Policy Loan

Apply with one app! Easily unlock the cash value of your policy and easily access funds anytime!

Click HERE to Policy Loan Key Fact Statements

Our Insurance Partner

Prudential Hong Kong

You may consult your insurance agent for more details

Flexibly Utilize the Advantage of Policy Loan to Allocate More Liquid Funds as You Need

Enjoy the protection of your policy while obtaining extra funds without needing to surrender it!

Simple Process. Fully Online Application.

No need for in-person meetings; the entire application process is handled online. Complete it in just 3 steps using the WeLab Bank App!

Low Entry Requirements. No Asset Requirements¹.

No asset proof is needed¹, and no minimum deposit requirements — just a WeLab Bank account is required to apply!

Flexible Loan Amounts

Minimum loan requirements as low as HKD 100,000 with up to 90% cash value of the policy, providing flexible support for any financial strategy you have!

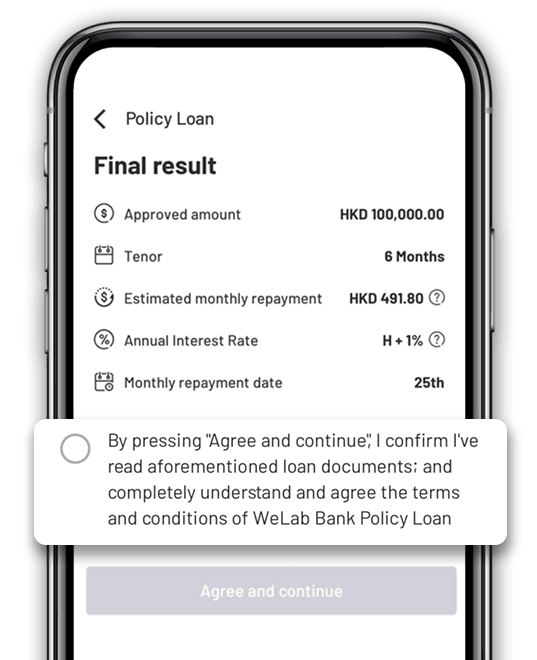

Extra Funds Available. Repay Interest without Repaying the Principal.

Simply repay the interest monthly, with the principal settled in full in the final instalment amount. Truly offers flexible cash flow, helping you adjust your financial goals at any time!

* The monthly repayment amount shown in the above calculation is for illustrative purpose only. The actual repayment amount and annualized interest rate may vary depending on the final assessment of your application.

The figures and formula used within this calculator may change at any time without notice. Any loan request is subject to assessment against normal lending criteria. Terms and Conditions apply.

Should you apply for the WeLab Bank Policy Loan with us, we will make our own calculations and we will not necessarily take your calculations into account. All interest rates displayed are guides ONLY and the monthly repayment as a result of this simulation have no legal offering.

WeLab Bank accepts no responsibility for any losses arising from any use of or reliance upon any calculations or conclusions reached using the calculator.

To borrow or not to borrow? Borrow only if you can repay!

Prudential's Only Fully Digital Banking Partner²

From application and approval to management, everything can be done with just one App — no complicated steps required. Experience convenient and quick loan services anytime, anywhere!

Truly Flexible Loan Amounts and Repayment Tenor

Policy loan amounts range from HKD 100,000 to HKD 1,500,000, with repayment tenor from 6 to 24 months. You can also extend your loan term through the WeLab Bank App before the repayment period ends³—managing everything in one app is that simple!

Competitive Interest Rate

Our policy loans use a floating interest rate based on the Hong Kong Interbank Offered Rate (HIBOR)⁴ plus 1.5% fixed interest rate to calculate monthly payment interest. This offers high flexibility and closely follows market trends, giving you an advantage in a declining interest rate environment. Before the final payment, you only need to repay the interest.

Applicable to a Wide Range of Insurance Products

We offer policy loan services for a variety of popular life insurance products under Prudential. For more details, please consult your insurance agent.

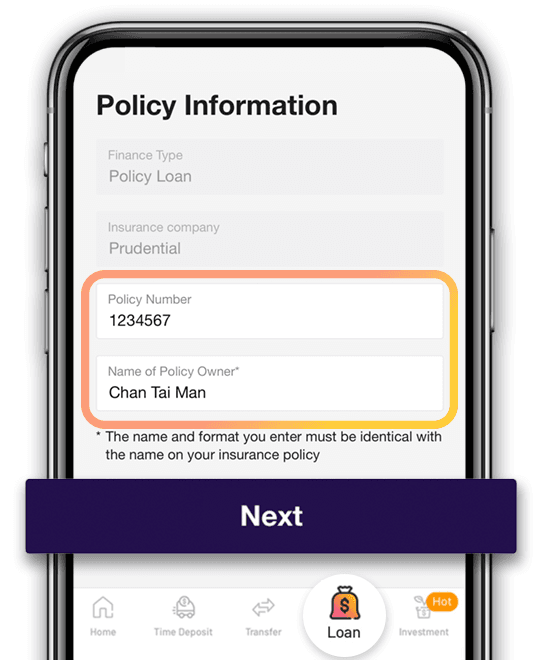

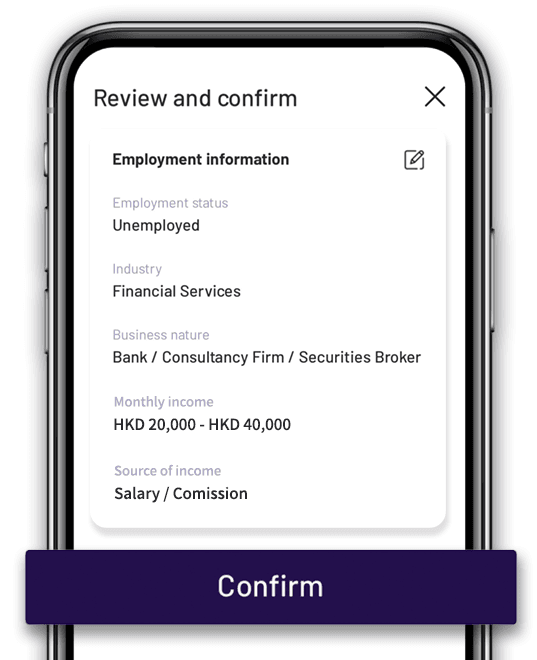

How to apply for policy loan?

Complete your Policy Loan application as simple as 3 steps#!

Step 1 - Submit the application

Simply fill out your loan, insurance policy, and financial information to submit your application.

The applicant of Policy Loan must have a WeLab Bank account. If you don't have one, it only takes you 5 minutes to set up#. Click here to learn more about the account opening process.

What is a Policy Loan?

Policy Loan uses your insurance policy's cash value as collateral to get extra fund; and you don't need to surrender the policy.

What are the criteria for applying for policy loan?

For applying policy loan, you must:

- Between 18 to 64 years old

- Have a valid WeLab Bank account

- Be the policyholder of the eligible insurance policies and meet certain criteria.

Is my insurance policy eligible for WeLab Bank Policy Loan?

At the moment, WeLab Bank only supports selected insurance policies for applying Policy Loan, including:

Prudential Hong Kong Limited (Prudential):

- Evergreen Wealth Advance

- Evergreen Growth Saver

- Evergreen Growth Saver Plus

- Evergreen Growth Saver Plus II

- Evergreen Wealth Multi-Currency Plan

- Prime Eternity

Where to find my policy number?

The policy number consists of 12 digits. You can find your policy number on your physical Certificate of Life Assurance; or insurance company’s online portal (e.g. myPrudential). You can also contact your insurance agent for assistance.

I do not have a WeLab Bank account, can I apply for the policy loan?

No, you need a WeLab Bank account to proceed your policy loan application and access the fund.

You can open an account anytime, anywhere easily by using your mobile phone. HK residents and Mainland Chinese visitors in HK to get started in as fast as 5 minutes online#. For your information, click here.

Do I need to come to WeLab Bank office for application and loan drawdown?

No, WeLab Bank has fully digitalize the process for your convenience.

Will WeLab Bank share any data relating to me with Credit Reference Agencies (CRAs)?

No, Policy Loan is a secure loan and the Bank will not obtain credit report from Credit Reference Agencies (CRAs) or sharing details relating to you with them.

Do I need to provide any supporting documents during the application process?

In most of the circumstances, applying for Policy Loan doesn't require any supporting documents.

What's the impact to my insurance policy when I used it to apply for Policy Loan?

During the repayment period, your insurance policy will be assigned to WeLab Bank as collateral. In case of delinquency, the Bank reserves the rights to surrender the policy and use the cash value to settle the remaining loan amount and fees.

What is the longest tenor and maximum loan amount?

We provide extra flexibility to meet your financial needs. The loan amount can be as high as 90% of the guarantee cash value of your insurance policy; and the tenor from 6-24 months. The final loan amount and tenor will be based on Bank's assessment and decision.

How long would it take me to get the money after loan approval letter and policy assignment form are signed?

We will target to disburse the fund to your WeLab Bank account in 10 working days. Our staff would contact you for further arrangement if required.

How do I repay my Policy Loan?

Policy Loan applicants must use his/her WeLab Bank account to make repayments, and please make sure the account has sufficient balance.

Can I early settle the policy loan?

Yes, but you're not allowed to early settle your policy loan in the first 6 month of the loan drawdown date. Also, the early settlement fee shall be 1% of the original principal amount.

What if I'm unable to make the repayment on time?

If you're unable to make the repayment on time, we will charge 30% of the overdue payment OR HKD500, whichever is lower. The Bank also reserve the right to deduct the amount from the cash value of your policy.

Remarks:

To borrow or not to borrow? Borrow only if you can repay!

Click HERE to read WeLab Bank Policy Loan Key Fact Statements.

#Actual steps may vary depending on factors such as your mobile phone and documents required.

(1) Subject to final approval requirement.

(2) As of November 2024, WeLab Bank is the only Digital Bank that partners with Prudential Hong Kong to provide an active policy loan program that uses a digital application process.

(3) Loan renewal is subject to the Terms and Conditions of WeLab Bank Policy Loan.

(4) The floating interest rate will be updated on every 14th calendar day based on the 1-month HIBOR rate published by The Hong Kong Association of Banks (“HKAB”) . If the 14th calendar day of the month is a non-working day (i.e. Saturday, Sunday, Public Holiday), the interest rate will be updated based on the 1-month HIBOR rate published by HKAB on the previous working day.

Want to know more about our offer terms?

Read terms and conditions of WeLab Bank Policy Loan / Key Facts Statement (KFS) for WeLab Bank Policy Loan / HKD Prime Rate (P)