Infrastructure

AI in infrastructureApplying AI-controlled data analysis tools in equipment management to predict failure patterns in construction and engineering equipment can help avoid breakdowns, reduce maintenance intervals, adapt operating parameters to changing conditions, and prolong the operating life of machines. With less error-prone, high-performance equipment, construction projects can be carried out in a more cost and time-efficient way.Within the context of AI-controlled and data-driven construction and engineering equipment, so called digital twins – digital replicas of physical assets – are gaining in importance.A US-based provider of infrastructure services for electric power, pipeline, industrial and communications industries, has created a data modelling method that can design an entirely replicated digital twin of a complete manufacturing plant. Based on Industrial Internet of Things (IIoT) technology, the analytics engine can predict both potential operational failures and operational savings prospects, while minimising the effects on plant operations.Addressing labour shortages and enhanced safety measuresThe implementation of connected and autonomous vehicles on construction sites, for instance, can help address labour shortages and reduce project delays. At the same time, autonomous vehicles responding to enhanced safety measures at construction sites are contributing to safer working environments for operators, as the latter are detached from the machine and not exposed to heavy vibrations, and dust, etc., when excavating.Technological transferFinally, the technological learnings gained with autonomous vehicles in mining and industrial settings can be transferred to autonomous driving in urban settings.For the period of 2022 to 2028, the AI market in construction is predicted to show double-digit growth of 24.3%, reaching a value of USD 9.53 billion in the next five years4.

Intelligent machines

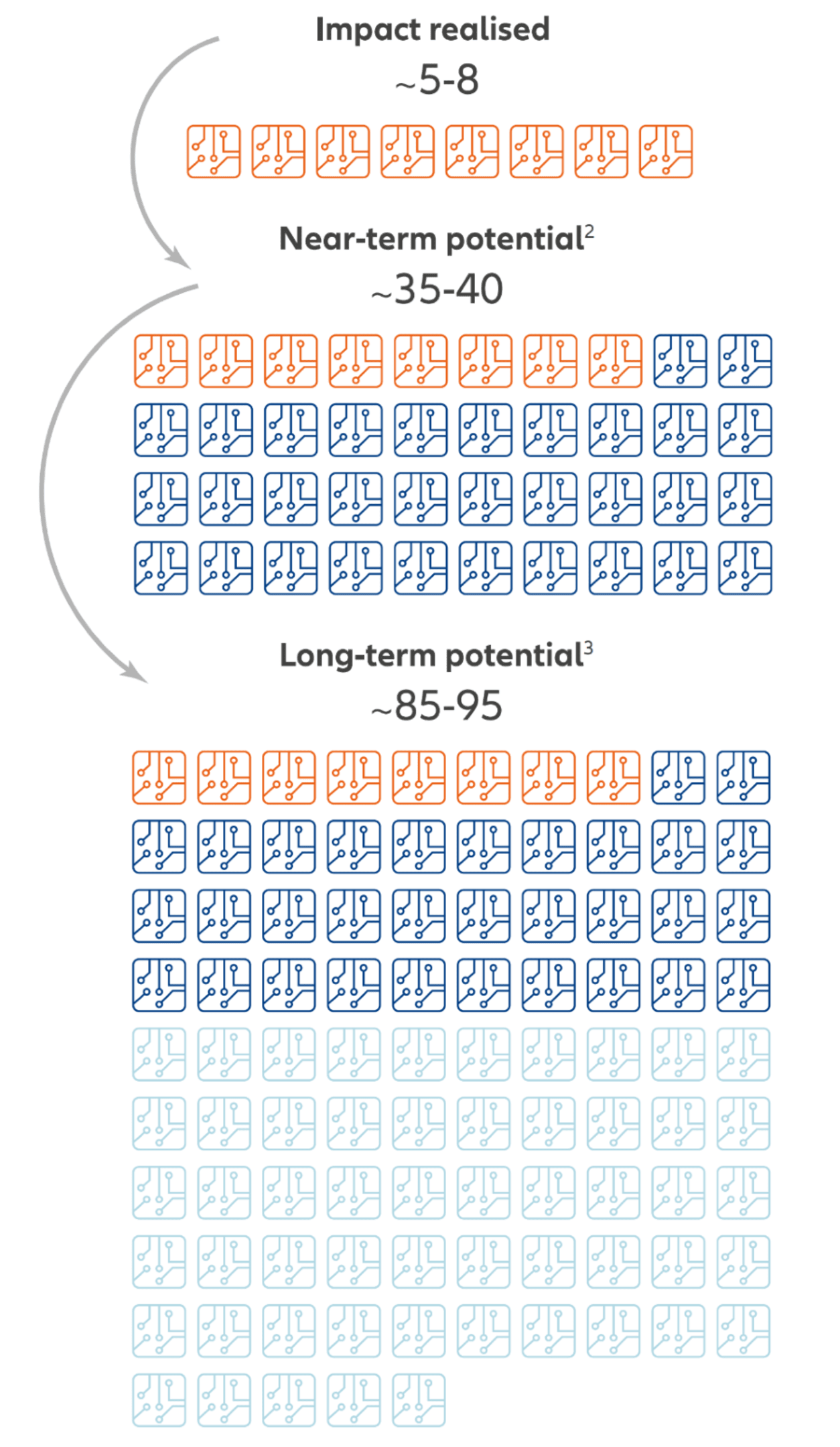

With increasing complexity in semiconductor fabrication processes, human cognitive capabilities can no longer keep up with multiple decisions that must be taken in an ever-accelerating way. In this context, AI-based techniques that collect huge amounts of data across the manufacturing process have become a key tool for determining whether each individual processing step was executed correctly.“Human first-computer last”A US-company that delivers critical processes in microchip manufacturing conducted a study5 that compared humans to machines in developing a semiconductor process. The results showed that humans excel in the early stages of process development, while algorithms are more cost-efficient near the tight tolerances of the target. Partnering computer algorithms with human experts can thus lead to a significant reduction of cost-to-target.How AI delivers value to the semiconductor industryAccording to a recent McKinsey survey, semiconductor companies could massively benefit from deploying AI, potentially adding an annual value up to USD 95 billion over the long term.Artificial intelligence could generate $85 billion to $95 billion for semiconductor companies over the long term 1 Earnings before interest and taxes.

1 Earnings before interest and taxes.2 Near-term potential refers to gains within the next 2-3 years.

3 Long-term potential refers to gains achieved 4 years or more in the future.

Source: Mckinsey: Scaling AI in the sector that enables it: Lessons for semiconductor-device makers. As of April 2021In contrast to this upside potential, less than a third of semiconductor-device makers are already generating value by implementing AI/ML, whereas around 70% are still in pilot stages and progressing sluggishly.This, in turn, illustrates the growth capacity of integrating AI/ML into the manufacturing and designing of semiconductors.

Next Generation Energy

Diminishing downtimes: AI/ML-enabled predictive maintenance solutionsAccording to US Department of Energy (DoE) estimates, the cost of power cuts to American businesses is around USD 150 billion annually6. This emphasises the importance of intelligent predictive maintenance solutions, especially for sensitive energy infrastructure.A US-semiconductor manufacturer develops ML-powered smart predictive maintenance solutions that are directly implemented on sensors or IoT devices. This not only diminishes latency and improves real-time managerial decisions, but also augments data protection, lowers bandwidth requirements, and helps to proactively avoid unforeseen breakdowns, resulting in savings on emergency repairs and longer asset life.Pet Economy

From treating to preventing: the digitalisation of clinical treatmentsAI software can detect complex diseases with increasing accuracy and help interpret veterinary results. This, in turn, leads to more accurate diagnoses, more efficient medication and cures and to a quicker and more reliable identification of individual preventive care requirements. This could foster the growth of the vet care market, not least with regards to pets’ longevity and the special (nutritional) needs of geriatric pets.A multinational company that develops and distributes products and services for the veterinary market designed an AI-powered haematology analyser that removes time-consuming and error-prone manual processes, delivering higher accuracy of results and giving reliable guidance for veterinarians.AI as a thematic investment caseThe emergence of AI has added new and fascinating facets to our unconstrained thematic investing approach. It has opened multiple new angles for participating in the growth prospects resulting from AI-driven structural shifts. Understanding and assessing in detail AI’s disruptive power, and its impact on the several themes covered by our Thematica strategy, can help investors identify untapped opportunities and stay ahead of the curve.Want to search and invest in related funds? Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI Technology】to find out more!Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!4 Mordorintelligence.com: AI In Construction Market Analysis. As of July, 20235 Lamresearch.com: AI Study Identifies Game-Changing Development Approach for Speeding Up, Slashing Cost of Chip Innovation. As of April 2023

6 US Department of Energy: Report Explores U.S. Advanced Small Modular Reactors to Boost Grid Resiliency. As of January 2018Importance Notice This document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.