WeLab Global Wallet Debit Card is here!

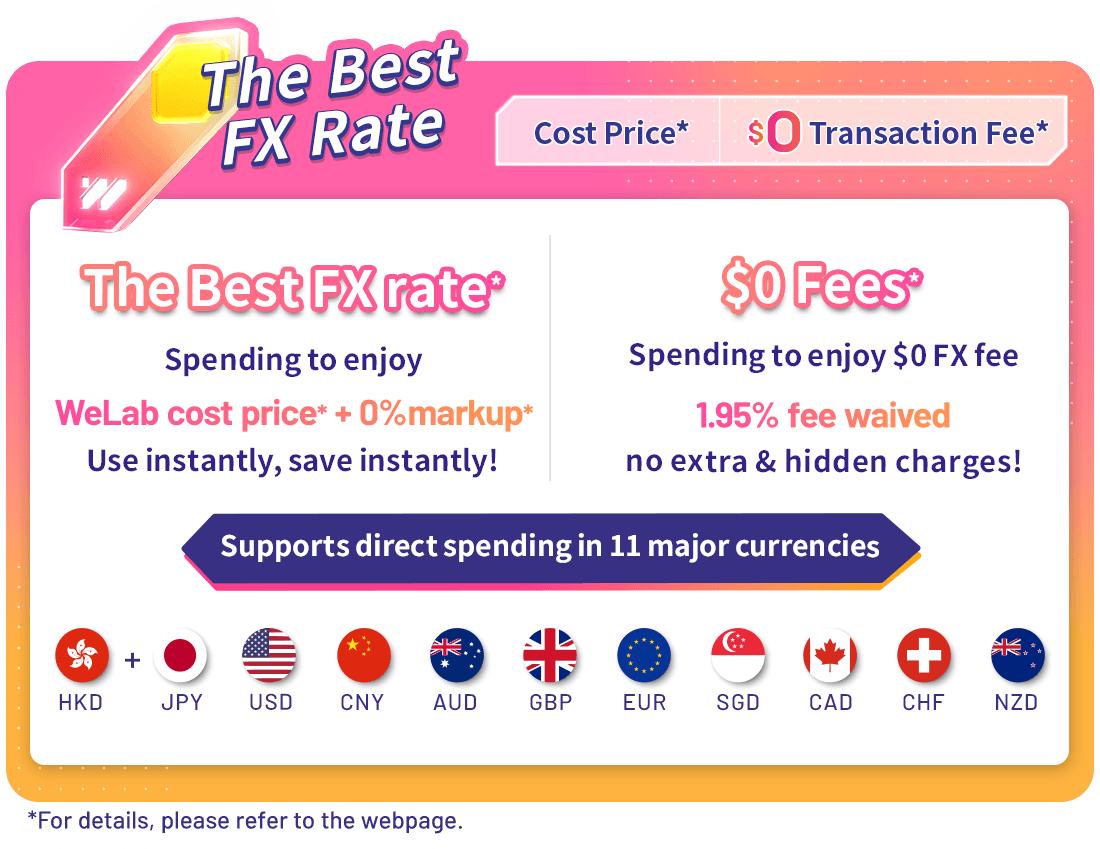

Enjoy the Best FX rate¹ to lock in the rate + $0 handling fee² + cashback on spending³!

Ready for New Year getaway? Whether you’re heading to Japan to enjoy hot springs, visiting friends in the UK, taking the kids for a quick trip to Shenzhen, or going to Australia to be among the first to welcome 2026! We’ve got your back whenever you feel like taking off, as WeLab Bank “travel essential” - WeLab Global Wallet Debit Card is here! 🤩

With just one WeLab Global Wallet Debit Card 💳, you don’t need to queue for currency exchange 💱 before departure, and you don’t need to carry cash 💵 when travelling. You can pay anytime with the Best FX rate1 to lock in your preferred rate + $0 handling fee2 plus earning cashback on spending3🌎. As long as you see the Mastercard® logo, wherever you go, it’s Easy Pay!

【Welcome Offer】Open an account now and enjoy up to 20% cash rebate* 💰

📅 Promotion period: 1 February 2026 – 31 March 2026 (both dates inclusive)

💴 How to join: During the promotional period, new customers who successfully open an account using the referral code (WBSS26) can enjoy the following rewards within the First 60-day Period# for Eligible Spending Transactions:

Reward 1 - 10% cash rebate*

Reward 2 - Extra 10% cash rebate (Fund in Reward): Deposit HKD 50,000 into your Core Account within 14 calendar days from successful account opening date, and maintain this balance for at least 60 calendar days. From the day this deposit requirement is met, you will earn an additional 10% cash rebate* on Eligible Spending Transactions.

# “First 60-day Period” means a period of 60 calendar days starting from the date on which a New Customer receives WeLab Bank's email notifying the successful Core Account opening.

* During the promotion period, total cash rebate is capped at HKD 250. Terms and conditions apply; click here for details.

[Exclusive Offer] Best FX Rate¹ + HKD 50 Cash Rebate* 🌍

📅 Promotion Period: Jan 1– Feb 28, 2026 (inclusive)

💴Reward: During the Promotion Period, Eligible customers who successfully exchange Eligible Foreign Currency equivalent in a single transaction of HKD 20,000 or above will receive a cash rebate of HKD 50*.

✅ Eligible customers refer to those who have not conducted any foreign exchange transactions through the “Foreign exchange” function in the WeLab Bank App between 1 June 2025 and 31 December 2025.

⚠️ Limited quota, first come, first served!

![[Exclusive Offer] Best FX Rate¹ + HKD 50 Cash Rebate* 🌍](/uploads/test1_04f65cf556.png)

Skip the pre-trip rush ✈️Settle instantly on the way to the airport ✨

One card supports HKD, JPY, USD, CNY, AUD, GBP, EUR, SGD, CAD, CHF and NZD — a total of 11 major currencies ✈️

Use the WeLab Bank App to lock in your preferred rate with the Best FX rate in town¹ + $0 handling fee²! Exchange anytime 24/7 — exchange instantly, earn instantly💰! For overseas spending, payment is directly deducted from your foreign currency account🪙.

With WeLab’s cost‑price FX rate, you can easily benefit from the exchange difference while saving time 😍!

One account Supports direct spending in 11 currencies

WeLab Global Wallet connects your debit card with your foreign currency accounts. Once exchanged, you can make payment whenever spending or withdrawing cash from the corresponding currency account directly. One card handles it all 🎯 hassle-free.

Transactions are clear and transparent 📲. One account helps you save smart and spend happily 💰!

$0 Foreign Currency Transaction Fee 🌟

Most credit cards charge a 1.95% foreign currency transaction fee for overseas spending 💳, but with the WeLab Global Wallet Debit Card 👉 you enjoy $0 foreign currency transaction fee3 + cashback on spending4 when paying in 11 major currencies.

Every swipe is convenient and rewarding 💳, whether you’re dining abroad 🍣, taking a ride 🚕, or buying souvenirs 🎎, it’s all effortlessly easy!

Withdraw Cash Worldwide

Traveling and need some cash? Whenever you see an ATM with the Cirrus® logo overseas, you can use your physical card to withdraw cash from ATMs that support the Cirrus® network. Before your trip, please activate the overseas withdrawal feature via the WeLab Bank app.

Auto FX Top up. Spend across currencies with ease

No sufficient foreign currencies in your account, NO WORRY— just spend or withdraw when you need to.

When your balance in 10 supported foreign currency falls short, Auto FX Top up automatically converts the required amount from your HKD balance in your Core Account at our prevailing exchange rate — so your transaction goes through seamlessly.

From everyday spending to cash withdrawals, enjoy smooth, hassle-free transactions anywhere.

💳 Use the WeLab Global Wallet Debit Card — exchange & earn instantly!

Say Goodbye to Currency Exchange Hassles👋🏻 Start Your New Travel Experience🌍✨

Want to know more? We’ve got answers!

Here are some commonly asked questions about the WeLab Global Wallet Debit Card!

Do I need to choose the foreign currency to pay every time I make a purchase or withdrawal?

If you have sufficient corresponding currency in your Core Account for purchase or cash withdrawal in 10 supported currencies, you usually do not need to choose to pay with foreign currency. If an overseas merchant or overseas ATM offers you the option to settle in foreign currency or in Hong Kong dollars, you should choose to pay with foreign currencies.

We will automatically debit from the corresponding foreign currency account based on the transaction currency.

Do I need to activate this feature?

No. The Auto FX Top-up feature will be enabled by default for all customers. You can enable or disable the feature anytime through the Card Control section in the WeLab Bank app.

If the balance of respective foreign currency in my Core Account is insufficient when making a purchase or withdrawal overseas, what will happen?

Once the function is enabled, the required amount of Hong Kong Dollar in your core account will be automatically converted to the needed foreign currency at our prevailing exchange rate. This allows you to complete the transactions in the supported currencies without having to pre‑fund your core account with foreign currency in advance.

If HKD balance in your Core Account is insufficient, the transaction will decline.

When disabled this function and the respective foreign currency in your Core Account is insufficient, the transaction will decline.

If the WeLab Global Wallet Debit Card does not support the foreign currency of my transaction or withdrawal, what will happen?

If the transaction currency is not among the 10currencies supported, we will settle the transaction in Hong Kong dollars based on the prevailing exchange rate and debit from your HKD account.

If the HKD account balance is insufficient, the transaction will be declined.

How can I withdraw cash overseas using the WeLab Global Wallet Debit Card?

You need to log in to the WeLab Bank App and enable the overseas withdrawal service, then withdraw cash at overseas ATMs that support the Mastercard® network (including Cirrus®).

Which ATMs can I use to withdraw cash?

You can withdraw cash at ATMs that support the Mastercard® network (including Cirrus®) and the local ATMs that support the JETCO network.

If an overseas merchant or overseas ATM offers me the option to settle the transaction or withdrawal in foreign currency or Hong Kong dollars, which option should I choose?

You should choose to pay in foreign currency. If you select Hong Kong dollar settlement, the merchant or ATM operator will use their exchange rate to convert the foreign currency transaction or withdrawal into Hong Kong dollars and debit from your HKD account. Such withdrawals are considered as Dynamic Currency Conversion (DCC) and may involve higher fees.

We recommend declining such withdrawals to avoid DCC and, if possible, try using another ATM.

When withdrawing cash overseas, which account should I select on the overseas ATM screen?

Some overseas ATMs may allow you to choose which account to withdraw cash from. On the screen, regardless of whether you select the current account or the savings account, the withdrawal will automatically be debited from the corresponding foreign currency Core Account.

How can I identify a Dynamic Currency Conversion (DCC) transaction during withdrawal or purchase, and what should I do?

Dynamic Currency Conversion (DCC) may occur when withdrawing cash overseas, making online or overseas transactions. If you see an exchange rate displayed or are offered an option to convert Hong Kong dollars into foreign currency or settle in Hong Kong dollars, such withdrawals or purchases are considered DCC and may involve higher fees.

If you find that you cannot choose to pay with foreign currency during withdrawal or purchase, we recommend you decline such transactions to avoid DCC and try to settle in foreign currency instead.

Which transactions are supported?

The feature applies to 10 Supported Currency transactions (including spending transactions and ATM supported by MasterCard® / Cirrus® network.

What is the Auto FX Top-up feature?

Auto FX Top-up makes multi-currency card transactions easier by removing the need to pre-fund your Core Account with foreign currency. If you have insufficient funds in a Supported Currency but enough HKD to cover the shortfall, the system will automatically convert the required HKD amount from Core Account at our prevailing exchange rate to settle the transaction – allowing you to complete transactions or cash withdrawals seamlessly.

Remarks

1 The best rates in town comparison is based on the exchange rates collected from the websites, online banking or mobile banking of 28 retail banks in Hong Kong (excluding those which do not publish FX rates via the aforementioned channels) as of approximately 2:15 pm on 23 January 2026. Those rates do not include any special promotions, discounts, offers, membership programs or other preferential rates (including but not limited to volume discounts), but include any fees charged by any banks when conducting the FX transactions to facilitate the comparison. Terms and Conditions apply, please click here for promotion details.

2 Handling fee refers to the fees for foreign currency exchange fee.

3 Overseas spending may be settled either in the local currency of the country/region where the transaction takes place or in Hong Kong Dollar: (A) For transaction settled in the local currency, (i) foreign currency transaction fee waiver will apply if the transaction is settled in any of the 10 eligible foreign currencies (including Japanese Yen, US Dollar, Renminbi, Australian Dollar, Sterling Pound, Euro, Singapore Dollar, Canadian Dollar, Swiss Franc and New Zealand Dollar), and (ii) if a foreign currency exchange is required to complete the transaction, the exchange will be carried out at our prevailing exchange rate, and no foreign currency exchange handling fee will be charged. (B) For transaction settled in Hong Kong Dollar, the transaction will not be treated as a foreign currency transaction and will be subject to the exchange rate, fees, and charges determined by the merchant bank, rather than by us.

4 From 1 January 2026 until 28 February 2026, enjoy 0.4% cash rebate on the Net Spending Amount of each Eligible Spending Transaction made with WeLab Global Wallet Debit Card. The Cash Rebate will be credited in the transaction settlement currency on or before 31 March 2026, capped at HKD100 or its equivalent. Terms and conditions apply. Please click here for promotion details.

Note: Dynamic Currency Conversion (DCC) may occur when withdrawing cash overseas, making online or overseas transactions. If you see an exchange rate displayed or are offered an option to convert Hong Kong dollars into foreign currency or settle in Hong Kong dollars, such withdrawals or purchases are considered DCC and may involve higher fees. WeLab Bank shall not be responsible for any charges or fees imposed by merchants in relation to such transactions.

Disclaimer

FX involves risks. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses.