How AI Is Powering a New Era of Industrial Automation?

While ChatGPT captured the public’s imagination, the staid manufacturing sector was already putting AI to work – potentially reaping more benefits than any other sector, according to McKinsey. Find out how tapping AI is a natural step in the evolution of industrial automation.- In the grand tradition of Henry Ford and Bell Labs, manufacturers are using cutting-edge AI tools to automate tasks, predict disruptions and make new discoveries.

- Three case studies: a design software firm helps users build AI-powered digital twins; a high-tech manufacturer leverages AI to build specialty electronics for clients; and an internet giant uses AI to discover previously unknown materials for building new technologies.

- In the search for tomorrow’s manufacturing leaders, we look for firms that are embracing AI to uncover patterns in complex and interwoven sets of data, unlocking new efficiencies.

In the news: AI is transforming industrial automation

Manufacturers have long used automation to improve operational efficiency, decrease defects, reduce factory downtime and maximise productivity. Decades ago, research and development companies such as Bell Labs—and trailblazing individuals such as Henry Ford—were on the cutting edge. More recently, 3D printing, robotics and computer vision have helped upgrade production methods across many industries—from aerospace to metals & mining. Today, artificial intelligence (AI) is leading the way, with digital twins*, generative AI and other technologies transforming industrial automation in ways Henry Ford could never have imagined. Here are three notable examples.Case studies: Using AI in new ways to aid manufacturing and material discovery

A design software provider (“DSP”) offers proprietary digital twin software1

What themes, sectors or regions would offer opportunities and potential risks?

Although AIG bond spreads remained tight through most of 2023 on the back of the favourable macro backdrop in the region described earlier, there are markets with potential value, such as South Korea and Japan. Fidelity also sees better value in shorter-dated and high-quality bonds across the region, where Fidelity may earn attractive returns due to the higher base rate environment without assuming excessive credit risk. With many Asian countries potentially reaching their inflation peak, some central banks have paused their tightening cycles and begun showing signs of turning dovish. This opens the door for opportunities in the local currency markets, such as local currency duration or local currency bonds that offer an attractive yield pick-up when hedged back to the US dollar because of the potential shifts in interest rate differential.A manufacturing services company (“MSC”) leans into AI2

MSC is an electronics manufacturing services company that helps customers design and build electronics products. Among MSC’s many innovations are the AI- and machine learning based detection systems used on the company’s factory floors. The systems help identify defects quickly and accurately, saving costs and enhancing efficiency—and they get more intelligent over time. The company also uses AI to optimize production processes, reducing redundancies and improving throughput. MSC even helped design an automated barista system that uses AI to serve coffee and cocktails.A large internet company (“LIC”) uses AI to discover millions of new materials for high-tech manufacturing3

Researchers at LIC used AI to discover 2.2 million new crystal structures, including an estimated 380,000 that are sufficiently stable for synthesis and further research. This significantly expands the number of known stable inorganic materials by nearly tenfold. In the past, materials scientists identified new crystals through a time- consuming trial-and-error process. The announcement demonstrates how AI can significantly accelerate the discovery process for new materials, which can be a key enabler of the next hardware or industrial breakthrough.Why it matters

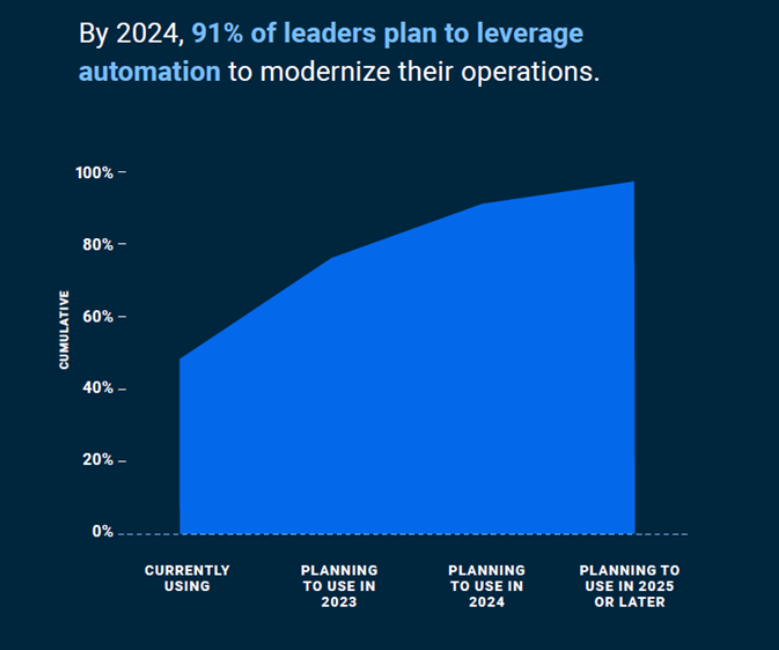

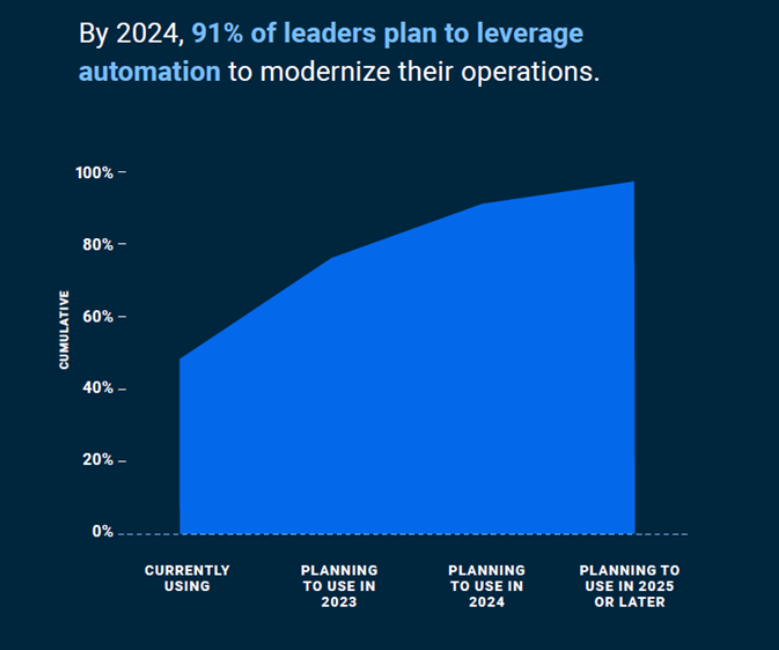

Today, industrial manufacturing is undergoing a sea change powered by AI innovations. Not only do most companies already recognise AI’s potential to improve their operations (Exhibit 1), but the evidence shows that it’s working. A recent survey by McKinsey suggested that manufacturing is the function that may be poised to reap the biggest benefits from AI adoption. Of the hundreds of organisations actively using AI, 55% anticipated at least a 10% decrease in manufacturing costs, while 66% expected at least a 5% increase in manufacturing revenue.4Exhibit 1: Most companies are already tapping AI’s potential Source: Samsara 2023 State of Connected Operations Report, March 2023.*A digital twin is a virtual replica of a physical object, operation or process, frequently powered by AI and continuously updated with a steady flow of data.1 Architect Magazine, February 20212 Bisinfotech, November 20233 Venturebeat, November 20234 McKinsey & Company, August 2022Want to search and invest in related funds? Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI and Tech】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Importance Notice This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.

Source: Samsara 2023 State of Connected Operations Report, March 2023.*A digital twin is a virtual replica of a physical object, operation or process, frequently powered by AI and continuously updated with a steady flow of data.1 Architect Magazine, February 20212 Bisinfotech, November 20233 Venturebeat, November 20234 McKinsey & Company, August 2022Want to search and invest in related funds? Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI and Tech】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Importance Notice This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.

Source: Samsara 2023 State of Connected Operations Report, March 2023.*A digital twin is a virtual replica of a physical object, operation or process, frequently powered by AI and continuously updated with a steady flow of data.1 Architect Magazine, February 20212 Bisinfotech, November 20233 Venturebeat, November 20234 McKinsey & Company, August 2022Want to search and invest in related funds? Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI and Tech】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Importance Notice This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.

Source: Samsara 2023 State of Connected Operations Report, March 2023.*A digital twin is a virtual replica of a physical object, operation or process, frequently powered by AI and continuously updated with a steady flow of data.1 Architect Magazine, February 20212 Bisinfotech, November 20233 Venturebeat, November 20234 McKinsey & Company, August 2022Want to search and invest in related funds? Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI and Tech】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Importance Notice This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.