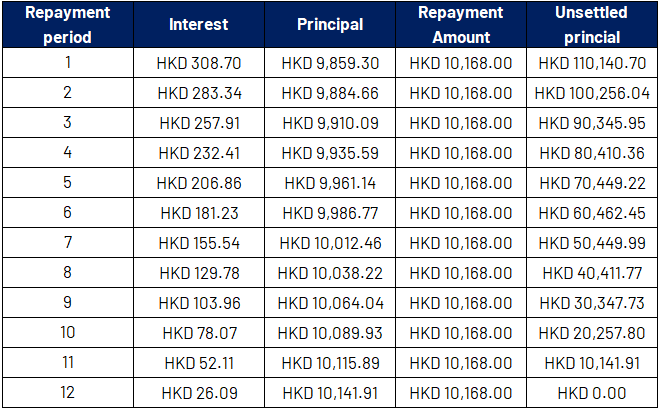

Total interest for the full term = HKD 168 x 12 months = HKD 2,016

Monthly repayment amount: (HKD 120,000 + HKD 2016)/ 12 = HKD 10,168

1st Term Interest = HKD 120,000 x 3.087% ÷ 12 = HKD 308.7

1st Term Principal = HKD (10,168-308.7) = HKD 9,859.3

2nd Term Interest = HKD 110,140.7x 3.087% ÷ 12 = HKD 283.34You can find the details of your monthly repayment as follows:

Please be reminded if you decide to repay your loans early after a certain period, the early repayment charges may outweigh the amount of interest saved. We also marked this period in our app to help you decide whether you will repay the loan in advance. We also marked this period in our app to help you decide whether you would like to repay the loan earlier than scheduled.All numbers are rounded to the nearest cent and are for reference only.

Please be reminded if you decide to repay your loans early after a certain period, the early repayment charges may outweigh the amount of interest saved. We also marked this period in our app to help you decide whether you will repay the loan in advance. We also marked this period in our app to help you decide whether you would like to repay the loan earlier than scheduled.All numbers are rounded to the nearest cent and are for reference only.