- you are at least 18 years old; and

- you have a valid Core Account with us; and

- you have a written consent issued by your employer (if you are an employee of a registered institution or a licensed corporation under the Securities and Futures Ordinance).

- Confirm information;

- Provide further personal information for the Wealth Management Services;

- Review Wealth Management Services Terms, Risk Disclosures, Important Notes, General Service Charges, etc, and submit your registration; and

- Complete a Customer Risk Profiling Questionnaire before start investment.

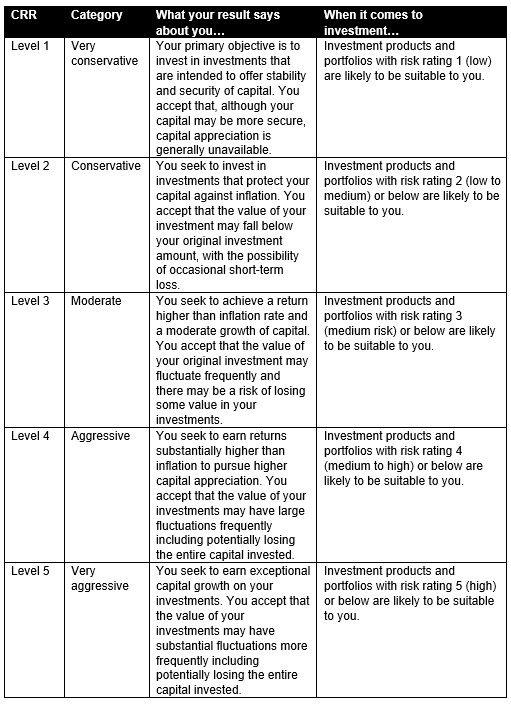

The CRR is derived from your personal circumstances as indicated in your CRPQ, including but not limited to, your investment objective, your risk tolerance and appetite. Your CRR can serve as a reference for your consideration when making your investment decisions.The CRR and its relations to products do not constitute a recommendation or solicitation of such related investment products or services to you.It is important for you to provide us the latest, accurate and complete information in your CRPQ and update your CRPQ regularly or when there is any change in personal circumstances. Please note that if you don’t have a valid CRPQ, you cannot access our Wealth Management Services.(6) How can I update my Customer Risk Profiling Questionnaire?Once your account is open and ready, you can access “My Account” at the top right corner on the Bank App and go to “Wealth Centre” > “Review Customer Risk Profile” to update your Customer Risk Profiling Questionnaire.

The CRR is derived from your personal circumstances as indicated in your CRPQ, including but not limited to, your investment objective, your risk tolerance and appetite. Your CRR can serve as a reference for your consideration when making your investment decisions.The CRR and its relations to products do not constitute a recommendation or solicitation of such related investment products or services to you.It is important for you to provide us the latest, accurate and complete information in your CRPQ and update your CRPQ regularly or when there is any change in personal circumstances. Please note that if you don’t have a valid CRPQ, you cannot access our Wealth Management Services.(6) How can I update my Customer Risk Profiling Questionnaire?Once your account is open and ready, you can access “My Account” at the top right corner on the Bank App and go to “Wealth Centre” > “Review Customer Risk Profile” to update your Customer Risk Profiling Questionnaire.Please note that there will be a limited number of attempt to re-conduct the CRPQ within a certain period, i.e. 3 times in 180 calendar days. It is important for you to check the accuracy of your answers before submitting the questionnaire.(7) How can I access “Wealth Management Services” on the WeLab Bank app?After you have received our confirmation of completion the registration, you can log-in our App and click on the “GoWealth” icon at the bottom menu, and start enjoying the Wealth Management Services.(8) What does FATCA / CRS mean?You can refer to our “Foreign Account Tax Compliance Act (“FATCA”) Statement” and “Common Reporting Standards (“CRS”) Statement” for more details.