Summary notes

The consensus across leading fund houses is clear^: 2026 offers opportunities, but demands selectivity, diversification, and active risk management.- Investors should consider balancing quality equity exposure with income-generating fixed income asset;

- Thematic allocations on AI and infrastructure will be critical to navigating this evolving landscape;

- Key risks highlighted across Fund House(s) include U.S. stagflation, inflation resurgence, and policy missteps.

Investment outlook details#

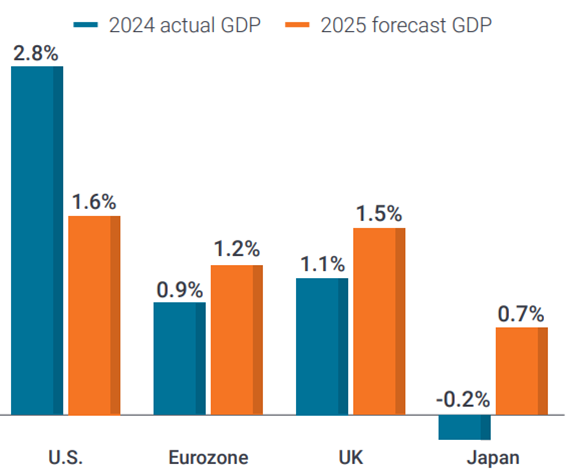

1.Macro OutlookThese Fund House(s) generally agree that global growth will remain resilient in 2026.1- Allianz project global GDP growth at around 2.7% (in purchasing power parity-weighted terms) and that the U.S. economy growth will slow to around between 1.5% and 2%, slightly below potential. While Europe should see 1–1.5% GDP growth in 2026 and Asia remain mixed, led by India and parts of Southeast Asia.

- JPAM forecast slower global growth in 2026, but see some tailwinds outside the U.S. In Europe, fiscal support could keep growth anchored in 2026, though investors should remain mindful of implementation risks. While in Asia, AI-related investment and export demand present some relief but the growth is challenged by tariffs and uncertain trade policies.

- BlackRock is overweight in U.S. and Japan equities, by viewing continued Federal Reserve easing, broad economic optimism and less policy uncertainty for U.S. and strong nominal GDP, healthy corporate capex and governance reforms for Japan respectively.

- Fidelity International opined that amid a supportive macro environment, growth should be resilient, and policy (both monetary and fiscal) is accommodative.

Figure 1: Global Growth Forecast (Source: FactSet, JPAM. *Real GDP growth forecasts are based on FactSet Economic Estimates, which are consensus estimates compiled by FactSet. Guide to the Markets – Asia. Data reflect most recently available as of 13/11/25.)

Figure 1: Global Growth Forecast (Source: FactSet, JPAM. *Real GDP growth forecasts are based on FactSet Economic Estimates, which are consensus estimates compiled by FactSet. Guide to the Markets – Asia. Data reflect most recently available as of 13/11/25.)- BlackRock see inflation is expected to stay sticky above the Fed’s 2% target.

- Allianz warn that U.S. inflation is forecasted to be above 3% due to tariff passthrough risks, while Europe inflation is projected to remain below 2% and Asia inflation remain under pressure.

- Invesco expect stable, above-target inflation in 2026.

- Allianz anticipate continued monetary easing, with the Fed likely cutting rates to 3.25–3.50% and the European Central Bank likely to cut rates to 1.75%. Across Fund House(s), there is consensus in general that the U.S. dollar will soften further, creating a tailwind for emerging markets.

Figure 2: 10-year breakeven inflation rate of the US. (Source: Federal Reserve Bank of St Louis, Fidelity International, November 2025. A measure of market expectations for inflation derived from 10-year fixed rate and inflation-linked Treasuries)2.EquitiesAbout U.S. equities, views converge on the need for selectivity and quality bias.2

Figure 2: 10-year breakeven inflation rate of the US. (Source: Federal Reserve Bank of St Louis, Fidelity International, November 2025. A measure of market expectations for inflation derived from 10-year fixed rate and inflation-linked Treasuries)2.EquitiesAbout U.S. equities, views converge on the need for selectivity and quality bias.2- BlackRock is overweight to U.S. equities, citing AI-driven earnings and Fed easing as key supports;

- Janus Henderson and Invesco, however, suggest that valuations are more attractive or a tailwind is provided in cyclicals, small- and mid-cap stocks;

- Allianz and Fidelity International advocate avoiding U.S. concentration risk.

- Europe is widely favoured by Allianz, JPAM, and Janus Henderson for its attractive valuations and fiscal support;

- According to Janus Henderson, despite headwinds from geopolitical risks, energy challenges, and trade frictions, Europe has responded positively with proposed large-scale structural reforms. These include cutting bureaucracy, boosting productivity, and delivering the biggest fiscal stimulus since post-World War II.

- Alongside these reforms, policies to advance clean energy and reduce dependency on traditional energy sources are gaining momentum. Large-scale defence and major infrastructure investments, including Germany’s US$500 billion Special Infrastructure Fund, signal a commitment to long-term competitiveness. Although near-term growth is muted, Europe’s forecast for 2025 stands out as relatively strong compared to other regions.

Figure 3: Rising Growth Forecast for Europe in 2025 by Janus Henderson. (Source: Bloomberg, as of 18 November 2025).About other market equities:4

Figure 3: Rising Growth Forecast for Europe in 2025 by Janus Henderson. (Source: Bloomberg, as of 18 November 2025).About other market equities:4- Japan earns overweight calls from BlackRock attributed to governance reforms and nominal growth.

- As opined by Fidelity International, mild inflation alongside gradual monetary normalisation should drive improvements in Japan’s corporate earnings in the new year. For years, Japan’s bank stocks have been overlooked because of their inefficient capital allocation and the country’s ultra-low-interest rate environment, but now they’re also stepping up dividend payments, share buybacks, and cutting back on cross-shareholdings. This is similar with construction companies under modest inflation, Japanese companies have ramped up investment in research and development, M&A, and productive capex, instead of hoarding cash. Robust capex is driving an increase in demand for construction. Japan is aggressively pursuing digitalisation as artificial intelligence becomes a central force for growth and innovation. The country’s ageing and shrinking workforce is accelerating the corporate adoption of AI. Major firms are investing in both AI and automation technologies to boost productivity and offset the demographic trend.

- China seen as an opportunity by Fidelity International, Invesco and Allianz, supported by policy stimulus and innovation. Allianz points out, China’s equity market remains deep and attractively priced, as well as under-owned by foreign investors, presenting contrarian opportunities for long-term capital flows. While performance has been volatile – and further news-driven volatility is to be expected – local Chinese equities have performed well in 2025, and the long-term trajectory remains positive, especially for investors focused on innovation, domestic consumption and strategic sectors.

- Emerging markets remain a strategic focus, with India highlighted by Allianz and BlackRock for its demographics and digital infrastructure.

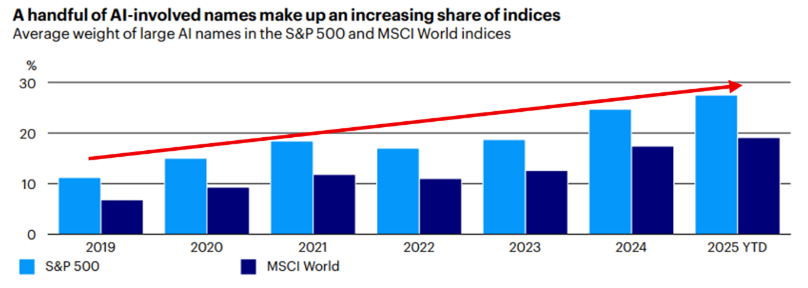

- AI continues to dominate equity themes, with all Fund House(s) emphasizing active exposure across the value chain, from hyperscalers and semiconductors to infrastructure enablers, while warning against passive concentration risk.

- Figure 4 from Invesco shows that AI-related companies have become an increasingly dominant part of major equity indices over time. In 2019, large AI names represented roughly 8–12% of the S&P 500 and MSCI World indices. By 2024, its proportion rose to about 25% of the S&P 500 and about 18% of MSCI World. As of 2025 year-to-date as of 28 October 2025, these weights have climbed even higher to 28–30% for the S&P 500 and nearly 20% for MSCI World.

Figure 4: Average weight of large AI names in the S&P 500 and MSCI World Indices. (Note: S&P 500: AI return measures the contribution to total S&P 500 Index performance specifically from NVDA, MSFT, AMZN, META, AVGO, GOOGL, ORCL, and AMD. S&P 500: ex-AI return measures the contribution to total S&P 500 Index performance, from all stocks other than those categorized as “S&P 500: AI”, previously listed Sources: Bloomberg L.P., and Invesco Strategy & Insights, as of October 28, 2025. Past performance does not guarantee a profit or eliminate the risk of loss. An investment cannot be made directly into an index.)

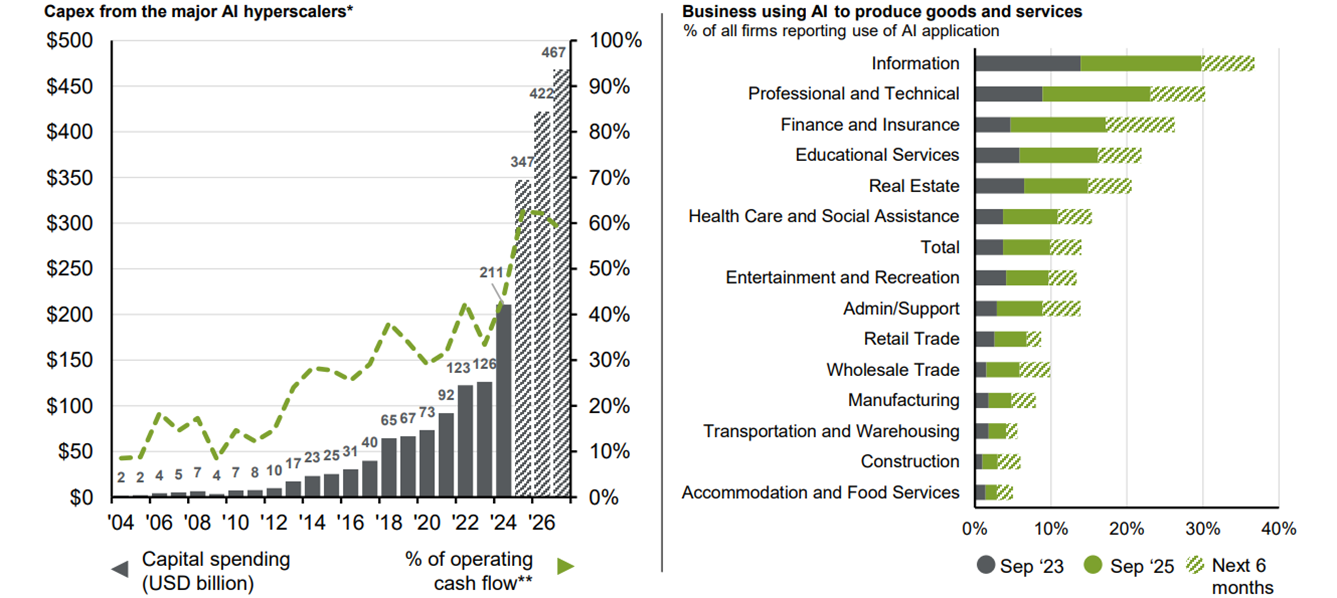

Figure 4: Average weight of large AI names in the S&P 500 and MSCI World Indices. (Note: S&P 500: AI return measures the contribution to total S&P 500 Index performance specifically from NVDA, MSFT, AMZN, META, AVGO, GOOGL, ORCL, and AMD. S&P 500: ex-AI return measures the contribution to total S&P 500 Index performance, from all stocks other than those categorized as “S&P 500: AI”, previously listed Sources: Bloomberg L.P., and Invesco Strategy & Insights, as of October 28, 2025. Past performance does not guarantee a profit or eliminate the risk of loss. An investment cannot be made directly into an index.)- Recent data from JPAM as reflected in Figure 5 underscores the scale and breadth of AI’s impact. Capital spending by major AI hyperscalers has surged from under $100 billion in 2020 to an estimated $467 billion by 2027 and consuming around 95% of operating cash flow by 2027. This serves as a clear sign of the intensity behind AI infrastructure buildouts.

- At the same time, AI adoption is spreading rapidly across industries. Sectors such as Information, Professional and Technical, Finance and Insurance, and Education Services report the highest usage today, with expectations for further growth in the next six months. Even traditionally slower adopters like Real Estate and Healthcare and Social Assistance are accelerating integration, signalling that AI’s influence is moving well beyond technology into the broader economy.

Figure 5: US: AI Capex and Applications (Source: JPAM; (Left) Bloomberg; (Right) Census Business Trends and Outlook Survey (AI Supplement). Data for 2025, 2026 and 2027 reflect consensus estimates. 2004 to 2012 are JPAM estimates and 2012 to present are Bloomberg consensus estimates. *Hyperscalers are 5 selected large cloud computing companies that own and operate data centers with horizontally linked servers that, along with cooling and data storage capabilities, enable them to house and operate AI workloads. **Reflects cash flow before capital expenditures in contrast to free cash flow, which subtracts out capital expenditures. Capital spending on the left reflects the components of non-residential gross private fixed investment as a share of nominal GDP. Past performance is not indicative of current or future results. Guide to the Markets – Asia. Data reflect most recently available as of 30/09/25.)3.Fixed IncomeFixed income outlooks are constructive but nuanced.6

Figure 5: US: AI Capex and Applications (Source: JPAM; (Left) Bloomberg; (Right) Census Business Trends and Outlook Survey (AI Supplement). Data for 2025, 2026 and 2027 reflect consensus estimates. 2004 to 2012 are JPAM estimates and 2012 to present are Bloomberg consensus estimates. *Hyperscalers are 5 selected large cloud computing companies that own and operate data centers with horizontally linked servers that, along with cooling and data storage capabilities, enable them to house and operate AI workloads. **Reflects cash flow before capital expenditures in contrast to free cash flow, which subtracts out capital expenditures. Capital spending on the left reflects the components of non-residential gross private fixed investment as a share of nominal GDP. Past performance is not indicative of current or future results. Guide to the Markets – Asia. Data reflect most recently available as of 30/09/25.)3.Fixed IncomeFixed income outlooks are constructive but nuanced.6- U.S. Treasuries are generally underweighted, with several Fund House(s) expecting curve steepening. Amid growing confidence in Fed rate cuts, BlackRock see that lower inflation and better tax revenues could push down yields near term while Invesco is not expected to have a material fall in inflation;

- Allianz and JPAM favour the investment-grade (“IG”);

- Fidelity International highlight European IG as offering better value than U.S. IG;

- Emerging market debt, especially local currency bonds, is viewed positively by Invesco and Fidelity International, supported by soft USD and attractive yield;

- Diversifiers such as securitized credit, floating-rate notes, and convertibles are recommended by multiple Fund House(s) for resilience. According to Janus Henderson, it is illustrated that during the last five major U.S. equity market downturns, high-quality fixed incomes, particularly securitized assets such as IG MBS, ABS, and AAA-rated Collateralized Loan Obligations (“CLOs”), have experienced far smaller losses than equities. In fact, AAA CLOs delivered a modest downside of 2.2%, while broad equity benchmarks fell over 20% on average (MSCI ACWI: −21.8%, S&P 500: −22.4%).

Figure 6: Comparative Peak-to-Trough Returns Across Asset Classes in Equity Corrections. Source: Bloomberg, JPAM, as of 14 November 2025. Asset class descriptions and indices used to represent them as per disclosures on page 11 of Janus Henderson < Janus Henderson Investors Market GPS Investment Outlook 2026 >. Returns represent the average peak-to-trough return for the five most recent corrections and bear markets on the S&P 500 Index, with corresponding returns for fixed income sectors over the same time period. Past performance does not predict future returns.4.Currencies & CommoditiesCurrency and commodity views are aligned on a gradual USD fade.7

Figure 6: Comparative Peak-to-Trough Returns Across Asset Classes in Equity Corrections. Source: Bloomberg, JPAM, as of 14 November 2025. Asset class descriptions and indices used to represent them as per disclosures on page 11 of Janus Henderson < Janus Henderson Investors Market GPS Investment Outlook 2026 >. Returns represent the average peak-to-trough return for the five most recent corrections and bear markets on the S&P 500 Index, with corresponding returns for fixed income sectors over the same time period. Past performance does not predict future returns.4.Currencies & CommoditiesCurrency and commodity views are aligned on a gradual USD fade.7- Allianz, JPAM, and Invesco favoring Euro/Yen/ selecting emerging market currencies, particularly in Latin America;

- Commodities outlook is constructive, with gold seen as a risk diversifier by Allianz and Fidelity International, while BlackRock view it as a tactical play rather than a long-term portfolio hedge;

- As opined by Fidelity International, industrial metals such as copper and uranium, along with energy resources, are expected to benefit from AI-driven infrastructure demand and power grid expansion.

- Key risks highlighted across Fund House(s) include U.S. stagflation, inflation resurgence, and policy missteps, as noted by Allianz and Janus Henderson;

- Geopolitical tensions in Russia and East Asia, European fiscal instability, and credit cracks are recurring concerns;

- AI-specific risks such as businesses profitability for companies that build and maintain the AI models and higher cost of AI-related investment due to a structurally higher cost of capital, are flagged by BlackRock and Fidelity International. To mitigate these risks, Fund House(s) recommend maintaining liquidity buffers, scenario-based hedging, and active portfolio rotation.

Open the WeLab Bank App and click Featured Funds to find out more!

#For details and the exact wording adopted by these Fund House(s) on particular investment outlook, please study relevant documents issued by respective fund house as listed out in Section “Source document(s) of 2026 Market Outlook of Fund House(s)“ of this document. The information contained herein is derived from publicly available market information and is for reference only.SourceSource document(s) of 2026 Market Outlook of Fund House(s):

- Allianz Global Investors Navigate New Pathways Outlook 2026, as of Dec 2025

- BlackRock 2026 Global Outlook Pushing Limits, as of Dec 2025

- Fidelity International Outlook 2026 The Age of Alpha, as of Dec 2025

- Invesco 2026 Annual Investment Outlook Resilience and Rebalancing, as of Dec 2025

- Janus Henderson Investors Market GPS Investment Outlook 2026, as of Dec 2025

- J.P. Morgan Asset Management Market Outlook 2026 Discipline to be the Name of the Game, as of Dec 2025

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 5-6, 9, 11.

- BlackRock < BlackRock 2026 Global Outlook Pushing Limits > Page 7, 18.

- Fidelity International < Fidelity International Outlook 2026 The Age of Alpha > Page 5-6, Page 7, Page 14

- Invesco < 2026 Annual Investment Outlook Resilience and Rebalancing > Page 3, Page 7, Page 12

- J.P. Morgan Asset Management < Market Outlook 2026 Discipline to be the Name of the Game > Page 4

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 8

- BlackRock < BlackRock 2026 Global Outlook Pushing Limits > Page 8, 18.

- Fidelity International < Fidelity International Outlook 2026 The Age of Alpha > Page 12

- Invesco < 2026 Annual Investment Outlook Resilience and Rebalancing > Page 2, 6

- Janus Henderson < Janus Henderson Investors Market GPS Investment Outlook 2026 > Page 2

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 8

- Janus Henderson < Janus Henderson Investors Market GPS Investment Outlook 2026 > Page 2-3, 6

- J.P. Morgan Asset Management < Market Outlook 2026 Discipline to be the Name of the Game > Page 4-5

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 5, 9, 10

- BlackRock < BlackRock 2026 Global Outlook Pushing Limits > Page 16-18

- Fidelity International < Fidelity International Outlook 2026 The Age of Alpha > Page 4, 19

- Invesco < 2026 Annual Investment Outlook Resilience and Rebalancing > Page 3, 9, 11

- J.P. Morgan Asset Management < Market Outlook 2026 Discipline to be the Name of the Game > Page 4

- Invesco < 2026 Annual Investment Outlook Resilience and Rebalancing > Page 8

- J.P. Morgan Asset Management < Market Outlook 2026 Discipline to be the Name of the Game > Page 6

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 13, 15

- BlackRock < BlackRock 2026 Global Outlook Pushing Limits > Page 17-18

- Fidelity International < Fidelity International Outlook 2026 The Age of Alpha > Page 4, 7, 14, 15

- Invesco < 2026 Annual Investment Outlook Resilience and Rebalancing > Page 11

- Janus Henderson < Janus Henderson Investors Market GPS Investment Outlook 2026 > Page 7-8

- J.P. Morgan Asset Management < Market Outlook 2026 Discipline to be the Name of the Game > Page 10

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 16

- BlackRock < BlackRock 2026 Global Outlook Pushing Limits > Page 17

- Fidelity International < Fidelity International Outlook 2026 The Age of Alpha > Page 5, 6, 9

- Invesco < 2026 Annual Investment Outlook Resilience and Rebalancing > Page 11

- J.P. Morgan Asset Management < Market Outlook 2026 Discipline to be the Name of the Game > Page 15

- Allianz < Allianz Global Investors Navigate New Pathways Outlook 2026 > Page 4-6

- BlackRock < BlackRock 2026 Global Outlook Pushing Limits > Page 9

- Fidelity International < Fidelity Outlook 2026 The Age of Alpha > Page 3, 8, 9, 26

- Janus Henderson < Janus Henderson Investors Market GPS Investment Outlook 2026 > Page 2

Importance Notice This document is issued by Welab Bank Limited (“Welab Bank Limited”). The contents of this document have not been reviewed by the Securities and Futures Commission of Hong Kong.This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this document are not equivalent to, nor should it be treated as a substitute for, time deposit, and are not protected by the Deposit Protection Scheme in Hong Kong.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by Welab Bank Limited, but Welab Bank Limited makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. Welab Bank Limited does not take responsibility for nor does Welab Bank Limited endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. Welab Bank Limited makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). Welab Bank Limited accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.Welab Bank Limited is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1(dealing in securities) and Type 4(advising on securities) regulated activities.In case of any discrepancy between the English and the Chinese versions of this document, the English version shall prevail.