AI’s impacts on Thematic Investment strategy (Part 1)

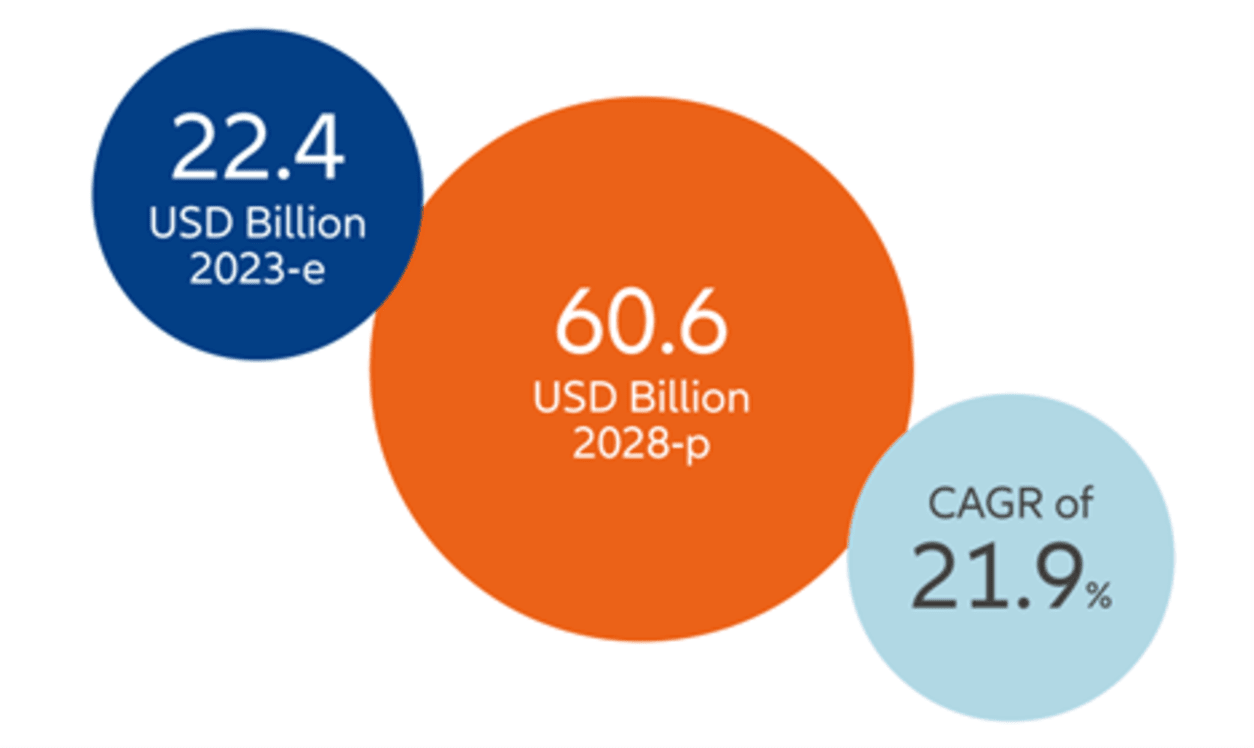

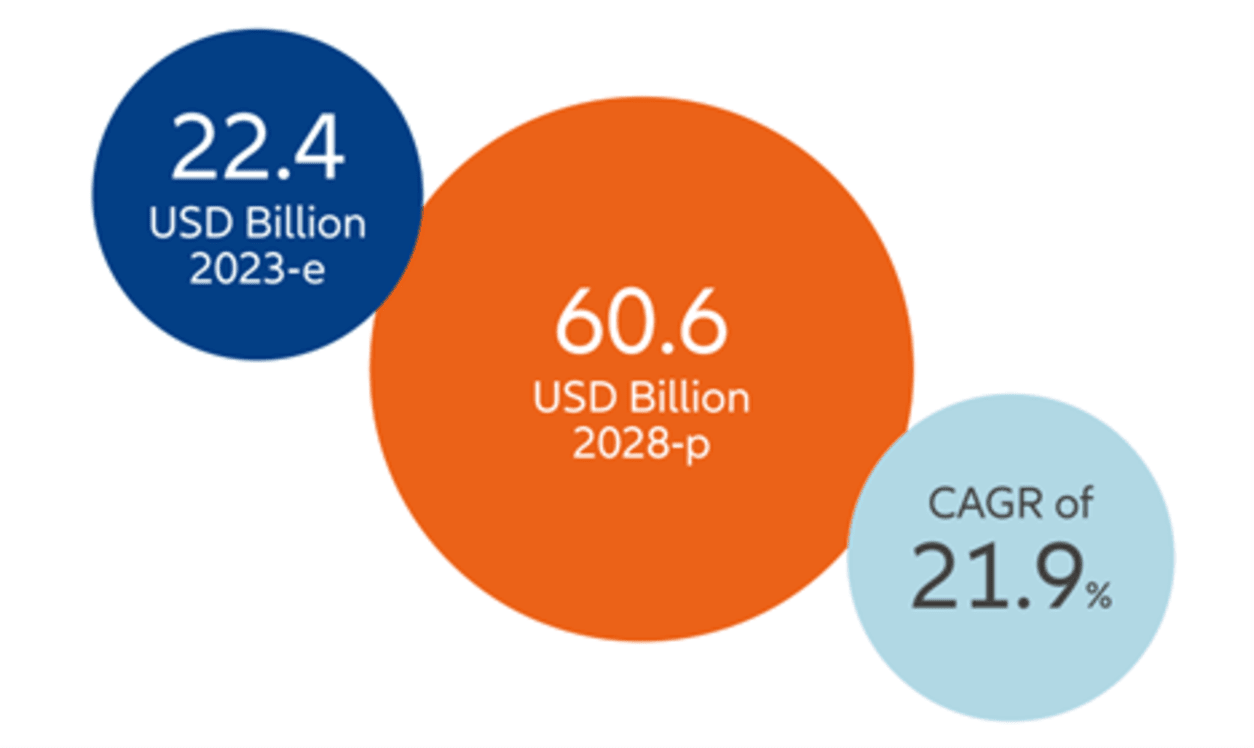

Since the public release of OpenAI’s ChatGPT large language model at the end of 2022, the integration of Artificial intelligence (AI) in core business processes has been gaining cross-industry traction. With its growing significance and proliferation, AI is showing its disruptive potential to drive structural shifts in the way we live, work, produce, and collaborate. An unconstrained thematic investing approach to AI can help identify opportunities arising from these transformational processes, offering investors the chance to participate in cross-sectional growth prospects.AllianzGI have identified several use cases to show AI’s present and future impacts on the investable themes within AllianzGI’s Thematica strategy. Digital Life: Where there is cyber there should be AI-backed securityWith an increasing level of connection and with more services moving to a cloud environment, cyber security is growing in significance as complex and deeply integrated IT environments are exposed to new cyber-risks from multiple layers and access points.To protect companies from sophisticated cyber-threats, a multi-layered, holistic, scalable, and seamless cyber security approach is needed. With the integration of AI, features like automated threat detection, malicious patterns prediction, accelerated data protection, and risk-based conditional access can contribute to establishing a multi-layered defence of business processes, data, and IT infrastructure.For instance, two leading US-based companies that provide sophisticated cyber and cloud security services have developed solutions based on the idea of “zero trust”. Dependent on user identity, device security credentials, and access policies, access rights are granted or withhold. These real-time risk-based conditional access applications facilitate and speed up the steering of a multitude of individual access requirements from users. This, in turn, protects complex and thus more vulnerable IT environments from breaches.In parallel, cyber security solutions that help companies identify data leakages in AI applications or assist in designing and building safer AI environments are also gaining importance.The disruptive power of AI-powered cyber security solutions is also reflected in the projected double-digit market growth of this segment:

Digital Life: Where there is cyber there should be AI-backed securityWith an increasing level of connection and with more services moving to a cloud environment, cyber security is growing in significance as complex and deeply integrated IT environments are exposed to new cyber-risks from multiple layers and access points.To protect companies from sophisticated cyber-threats, a multi-layered, holistic, scalable, and seamless cyber security approach is needed. With the integration of AI, features like automated threat detection, malicious patterns prediction, accelerated data protection, and risk-based conditional access can contribute to establishing a multi-layered defence of business processes, data, and IT infrastructure.For instance, two leading US-based companies that provide sophisticated cyber and cloud security services have developed solutions based on the idea of “zero trust”. Dependent on user identity, device security credentials, and access policies, access rights are granted or withhold. These real-time risk-based conditional access applications facilitate and speed up the steering of a multitude of individual access requirements from users. This, in turn, protects complex and thus more vulnerable IT environments from breaches.In parallel, cyber security solutions that help companies identify data leakages in AI applications or assist in designing and building safer AI environments are also gaining importance.The disruptive power of AI-powered cyber security solutions is also reflected in the projected double-digit market growth of this segment: Source: Marketsandmarktes.com: AI in cybersecurity Market by Offering, Deployment Type, Security Type, Technology, Application, End User and Geography – Global Forecast to 2028. As of August 2023Health TechTrAIning for surgeons: “An experimental study of the National Center for Tumor Diseases Dresden (NCT/UCC) on the practical value of machine learning (ML) methods in abdominal surgery found that all of the four applied ML models outperformed at least 26 out of 28 human participants in pancreas segmentation demonstrating that ML methods have the potential to provide relevant assistance in anatomy recognition in minimally invasive surgery in near-real-time.”1In modern health tech, AI is deployed in the development of advanced surgical education. For example, a US based company that develops and manufactures robot-assisted minimally invasive surgery products, is working on building AI training applications.By collecting and evaluating information from millions of surgical interventions, and by comparing different surgical techniques, the company’s AI training applications will be able to make personalised recommendations during all steps of surgical learning, helping practitioners improve their skills both continuously and selectively.Not least, the AI-backed training of surgeons can also help to lower the likelihood of complications and improve clinical results, through training surgeons to use the most appropriate combinations of instruments and approaches in an intervention.

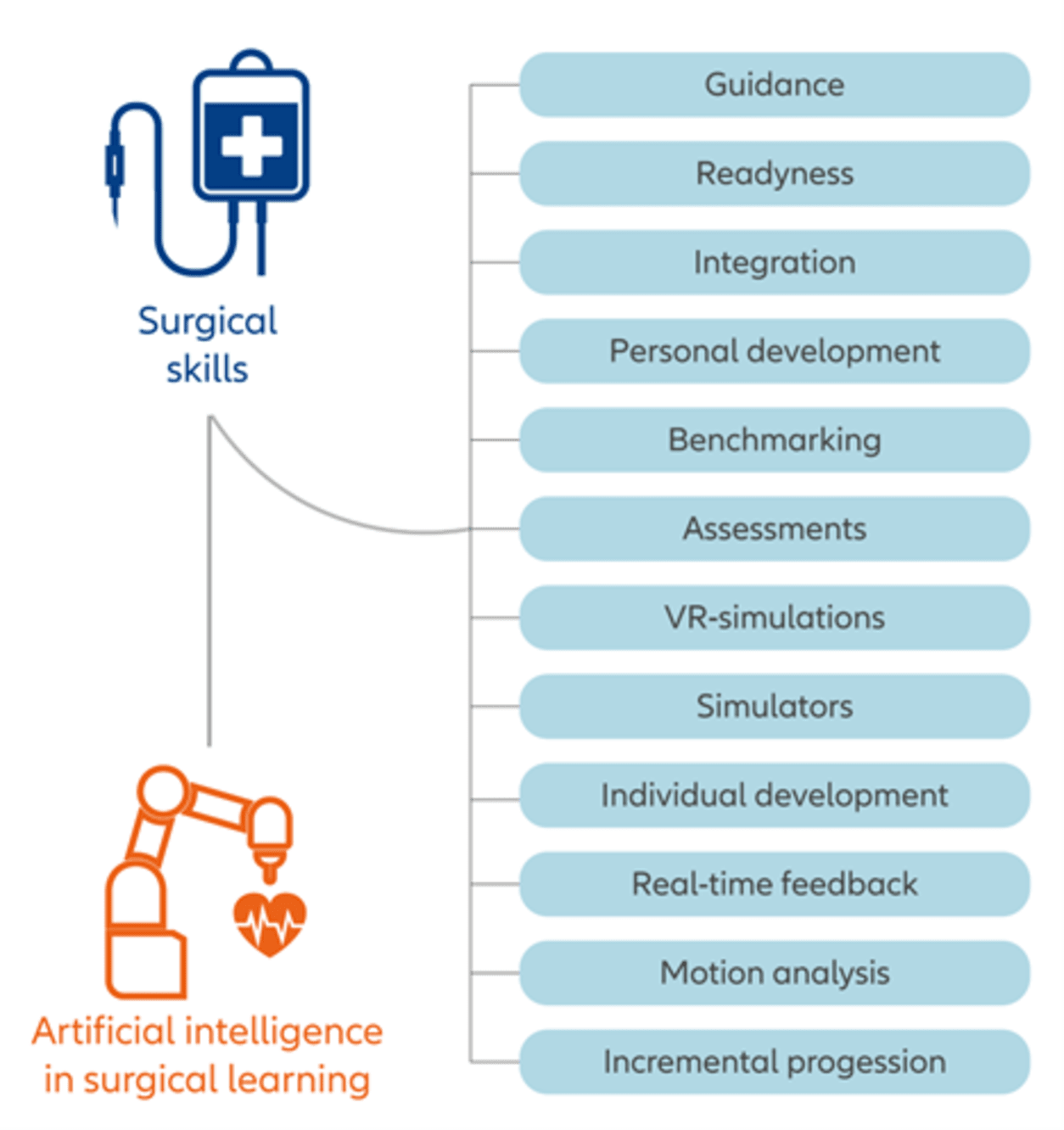

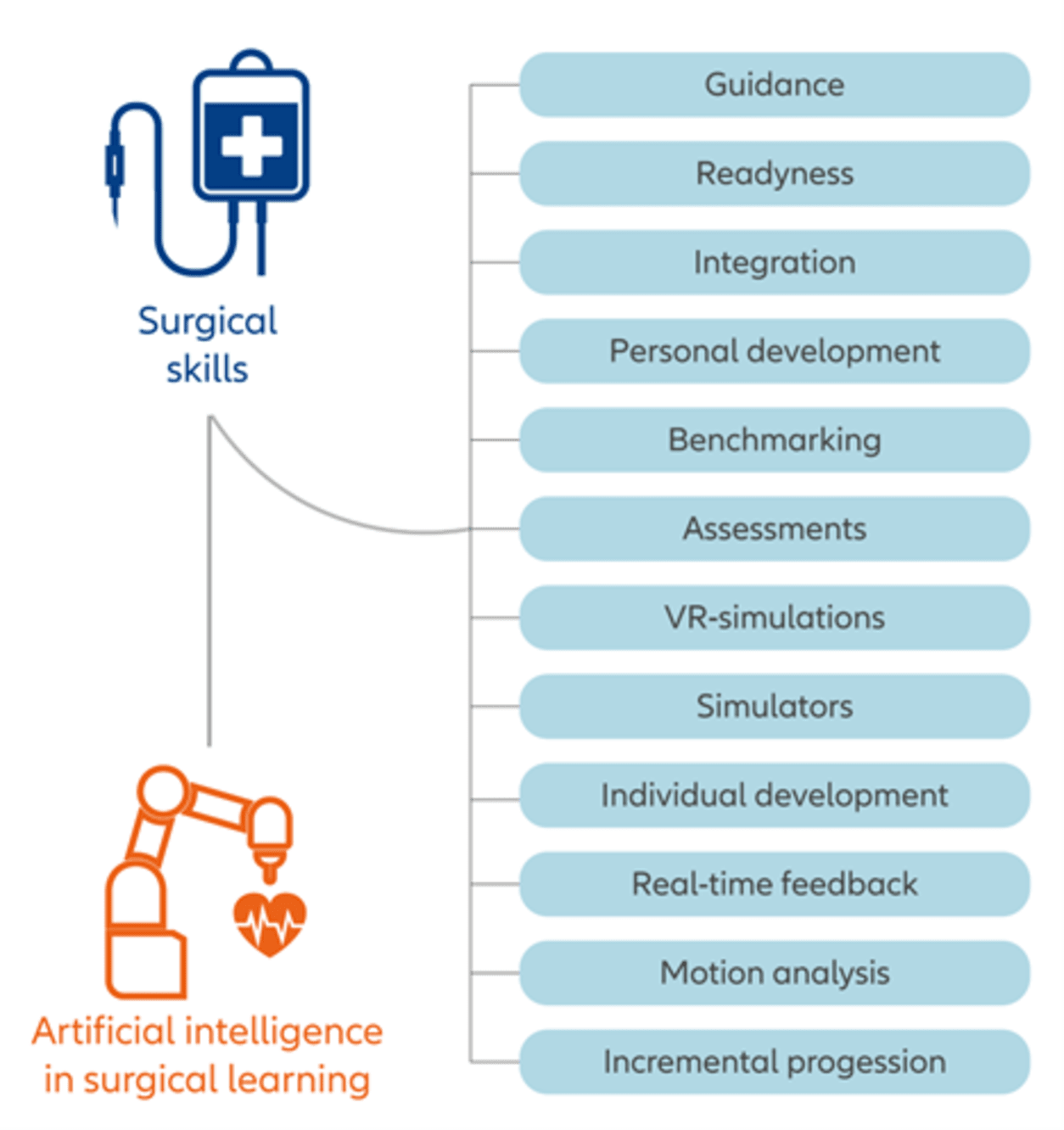

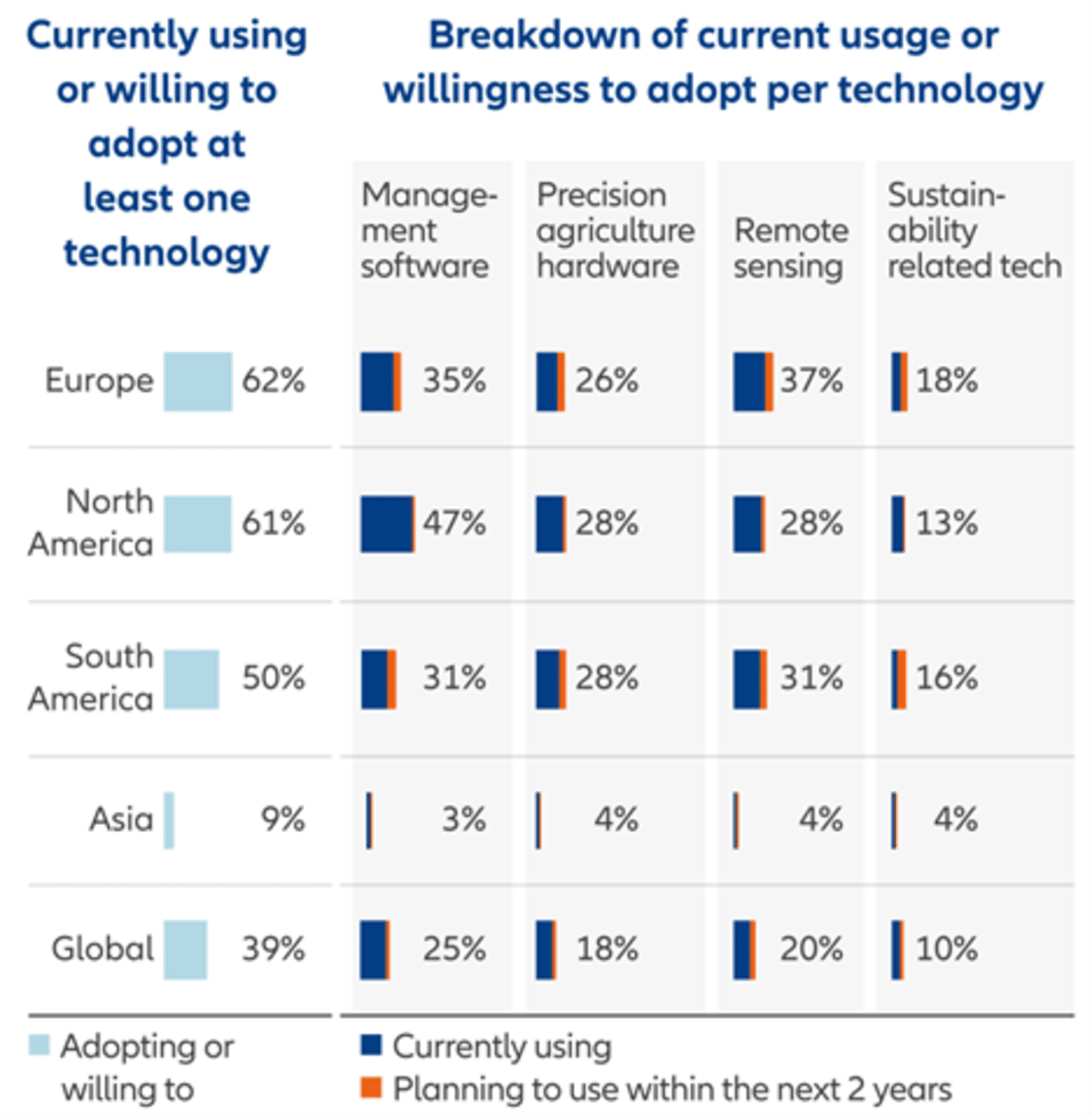

Source: Marketsandmarktes.com: AI in cybersecurity Market by Offering, Deployment Type, Security Type, Technology, Application, End User and Geography – Global Forecast to 2028. As of August 2023Health TechTrAIning for surgeons: “An experimental study of the National Center for Tumor Diseases Dresden (NCT/UCC) on the practical value of machine learning (ML) methods in abdominal surgery found that all of the four applied ML models outperformed at least 26 out of 28 human participants in pancreas segmentation demonstrating that ML methods have the potential to provide relevant assistance in anatomy recognition in minimally invasive surgery in near-real-time.”1In modern health tech, AI is deployed in the development of advanced surgical education. For example, a US based company that develops and manufactures robot-assisted minimally invasive surgery products, is working on building AI training applications.By collecting and evaluating information from millions of surgical interventions, and by comparing different surgical techniques, the company’s AI training applications will be able to make personalised recommendations during all steps of surgical learning, helping practitioners improve their skills both continuously and selectively.Not least, the AI-backed training of surgeons can also help to lower the likelihood of complications and improve clinical results, through training surgeons to use the most appropriate combinations of instruments and approaches in an intervention. Source: Multidisciplinary Digital Publishing Institute: Artificial Intelligence in Surgical Learning. As of February 2023How AI-enhanced conversational agents can help control costs and deliver faster servicesAI-enhanced conversational agents can amplify personalised care through useful and time-saving features. For instance, a US-domiciled healthcare and insurance company, deploys Natural Processing Language (NPL) models – an area of AI – to understand callers’ requests, reply automatically, or redirect incoming calls to internally available resources and responsible departments. This can contribute to shortening the call duration and speeding up responses to patients’ questions.Automatically conducted real-time authorisations of patients’ insurance plans can also lead to significant cost savings, especially in terms of expensive labour time, compared to manual processes.Collecting and classifying data for an improved patient service experienceAI-enhanced conversational agents can collect and classify patient data gained from conversations and propose services that are tailored to individual needs and patient history. This, in turn, can significantly improve patient experiences.Based on the data and information gathered, AI can also predict certain conditions, leading to better clinical outcomes and further substantial cost-savings.Clean Water and LandAI in agricultureThe application of machine learning, a subset of AI, can help farmers create a cost-effective, fine-tuned seeding and spraying schedule that will optimise crop yield and quality, reduce weeds, while significantly diminishing the use of pesticides. The real-time differentiation and localisation of weeds permits a targeted deployment of herbicides and the shortest path to weed control. This is an essential contribution to food security.A global manufacturer of agricultural machinery and farm management software has developed a computer-vision and machine-learning backed precision agriculture system. This can contribute to a substantial reduction of pesticides, while supporting farmers in saving valuable resources and promoting better root health in crops.Higher adoption rates could drive further growth of precision agriculture marketAlthough the global precision farming market size is projected to amount to USD 20.84 billion by 2030, showing a staggering double-digit compound annual growth rate (CAGR) of 12.8%2 , there remains plenty of room for improvement.A still mediocre adoption rate of sophisticated information technology among global farmers is both hampering the advancement of precision farming market’s size and value, as well as offering investment opportunities to participate in the segment’s growth potential.This is especially true for Asia, which has the world’s largest amount of arable land3 and, in parallel, the lowest adoption rate for precision farming.

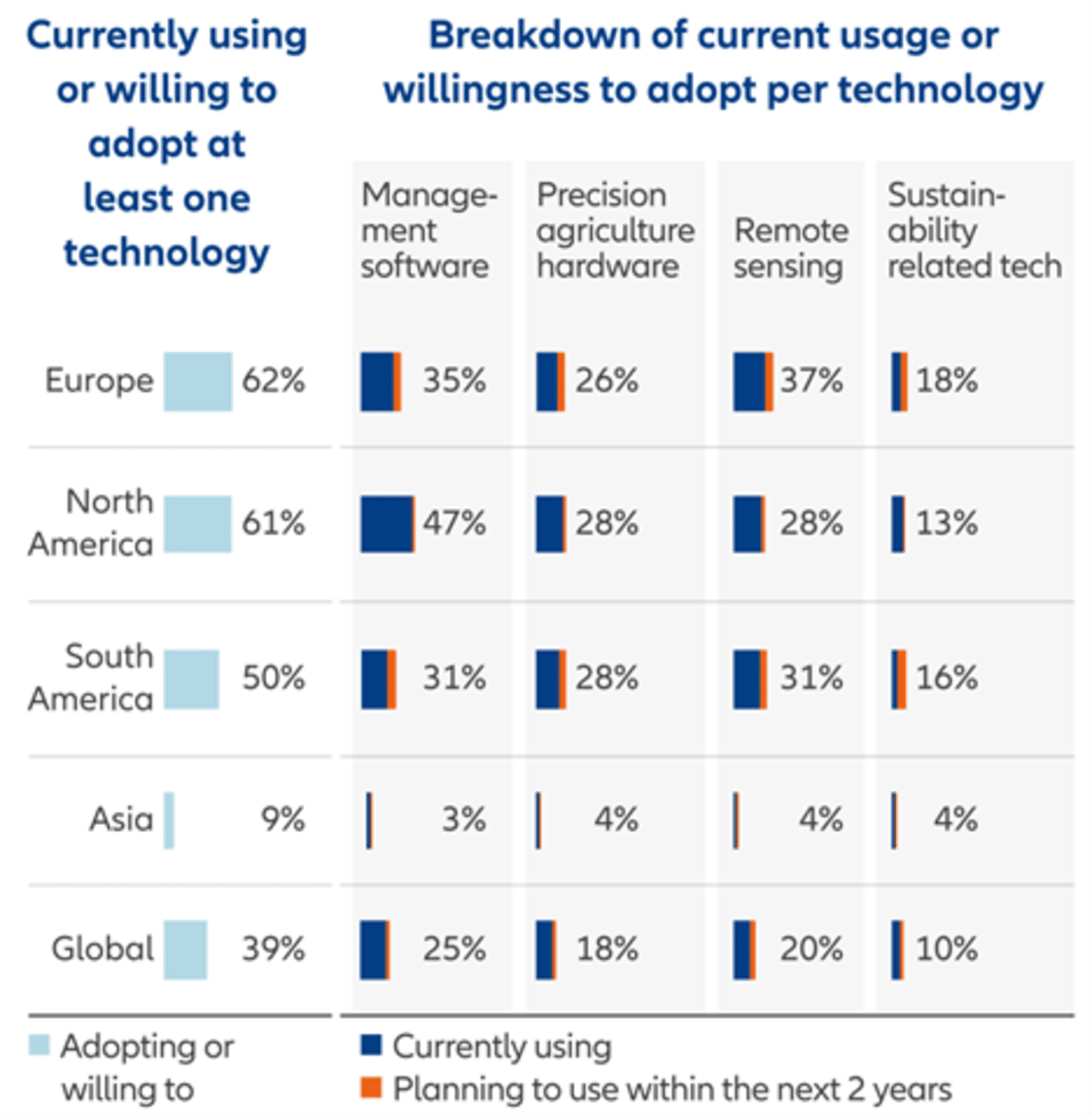

Source: Multidisciplinary Digital Publishing Institute: Artificial Intelligence in Surgical Learning. As of February 2023How AI-enhanced conversational agents can help control costs and deliver faster servicesAI-enhanced conversational agents can amplify personalised care through useful and time-saving features. For instance, a US-domiciled healthcare and insurance company, deploys Natural Processing Language (NPL) models – an area of AI – to understand callers’ requests, reply automatically, or redirect incoming calls to internally available resources and responsible departments. This can contribute to shortening the call duration and speeding up responses to patients’ questions.Automatically conducted real-time authorisations of patients’ insurance plans can also lead to significant cost savings, especially in terms of expensive labour time, compared to manual processes.Collecting and classifying data for an improved patient service experienceAI-enhanced conversational agents can collect and classify patient data gained from conversations and propose services that are tailored to individual needs and patient history. This, in turn, can significantly improve patient experiences.Based on the data and information gathered, AI can also predict certain conditions, leading to better clinical outcomes and further substantial cost-savings.Clean Water and LandAI in agricultureThe application of machine learning, a subset of AI, can help farmers create a cost-effective, fine-tuned seeding and spraying schedule that will optimise crop yield and quality, reduce weeds, while significantly diminishing the use of pesticides. The real-time differentiation and localisation of weeds permits a targeted deployment of herbicides and the shortest path to weed control. This is an essential contribution to food security.A global manufacturer of agricultural machinery and farm management software has developed a computer-vision and machine-learning backed precision agriculture system. This can contribute to a substantial reduction of pesticides, while supporting farmers in saving valuable resources and promoting better root health in crops.Higher adoption rates could drive further growth of precision agriculture marketAlthough the global precision farming market size is projected to amount to USD 20.84 billion by 2030, showing a staggering double-digit compound annual growth rate (CAGR) of 12.8%2 , there remains plenty of room for improvement.A still mediocre adoption rate of sophisticated information technology among global farmers is both hampering the advancement of precision farming market’s size and value, as well as offering investment opportunities to participate in the segment’s growth potential.This is especially true for Asia, which has the world’s largest amount of arable land3 and, in parallel, the lowest adoption rate for precision farming. Source: McKinsey survey among 5,500+ farmers across the globe. As of 2022Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI Technology】to find out more!Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.

Source: McKinsey survey among 5,500+ farmers across the globe. As of 2022Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI Technology】to find out more!Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.  Digital Life: Where there is cyber there should be AI-backed securityWith an increasing level of connection and with more services moving to a cloud environment, cyber security is growing in significance as complex and deeply integrated IT environments are exposed to new cyber-risks from multiple layers and access points.To protect companies from sophisticated cyber-threats, a multi-layered, holistic, scalable, and seamless cyber security approach is needed. With the integration of AI, features like automated threat detection, malicious patterns prediction, accelerated data protection, and risk-based conditional access can contribute to establishing a multi-layered defence of business processes, data, and IT infrastructure.For instance, two leading US-based companies that provide sophisticated cyber and cloud security services have developed solutions based on the idea of “zero trust”. Dependent on user identity, device security credentials, and access policies, access rights are granted or withhold. These real-time risk-based conditional access applications facilitate and speed up the steering of a multitude of individual access requirements from users. This, in turn, protects complex and thus more vulnerable IT environments from breaches.In parallel, cyber security solutions that help companies identify data leakages in AI applications or assist in designing and building safer AI environments are also gaining importance.The disruptive power of AI-powered cyber security solutions is also reflected in the projected double-digit market growth of this segment:

Digital Life: Where there is cyber there should be AI-backed securityWith an increasing level of connection and with more services moving to a cloud environment, cyber security is growing in significance as complex and deeply integrated IT environments are exposed to new cyber-risks from multiple layers and access points.To protect companies from sophisticated cyber-threats, a multi-layered, holistic, scalable, and seamless cyber security approach is needed. With the integration of AI, features like automated threat detection, malicious patterns prediction, accelerated data protection, and risk-based conditional access can contribute to establishing a multi-layered defence of business processes, data, and IT infrastructure.For instance, two leading US-based companies that provide sophisticated cyber and cloud security services have developed solutions based on the idea of “zero trust”. Dependent on user identity, device security credentials, and access policies, access rights are granted or withhold. These real-time risk-based conditional access applications facilitate and speed up the steering of a multitude of individual access requirements from users. This, in turn, protects complex and thus more vulnerable IT environments from breaches.In parallel, cyber security solutions that help companies identify data leakages in AI applications or assist in designing and building safer AI environments are also gaining importance.The disruptive power of AI-powered cyber security solutions is also reflected in the projected double-digit market growth of this segment: Source: Marketsandmarktes.com: AI in cybersecurity Market by Offering, Deployment Type, Security Type, Technology, Application, End User and Geography – Global Forecast to 2028. As of August 2023Health TechTrAIning for surgeons: “An experimental study of the National Center for Tumor Diseases Dresden (NCT/UCC) on the practical value of machine learning (ML) methods in abdominal surgery found that all of the four applied ML models outperformed at least 26 out of 28 human participants in pancreas segmentation demonstrating that ML methods have the potential to provide relevant assistance in anatomy recognition in minimally invasive surgery in near-real-time.”1In modern health tech, AI is deployed in the development of advanced surgical education. For example, a US based company that develops and manufactures robot-assisted minimally invasive surgery products, is working on building AI training applications.By collecting and evaluating information from millions of surgical interventions, and by comparing different surgical techniques, the company’s AI training applications will be able to make personalised recommendations during all steps of surgical learning, helping practitioners improve their skills both continuously and selectively.Not least, the AI-backed training of surgeons can also help to lower the likelihood of complications and improve clinical results, through training surgeons to use the most appropriate combinations of instruments and approaches in an intervention.

Source: Marketsandmarktes.com: AI in cybersecurity Market by Offering, Deployment Type, Security Type, Technology, Application, End User and Geography – Global Forecast to 2028. As of August 2023Health TechTrAIning for surgeons: “An experimental study of the National Center for Tumor Diseases Dresden (NCT/UCC) on the practical value of machine learning (ML) methods in abdominal surgery found that all of the four applied ML models outperformed at least 26 out of 28 human participants in pancreas segmentation demonstrating that ML methods have the potential to provide relevant assistance in anatomy recognition in minimally invasive surgery in near-real-time.”1In modern health tech, AI is deployed in the development of advanced surgical education. For example, a US based company that develops and manufactures robot-assisted minimally invasive surgery products, is working on building AI training applications.By collecting and evaluating information from millions of surgical interventions, and by comparing different surgical techniques, the company’s AI training applications will be able to make personalised recommendations during all steps of surgical learning, helping practitioners improve their skills both continuously and selectively.Not least, the AI-backed training of surgeons can also help to lower the likelihood of complications and improve clinical results, through training surgeons to use the most appropriate combinations of instruments and approaches in an intervention. Source: Multidisciplinary Digital Publishing Institute: Artificial Intelligence in Surgical Learning. As of February 2023How AI-enhanced conversational agents can help control costs and deliver faster servicesAI-enhanced conversational agents can amplify personalised care through useful and time-saving features. For instance, a US-domiciled healthcare and insurance company, deploys Natural Processing Language (NPL) models – an area of AI – to understand callers’ requests, reply automatically, or redirect incoming calls to internally available resources and responsible departments. This can contribute to shortening the call duration and speeding up responses to patients’ questions.Automatically conducted real-time authorisations of patients’ insurance plans can also lead to significant cost savings, especially in terms of expensive labour time, compared to manual processes.Collecting and classifying data for an improved patient service experienceAI-enhanced conversational agents can collect and classify patient data gained from conversations and propose services that are tailored to individual needs and patient history. This, in turn, can significantly improve patient experiences.Based on the data and information gathered, AI can also predict certain conditions, leading to better clinical outcomes and further substantial cost-savings.Clean Water and LandAI in agricultureThe application of machine learning, a subset of AI, can help farmers create a cost-effective, fine-tuned seeding and spraying schedule that will optimise crop yield and quality, reduce weeds, while significantly diminishing the use of pesticides. The real-time differentiation and localisation of weeds permits a targeted deployment of herbicides and the shortest path to weed control. This is an essential contribution to food security.A global manufacturer of agricultural machinery and farm management software has developed a computer-vision and machine-learning backed precision agriculture system. This can contribute to a substantial reduction of pesticides, while supporting farmers in saving valuable resources and promoting better root health in crops.Higher adoption rates could drive further growth of precision agriculture marketAlthough the global precision farming market size is projected to amount to USD 20.84 billion by 2030, showing a staggering double-digit compound annual growth rate (CAGR) of 12.8%2 , there remains plenty of room for improvement.A still mediocre adoption rate of sophisticated information technology among global farmers is both hampering the advancement of precision farming market’s size and value, as well as offering investment opportunities to participate in the segment’s growth potential.This is especially true for Asia, which has the world’s largest amount of arable land3 and, in parallel, the lowest adoption rate for precision farming.

Source: Multidisciplinary Digital Publishing Institute: Artificial Intelligence in Surgical Learning. As of February 2023How AI-enhanced conversational agents can help control costs and deliver faster servicesAI-enhanced conversational agents can amplify personalised care through useful and time-saving features. For instance, a US-domiciled healthcare and insurance company, deploys Natural Processing Language (NPL) models – an area of AI – to understand callers’ requests, reply automatically, or redirect incoming calls to internally available resources and responsible departments. This can contribute to shortening the call duration and speeding up responses to patients’ questions.Automatically conducted real-time authorisations of patients’ insurance plans can also lead to significant cost savings, especially in terms of expensive labour time, compared to manual processes.Collecting and classifying data for an improved patient service experienceAI-enhanced conversational agents can collect and classify patient data gained from conversations and propose services that are tailored to individual needs and patient history. This, in turn, can significantly improve patient experiences.Based on the data and information gathered, AI can also predict certain conditions, leading to better clinical outcomes and further substantial cost-savings.Clean Water and LandAI in agricultureThe application of machine learning, a subset of AI, can help farmers create a cost-effective, fine-tuned seeding and spraying schedule that will optimise crop yield and quality, reduce weeds, while significantly diminishing the use of pesticides. The real-time differentiation and localisation of weeds permits a targeted deployment of herbicides and the shortest path to weed control. This is an essential contribution to food security.A global manufacturer of agricultural machinery and farm management software has developed a computer-vision and machine-learning backed precision agriculture system. This can contribute to a substantial reduction of pesticides, while supporting farmers in saving valuable resources and promoting better root health in crops.Higher adoption rates could drive further growth of precision agriculture marketAlthough the global precision farming market size is projected to amount to USD 20.84 billion by 2030, showing a staggering double-digit compound annual growth rate (CAGR) of 12.8%2 , there remains plenty of room for improvement.A still mediocre adoption rate of sophisticated information technology among global farmers is both hampering the advancement of precision farming market’s size and value, as well as offering investment opportunities to participate in the segment’s growth potential.This is especially true for Asia, which has the world’s largest amount of arable land3 and, in parallel, the lowest adoption rate for precision farming. Source: McKinsey survey among 5,500+ farmers across the globe. As of 2022Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI Technology】to find out more!Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.

Source: McKinsey survey among 5,500+ farmers across the globe. As of 2022Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Equity > AI Technology】to find out more!Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.