GoWealth Digital Wealth Advisory

Backed by WeLab Bank’s fintech experience and AllianzGI’s investment management expertise.

This webpage is for information only and does not constitute any investment advice. Investment involves risks, please refer to the Disclaimers herein for details. The screen displays and the images of the website are for illustrative purpose only.

Invest in your dreams in just 3 steps.

Flexible mutual fund investment on your terms

Enjoy the ultimate flexibility in your investment, with no lock-up period and no redemption fee, All fees are transparent. Invest from HKD 100, so you can make adjustments anytime, anywhere.

Personalised recommendation

Invest with ease and receive instant and personalised fund portfolio recommended based on your financial needs. We help you to reach financial independence, so you can manage and grow your wealth easier than ever¹.

Ground-breaking projections

The market is dynamic and so is our advanced algorithm, which can project market trends in the next 52 years². Detailed simulations and analysis can help you adjust your goals according to any market changes.

Stay on track with smart alerts

Too busy to keep track of your goals? Our smart alerts will help you to stay on track, so you can glide through any market conditions and manage your portfolio at fingertips¹.

Sustainable investment (ESG)

Our professional team is committed to integrating environmental, social, and governance factors into the process of product selection³ to create a better future together.

Digital bank x Global asset manager

Enter the revolutionary era of WealthTech

With Allianz Group support as an investor and strategic partner to WeLab, we have developed “GoWealth Investment Engine” - a powerful engine backed by WeLab Bank’s fintech experience and AllianzGI’s4 investment management expertise, which provides pioneering investment advisory solutions that usher in a new era of WealthTech.

Invest at your fingertips

Check out how simple it is

Select your goal

Whether you have a specific goal in mind or not, we offer different goal planning to fit your financial needs. You can also choose to invest every month to take advantage of dollar cost averaging to reduce the effect of market timing on your investment.

The pages and investment products shown are for illustrative purposes only.

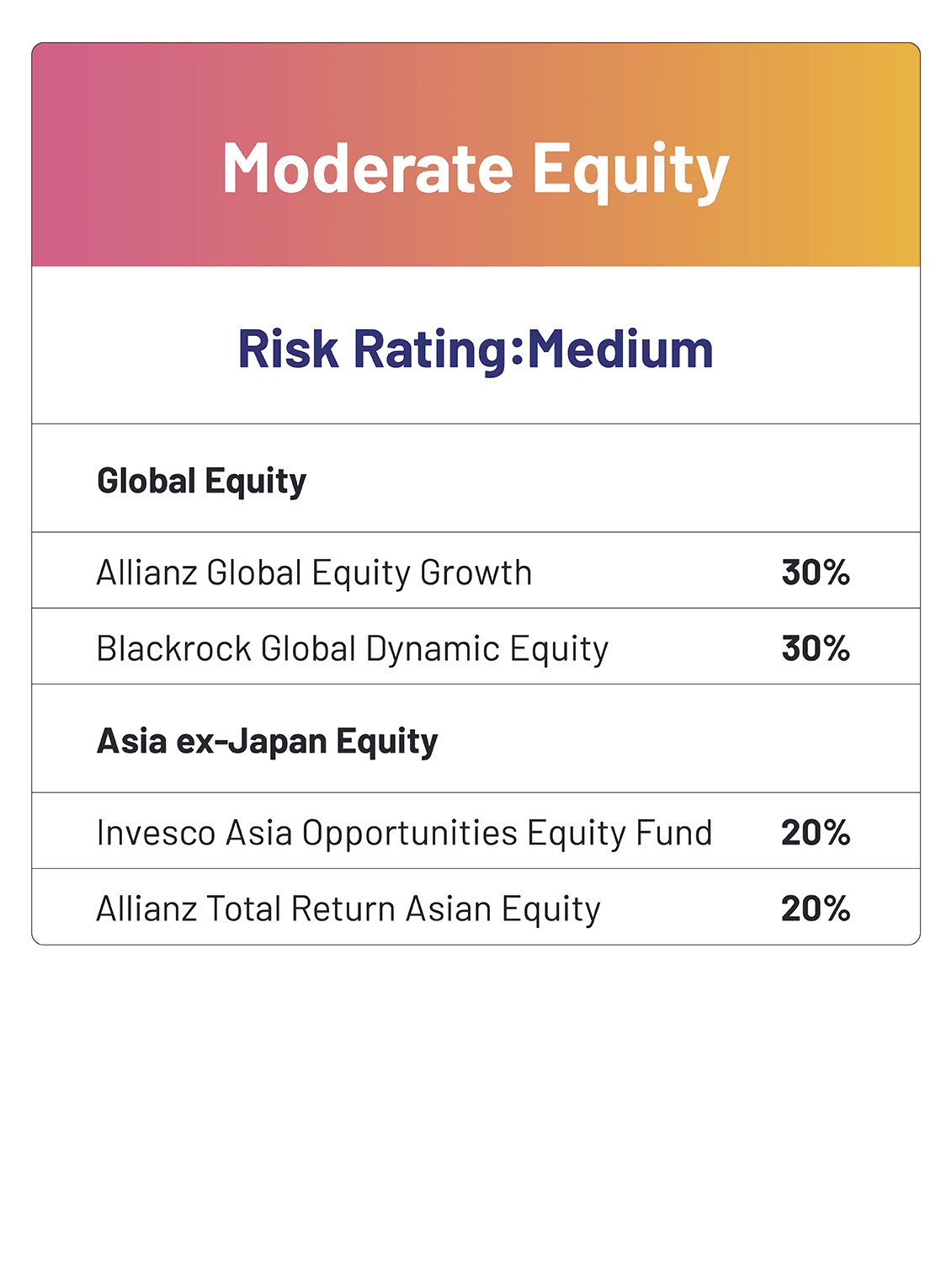

Personalised Fund Portfolio

Covering global assets, better aid your risk diversification

Active investment x Top fund managers in the world

GoWealth’s investment portfolio covers actively managed mutual funds diversified across asset classes. The fund managers are all from top global asset management firms with global investment expertise, risk management capability, and know-how in sustainable investing (ESG). The solution strives to assist customers in capturing market opportunities.

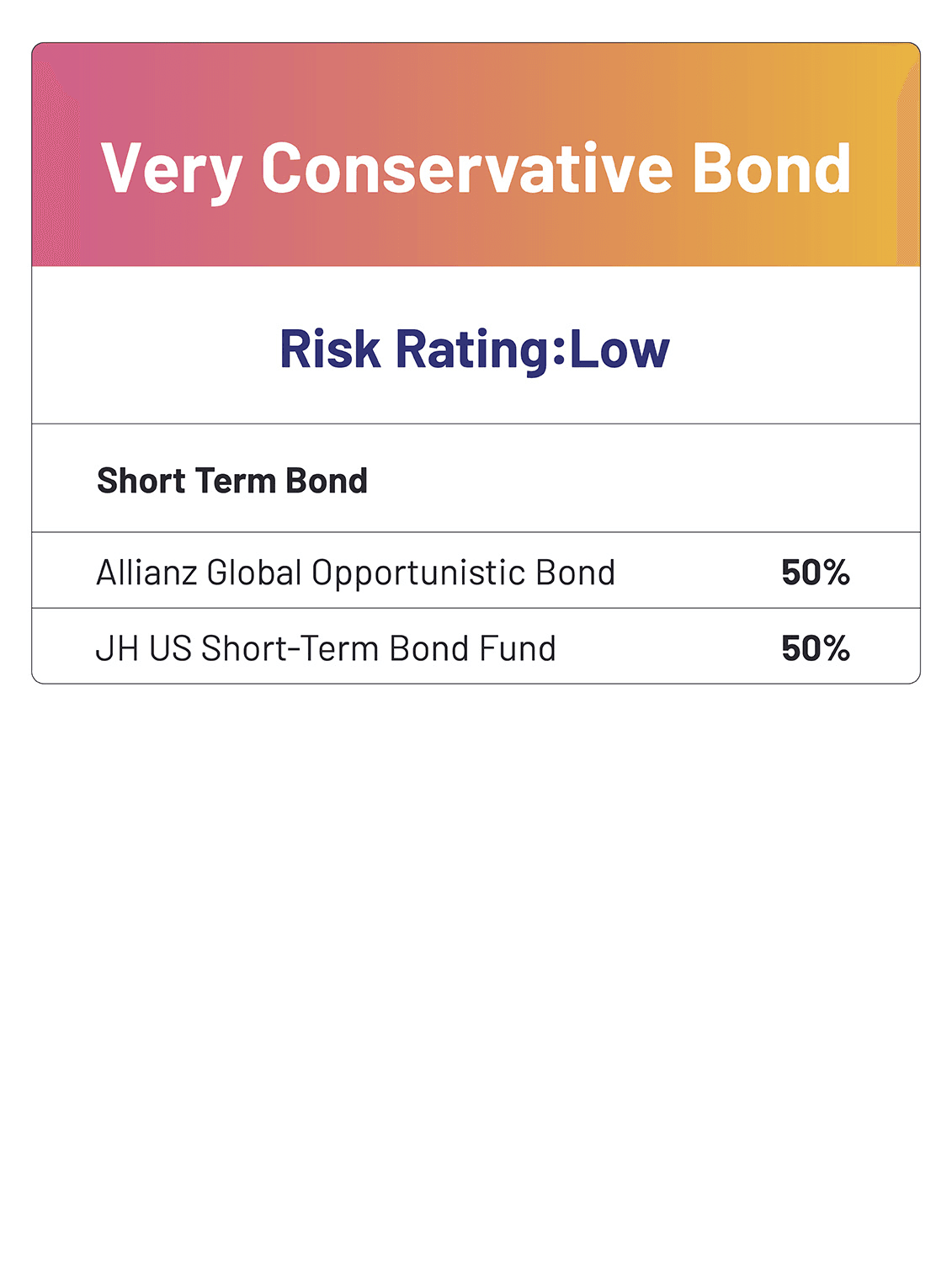

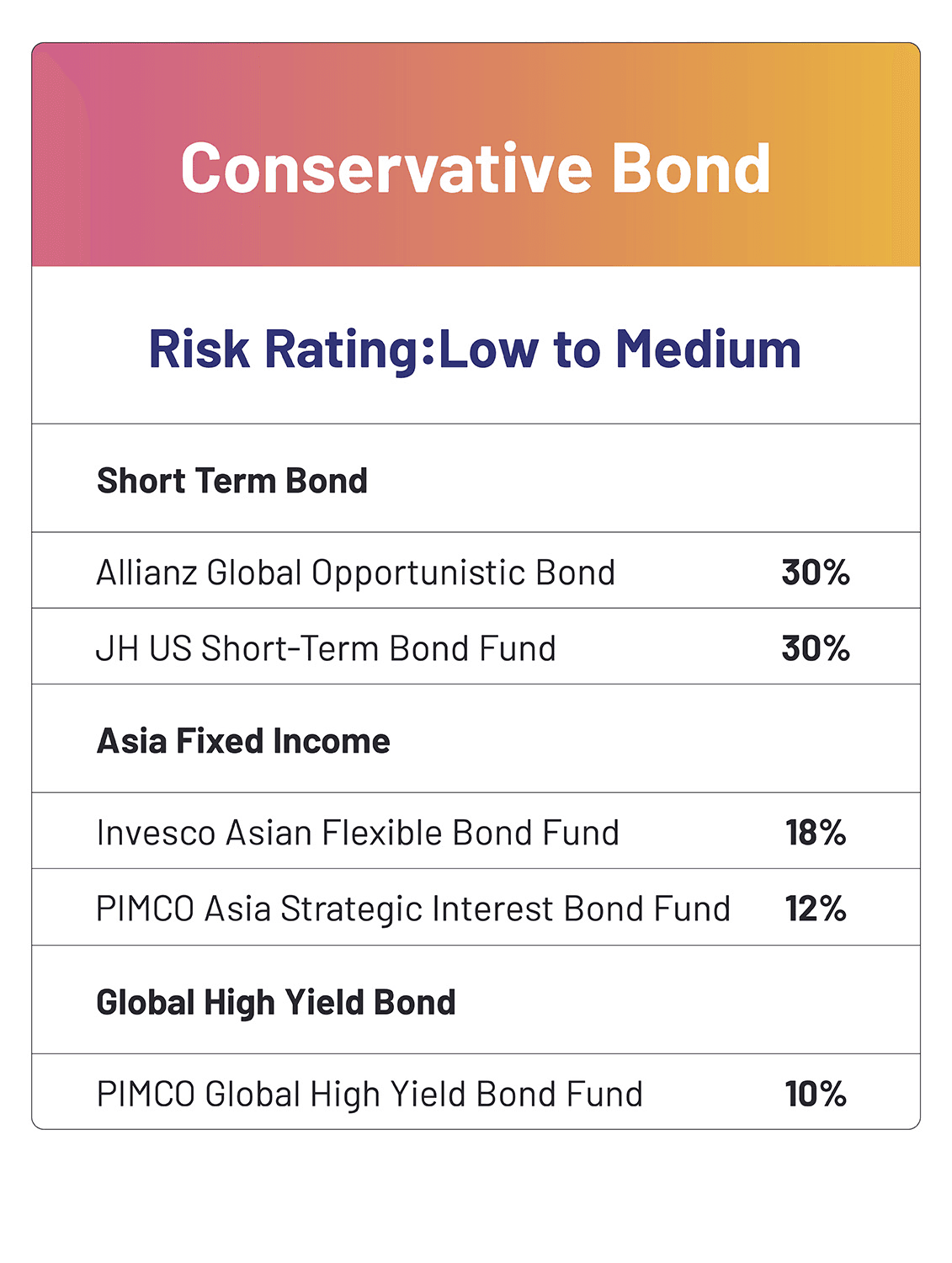

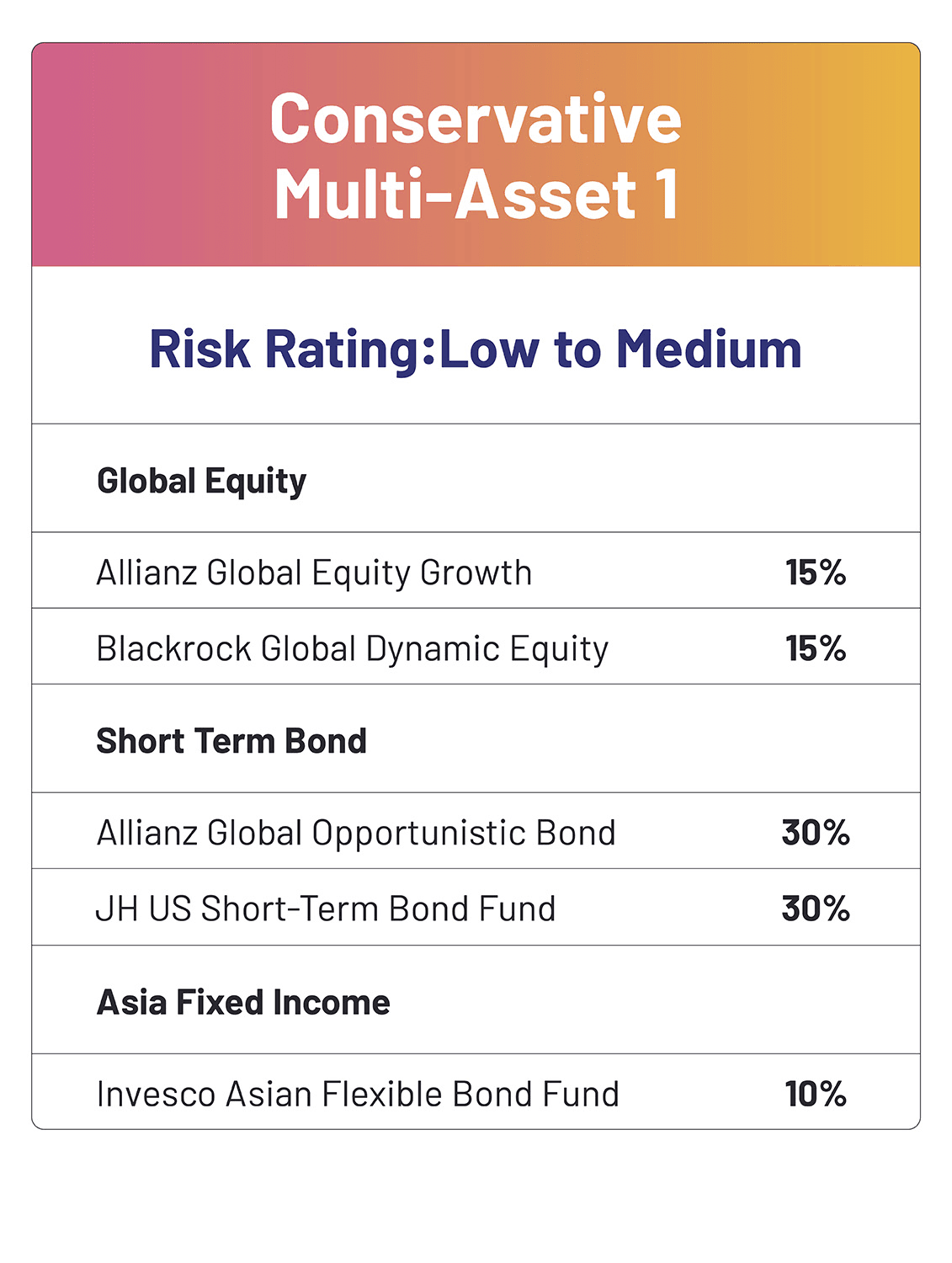

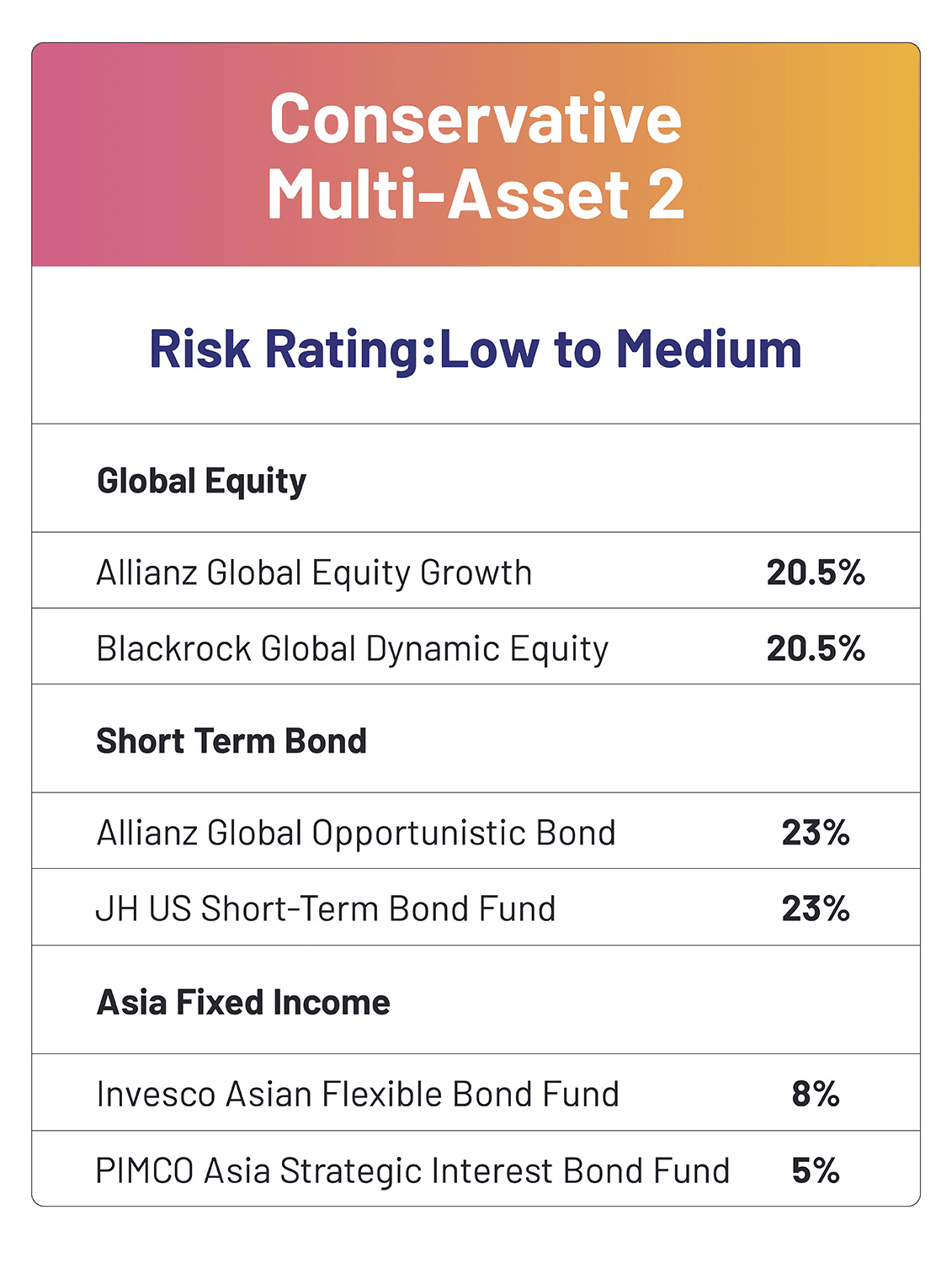

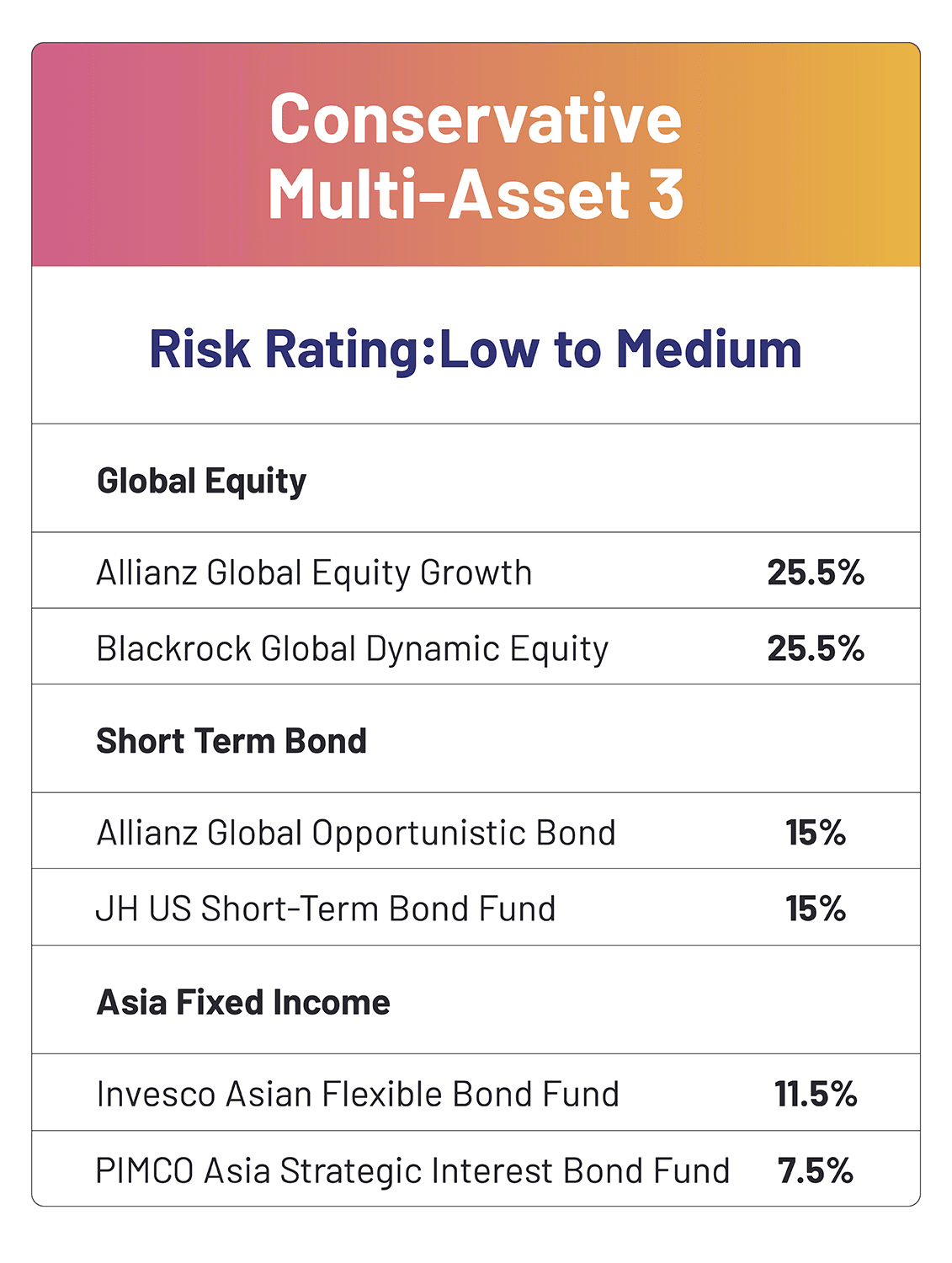

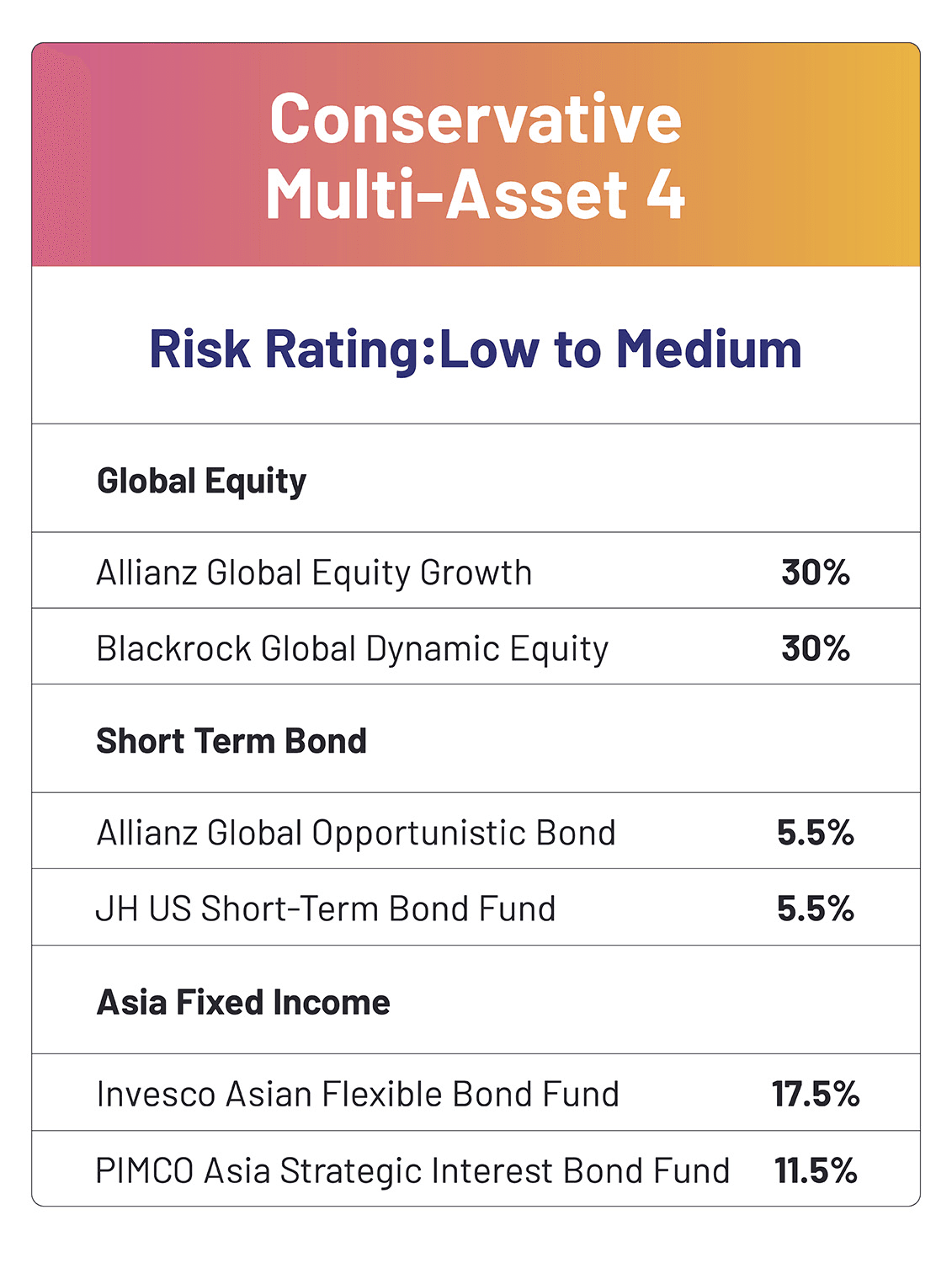

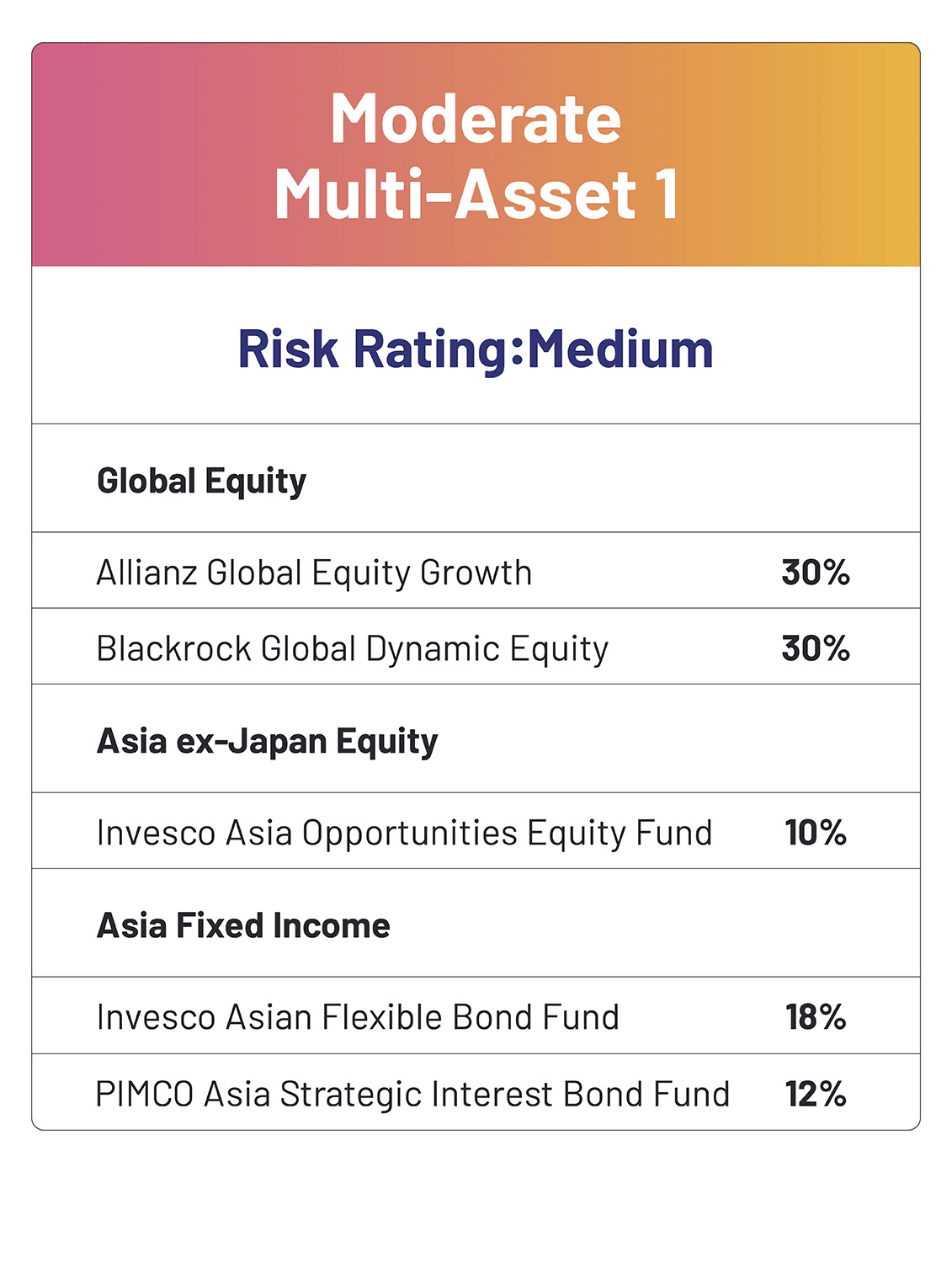

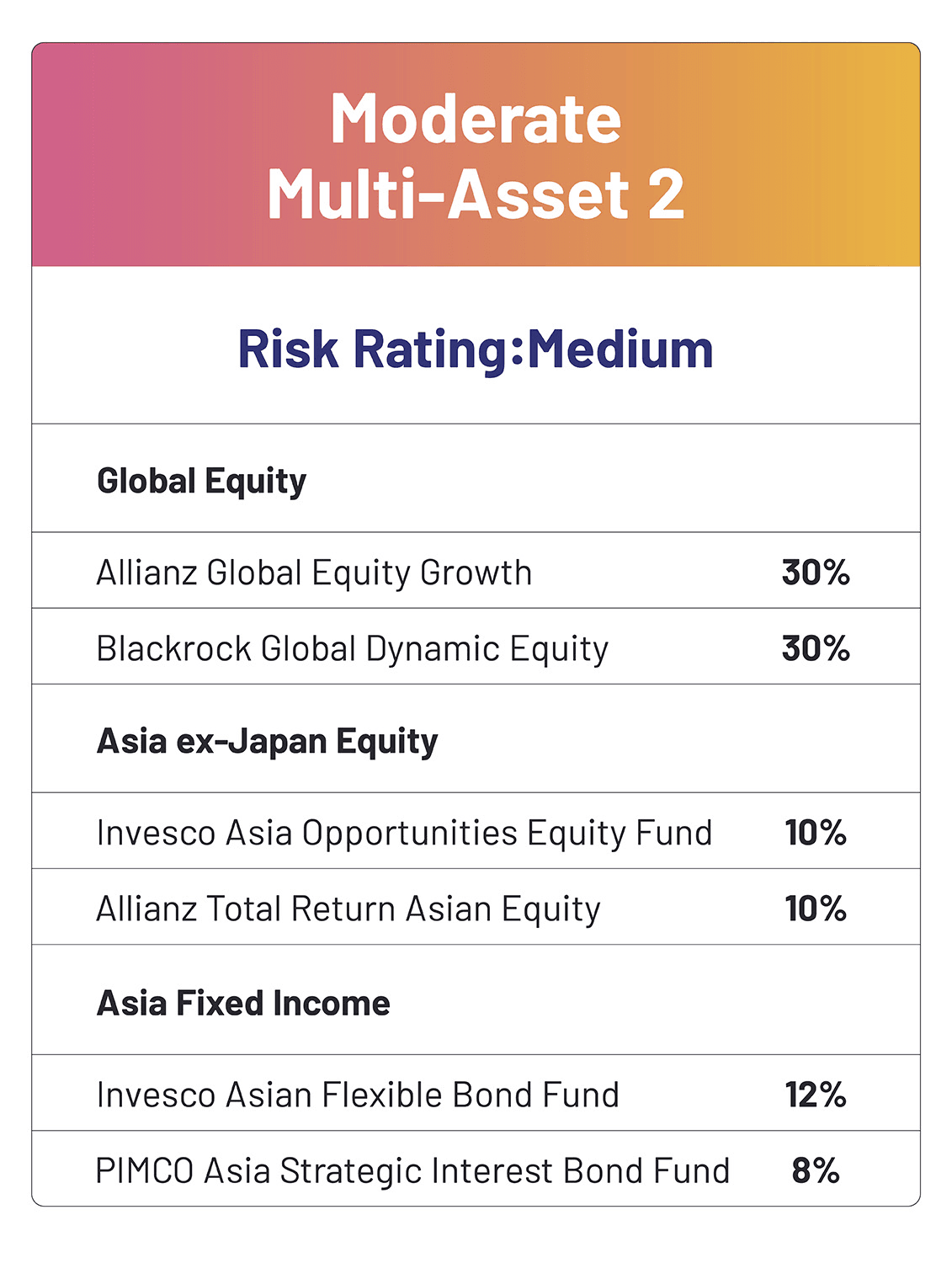

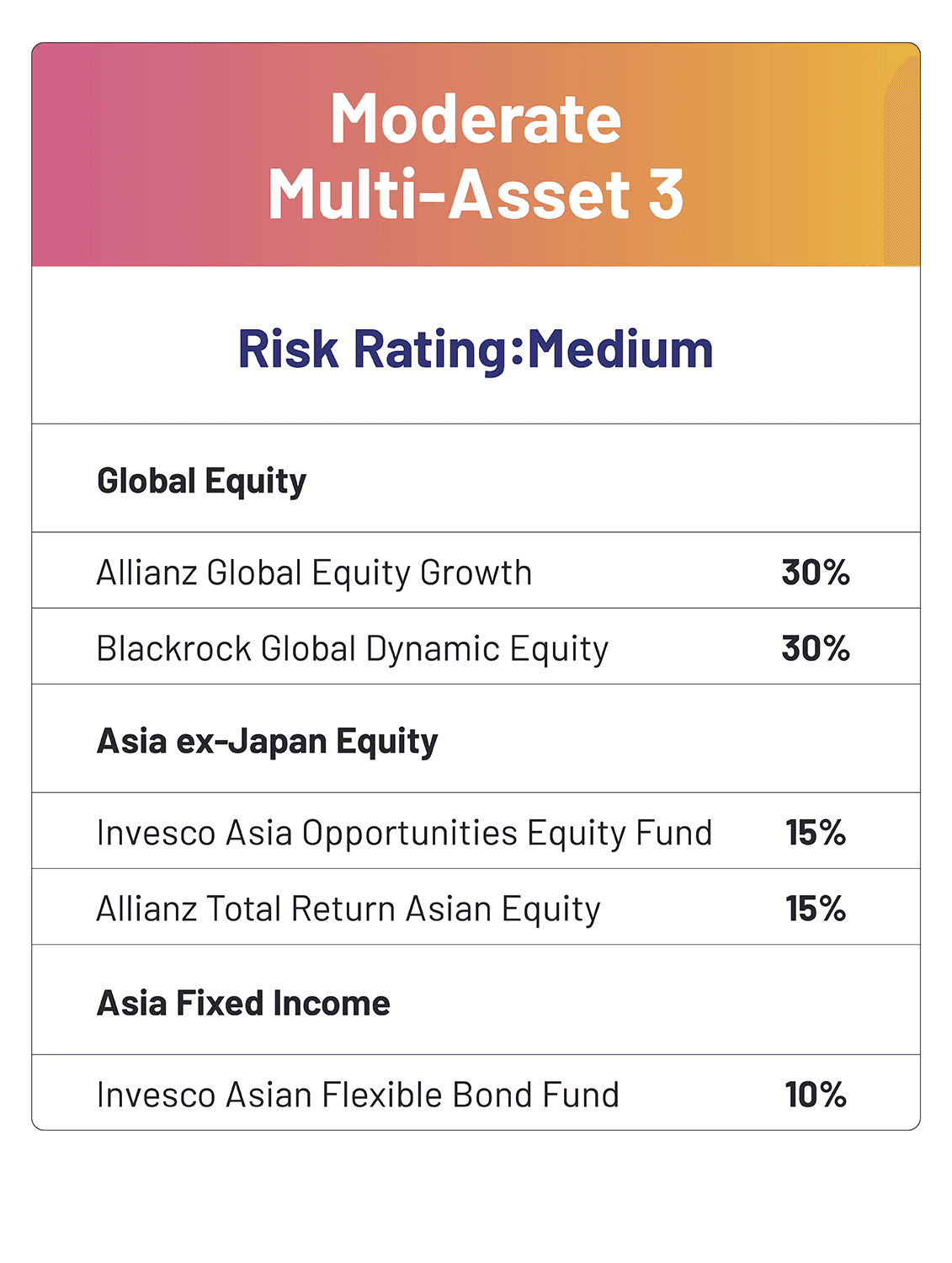

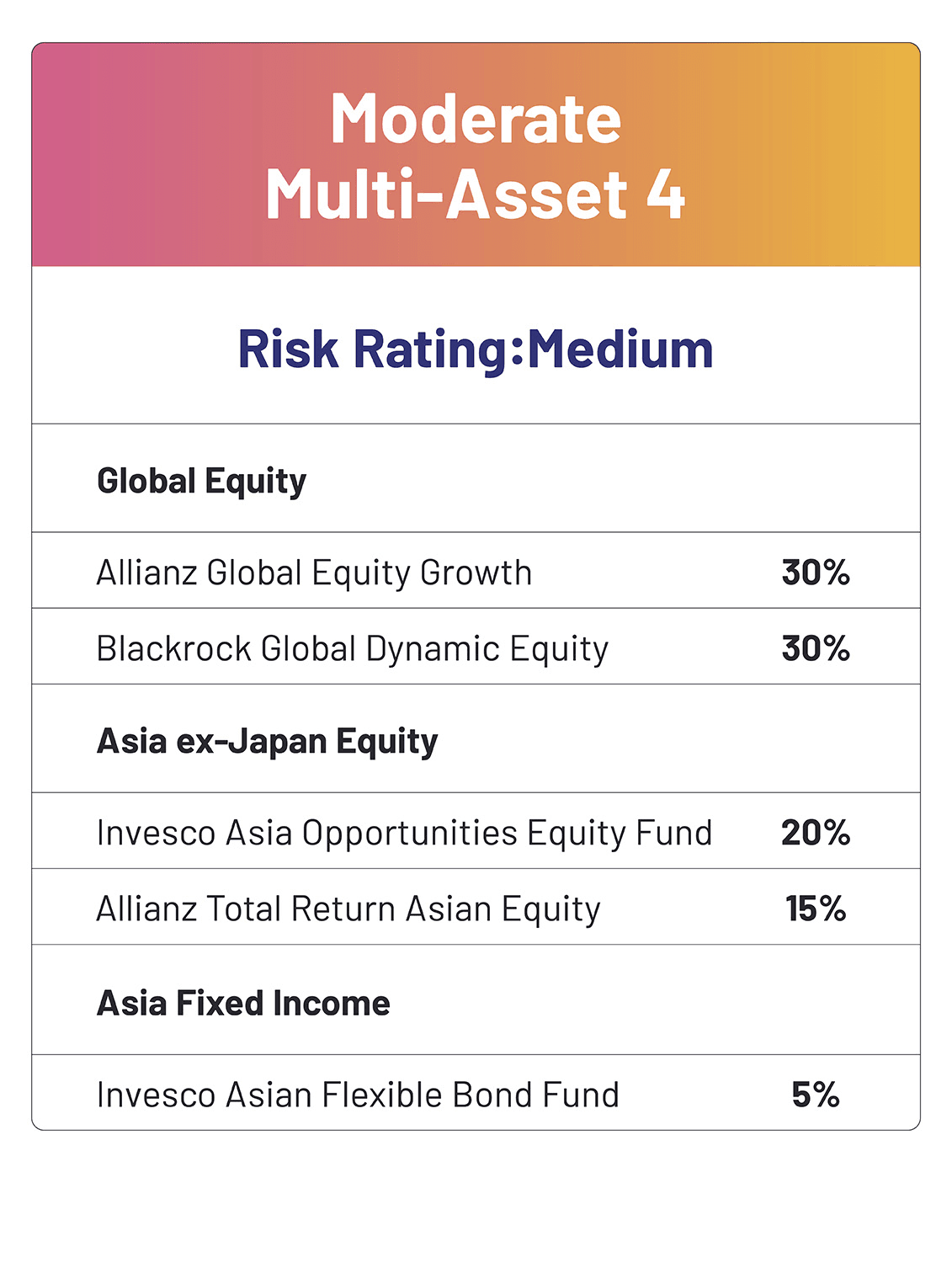

GoWealth Multi-Asset Investing

Covering multiple broad based asset class, GoWealth portfolio recommendations provides the most optimal probability to achieve your goal by taking into account of your latest inputs and relevant personal circumstances specific to the goal.

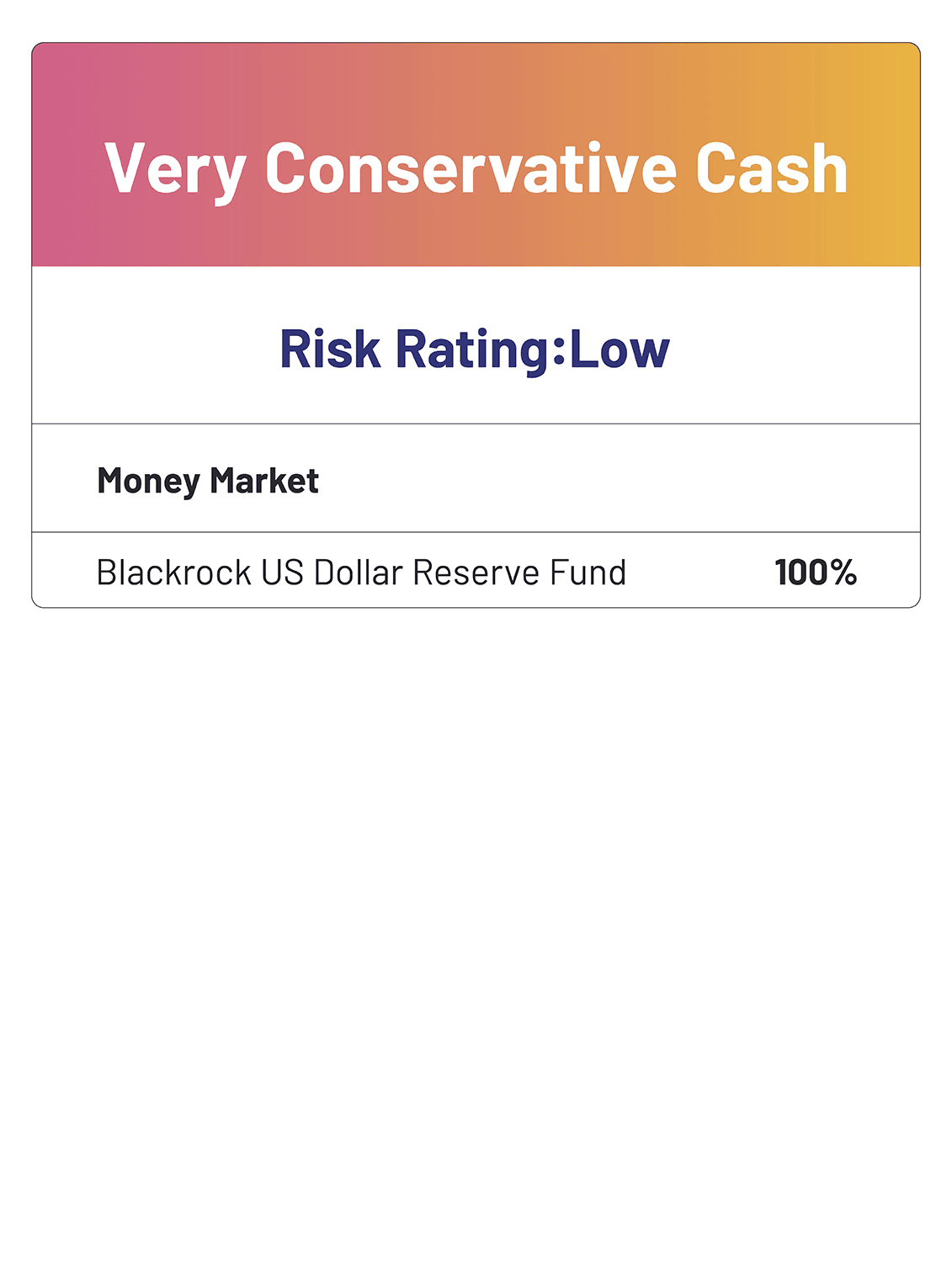

Very Conservative Cash

Risk Rating: 1 Low

The model portfolios shown are for illustrative purposes only. Please refer to the latest data in the app.

Product Features Comparison

GoWealth | General Banks | General Investment-linked Insurance Plan | |

|---|---|---|---|

| Digital Wealth Advisory Service | ✔ | X | X |

| Market Conditions Smart Alerts | ✔ | X | X |

| No lock-up period | ✔ | ✔ | X |

Fee Structure Comparison

GoWealth | General Banks | General Investment-linked Insurance Plan | |

|---|---|---|---|

| Subscription Fee | Waived | Up to 5% | FREE |

| Early Redemption Fee | FREE | FREE | Average 6-8% (Decrease after each policy year) |

| Annualized Admin Fee | FREE | FREE | Average 1-2% annually |

Remark: Above fees are made to fund distributors or insurance companies. Fund Platform Fee will be charged for Digital Wealth Advisory. Please refer to General Service Charges for details.

Embark on an auto-smart investment journey

Reach your financial goals on autopilot¹. Download WeLab Bank app.

Want to know more? We’ve got answers!

What is GoWealth?

WeLab Bank aims to make everyone’s financial goals achievable through investment advisory solution co-developed with Allianz Global Investors. In this brand-new digital wealth experience, you can now set a goal (e.g. Reach your target wealth, build an investing habit, achieve your retirement goal), tracks and manage your progress and reach your goal on autopilot1 with ease all in one place.

What will I invest into?

By investing with us, you will invest in professionally managed and well diversified mutual funds across money market funds, equity funds and bond funds , based on our personalized portfolio recommendation. Our hand-picked funds are all SFC authorized, which open you up to worldwide investment opportunities.

Should I trust WeLab Bank?

We are regulated by the Hong Kong Monetary Authority (HKMA) & the Securities and Futures Commission (SFC) and have licensed by SFC for Type 1 (dealing in securities) & Type 4 (advising on securities) regulated activities. The portfolio recommendation has considered your latest inputs and personal circumstances specific to your goal based on the GoWealth Investment Engine co-developed by WeLab Bank and Allianz Global Investors1.

What if my goals change, can I make changes to my investment?

It’s normal that over time, plans change. You can feel free to edit or cancel your goals anytime with no lock up period or redemption fees. If you edit your goal, based on your latest inputs and personal circumstances specific to your goal, we may offer you a new portfolio or suggestion to rebalance your portfolio. You should also consider the transaction costs (including but not limited to commission, fees and other charges) to be incurred as they will affect your value of investment.

I love the auto-invest feature. How can I ensure sufficient money to contribute to my investment every month?

If you choose to pay in HKD, you may turn on the “Auto Reload” function under the Transfer tab so you can ensure sufficient fund in your WeLab Bank account. For details of the “Auto-Reload” function, please refer to the relevant FAQs.

What fees will be charged?

Only Fund Platform Fee is charged by the Bank, please refer to the General Service Charges for details. While fund managers will receive management fee deducted from the fund and is reflected in the daily fund price.

Visit more FAQ

Click HERE to visit GoWealth FAQ page.

Click HERE to visit Foreign Exchange FAQ page.

Disclaimers

This webpage is for information only and does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.

Investment involves risk. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Part of your investment may not be able to liquidate immediately under certain market situation. Please refer to our Wealth Management Services Terms (including relevant risk disclosures) and relevant fund offering documents for more details of our services as well as the nature and risks of the relevant products.

The investment decision is yours but you should not invest in these product(s) nor services unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives.

Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s).

If you have any inquiries on the nature and risks involved in this webpage, relevant product(s) and services, trading or investment funds, etc, you should seek advice from independent financial adviser.

The information contained on this Website should not be construed as a distribution, an offer to sell, or asolicitation to buy any securities in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction. If you are outside of Hong Kong, please inform yourself about and observe any relevant restrictions.

By proceeding with a purchase, you are representing and warranting that you are either resident in Hong Kong or the applicable laws and regulations of your jurisdiction allow you to access the information in this Website or our App and make the purchase.

This webpage is issued by Welab Bank Limited. The contents of this webpage have not been reviewed by the Securities and Futures Commission in Hong Kong.

In case of any discrepancy between the English and the Chinese versions of this webpage, the English version shall prevail.

Footnotes

[1] You may set up your investment goal via our Wealth Management Services on the WeLab Bank app, including the relevant investment horizon and one-time investment and monthly investment amounts. Our algorithm will recommend you a model portfolio based on your investment goal as well as your relevant personal circumstances. If you accept the recommendation, we will follow your instruction to process your one-time investment, and invest the monthly investment amount set by you in the model portfolio each month automatically. We will provide you various types of alerts/notifications, including but not limited to alerts/notifications about the status of your investment goal. However, such alerts/notifications are not investment advice. You may view the status of your investment goal and edit your investment goal on the WeLab Bank app according to your needs. The services are not discretionary asset management services. Any recommendation provided under the services is not a guarantee that you will achieve your investment goal.

[2] The algorithm in the GoWealth Digital Wealth Advisory Services relies on the portfolio simulation database containing 7,488,000 simulation paths for the model portfolios projected over the next 52 years (i.e. 624 months), which reflects our capital market forecast on various asset classes and the model portfolios in terms of risk, return and correlations.

Such information and simulations are assumptions only. They do not reflect or project actual investment performance of the model portfolio or performance of any constituent funds therein. The recommendation is not a guarantee that you will achieve your goal.

[3] Professional team will perform product diligence on each constituent fund of the model portfolios, in which ESG factors will form part of the consideration factors.

[4] Allianz Global Investors is a leading active asset manager. For details about the WeLab-Allianz strategic partnership, please refer to the press release.

[5] Click HERE to read terms and conditions.

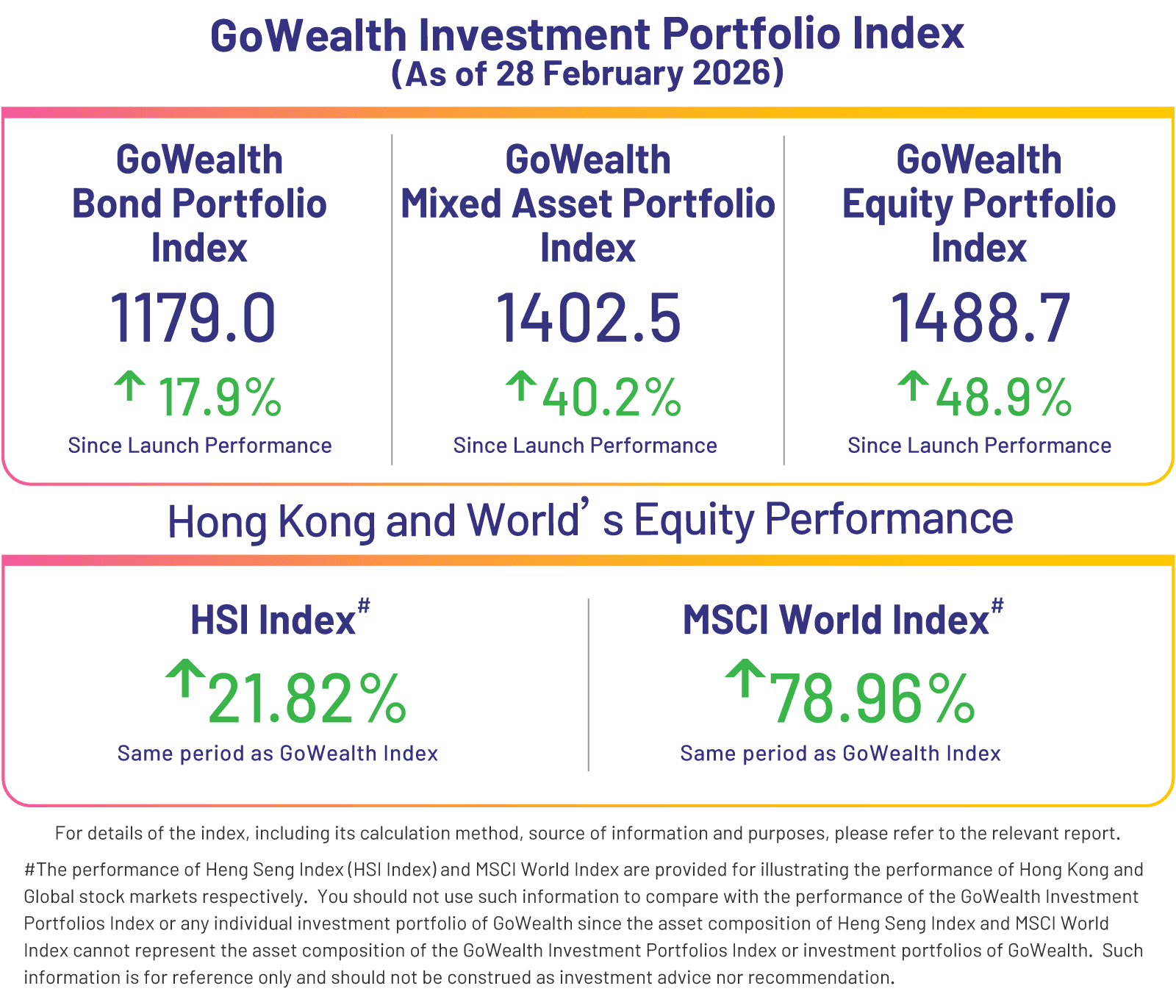

Note: We formulate GoWealth Investment Portfolio Index for bond portfolios, mixed asset portfolios, and equity portfolios respectively, aiming at illustrating the performance of the investment portfolios of GoWealth since launch. The Index is provided for reference only and does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. Investment involves risks. Past performance is not indicative or guarantee of future results. You should not regard the index as a prediction or guarantee of future performance.

For details of the index, including its calculation method, source of information and purposes, please refer to the relevant report.