members of the Scheme, whether in Hong Kong dollars, Renminbi or other foreign currencies, are protected. This includes current accounts, savings accounts, deposits used as collateral, and fixed deposits with terms not exceeding five years. WeLab Bank is a member of the Hong Kong Deposit Protection Scheme. Qualified deposits accepted by this bank are protected by the Deposit Protection Scheme, with a maximum coverage of HK$800,000 per depositor.

(3) Fund platform fee (0.1% per month) for WeLab Money Plus will be waived, please refer to the Fund details page in WeLab Bank app and General Service Charges.

(4) Risks: The Fund may be more susceptible to adverse economic, political, policy, foreign exchange, liquidity, tax, legal or regulatory events affecting the USD money markets. The Fund may also invest in emerging markets and is also subject to emerging market risk. The Fund is also subject to other risks associated with debt securities e.g. credit/counterparty, interest rate, credit rating and downgrading, credit rating agency and valuation risks.

Click here to view relevant terms and conditions.Important Disclaimer:

This webpage is for information only and does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.

Investment involves risk. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Part of your investment may not be able to liquidate immediately under certain market situation. Please refer to our Wealth Management Services Terms (including relevant risk disclosures) and relevant fund offering documents for more details of our services as well as the nature and risks of the relevant products.

The investment decision is yours but you should not invest in these product(s) nor services unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives.

Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s).

If you have any inquiries on the nature and risks involved in this webpage, relevant product(s) and services, trading or investment funds, etc, you should seek advice from independent financial adviser.

The information contained on this Website should not be construed as a distribution, an offer to sell, or a solicitation to buy any securities in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction.

If you are outside of Hong Kong, please inform yourself about and observe any relevant restrictions. By proceeding with a purchase, you are representing and warranting that you are either resident in Hong Kong or the applicable laws and regulations of your jurisdiction allow you to access the information in this Website or our App and make the purchase.

This webpage is issued by Welab Bank Limited. The contents of this webpage have not been reviewed by the Securities and Futures Commission in Hong Kong.

In case of any discrepancy between the English and the Chinese versions of this webpage, the English version shall prevail.