Related Theme in WeLab Bank Featured Fund Services

AI Technology

- One of the most popular themes among WeLab Bank customers

- Funds under this theme invest majority into technology-related firms in the developed market, including the whole of the supply chain.

- The latest 3-Year total return: 17.8% - 34.5%#

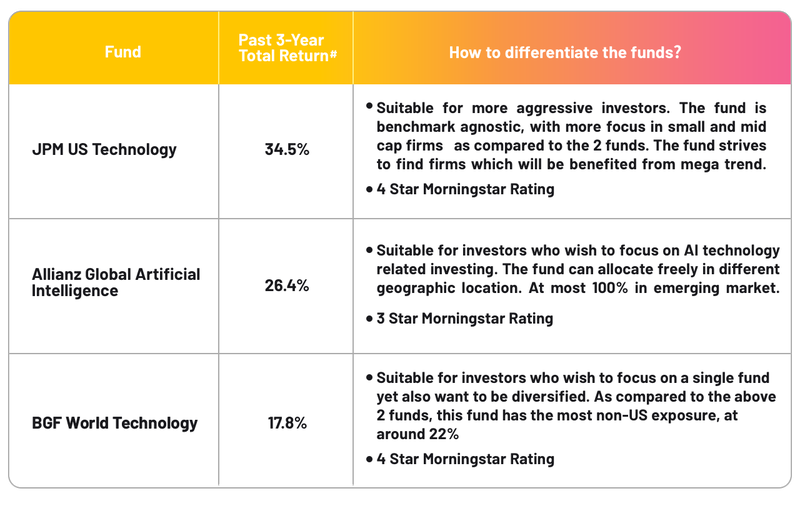

Featured Funds of AI Technology

#Data as of 30 June 2023. The table lists out all the funds under such themes and the past 3-year total return of the funds. The figures are provided by Morningstar Asia Limited and are for information only and not guaranteed. We do not take responsibility for and do not endorse the accuracy of such information. Past performance is not indicative of future results. The information set out in the table above is for reference only and does not constitute any comment, recommendation, solicitation, offer or sale of any investment product.Below are the captioned fund’s calendar year return since 2018, as of 30 June 2023 JPM US Technology: 2023 YTD: 46.4%; 2022: -44.9%; 2021: 12.8%; 2020: 87.0%; 2019: 41.3%; 2018: 3.6%。Allianz Global Artificial Intelligence: 2023 YTD: 35.8%; 2022: -45.6%; 2021: 7.9%; 2020: 100.5%; 2019: 28.9%; 2018: -5.4%。BGF World Technology: 2023 YTD: 34.3%; 2022: -44.1%; 2021: 12.8%; 2020: 86.9%; 2019: 43.5%; 2018: -0.3%

#Data as of 30 June 2023. The table lists out all the funds under such themes and the past 3-year total return of the funds. The figures are provided by Morningstar Asia Limited and are for information only and not guaranteed. We do not take responsibility for and do not endorse the accuracy of such information. Past performance is not indicative of future results. The information set out in the table above is for reference only and does not constitute any comment, recommendation, solicitation, offer or sale of any investment product.Below are the captioned fund’s calendar year return since 2018, as of 30 June 2023 JPM US Technology: 2023 YTD: 46.4%; 2022: -44.9%; 2021: 12.8%; 2020: 87.0%; 2019: 41.3%; 2018: 3.6%。Allianz Global Artificial Intelligence: 2023 YTD: 35.8%; 2022: -45.6%; 2021: 7.9%; 2020: 100.5%; 2019: 28.9%; 2018: -5.4%。BGF World Technology: 2023 YTD: 34.3%; 2022: -44.1%; 2021: 12.8%; 2020: 86.9%; 2019: 43.5%; 2018: -0.3%Insights from WeLab Bank Investment Experts

Worried that AI is overpriced? Invest smartly into the entire supply chain

Everyone says AI is going to be transformative, turbocharging the economy. But there aren’t much analysis on “how”?Overall speaking, AI is a technology which helps all of us to “produce more, with less work”. For example, an AI-driven chatbot might be able to answer most of the questions from banking customers, freeing up employees to spend more time selling services or provide a better in-person experience to the bank’s clients.So how do you invest in AI?The ecosystem consists of 3 groups: companies that sell AI as a product or a service, companies that build AI models and develop the wider infrastructure, and companies that are building the hardware necessary for it all to work.Although AI has been a hot topic in the market for a while, but investment opportunities do not limit to the common household names. But if investors want to expand their reach to the full supply chain, it may cost them a lot of effort and time.Investors can consider investing through global asset managers. Relying on the expertise of investment professionals, investors may have exposure to the whole technology sector ecosystem, capturing opportunities while capturing the long term growth of the sectors.

^From 5 June to 4 August 2023, the Fund Platform Fee Monthly Rate applicable to the Featured Funds Services is 0%. Terms and conditions apply. For details, please visit HERE.

^From 5 June to 4 August 2023, the Fund Platform Fee Monthly Rate applicable to the Featured Funds Services is 0%. Terms and conditions apply. For details, please visit HERE.Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.