Guide for Global Remittance

WeLab Bank has launched the new global remittance! We will go over in detail how to remit transfer money from WeLab Bank account.

How to send your money across the world with WeLab Bank?

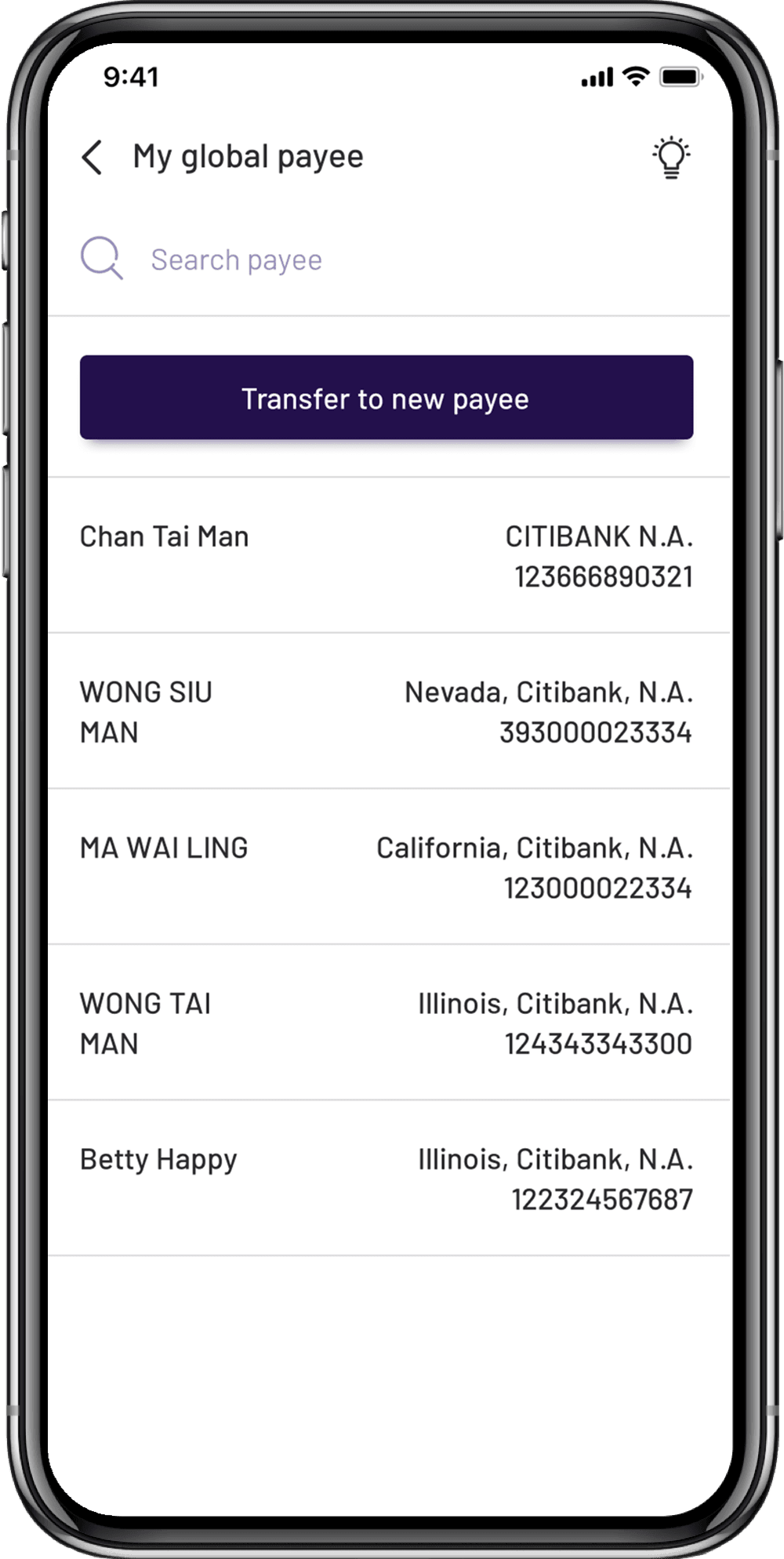

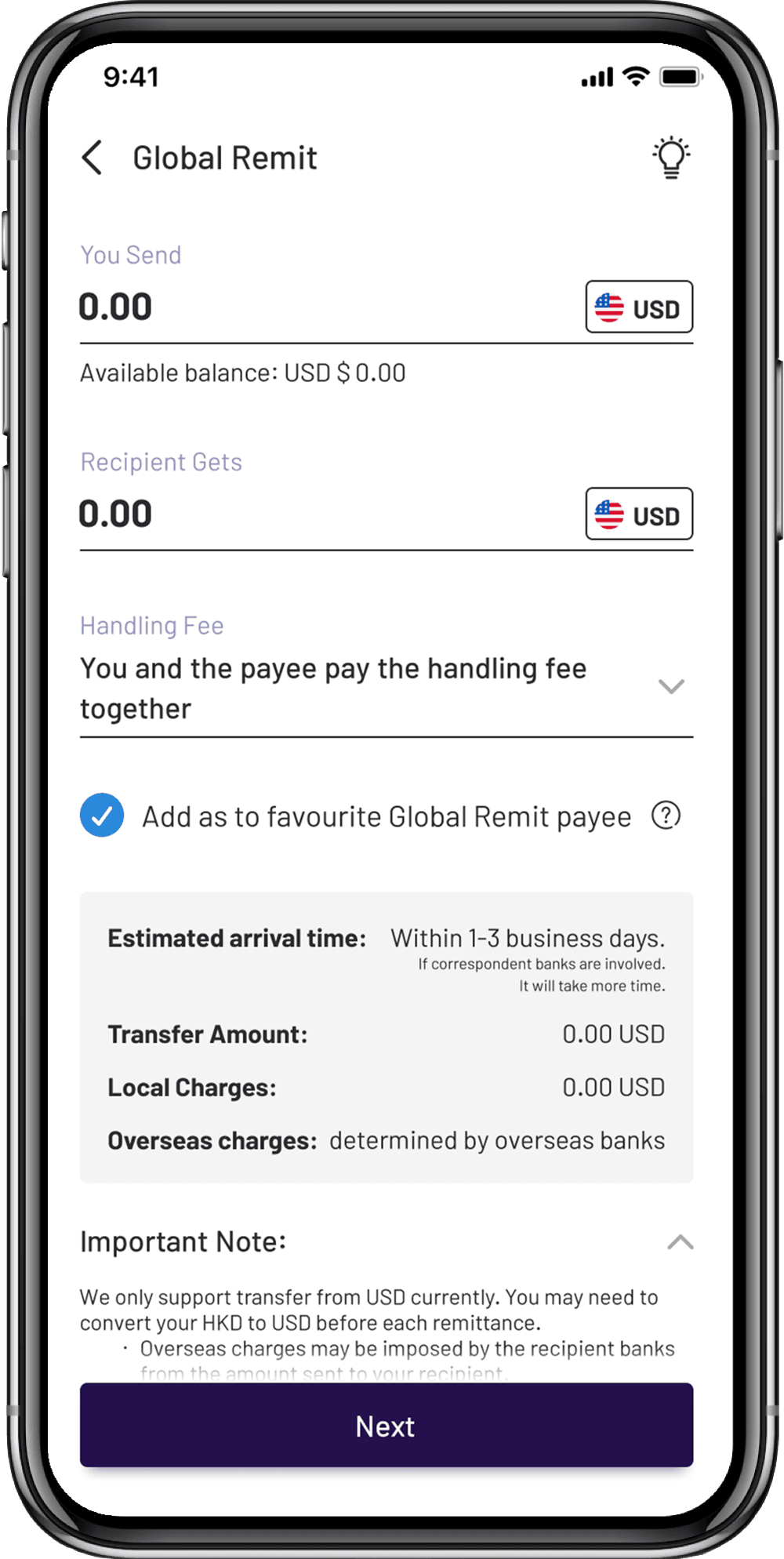

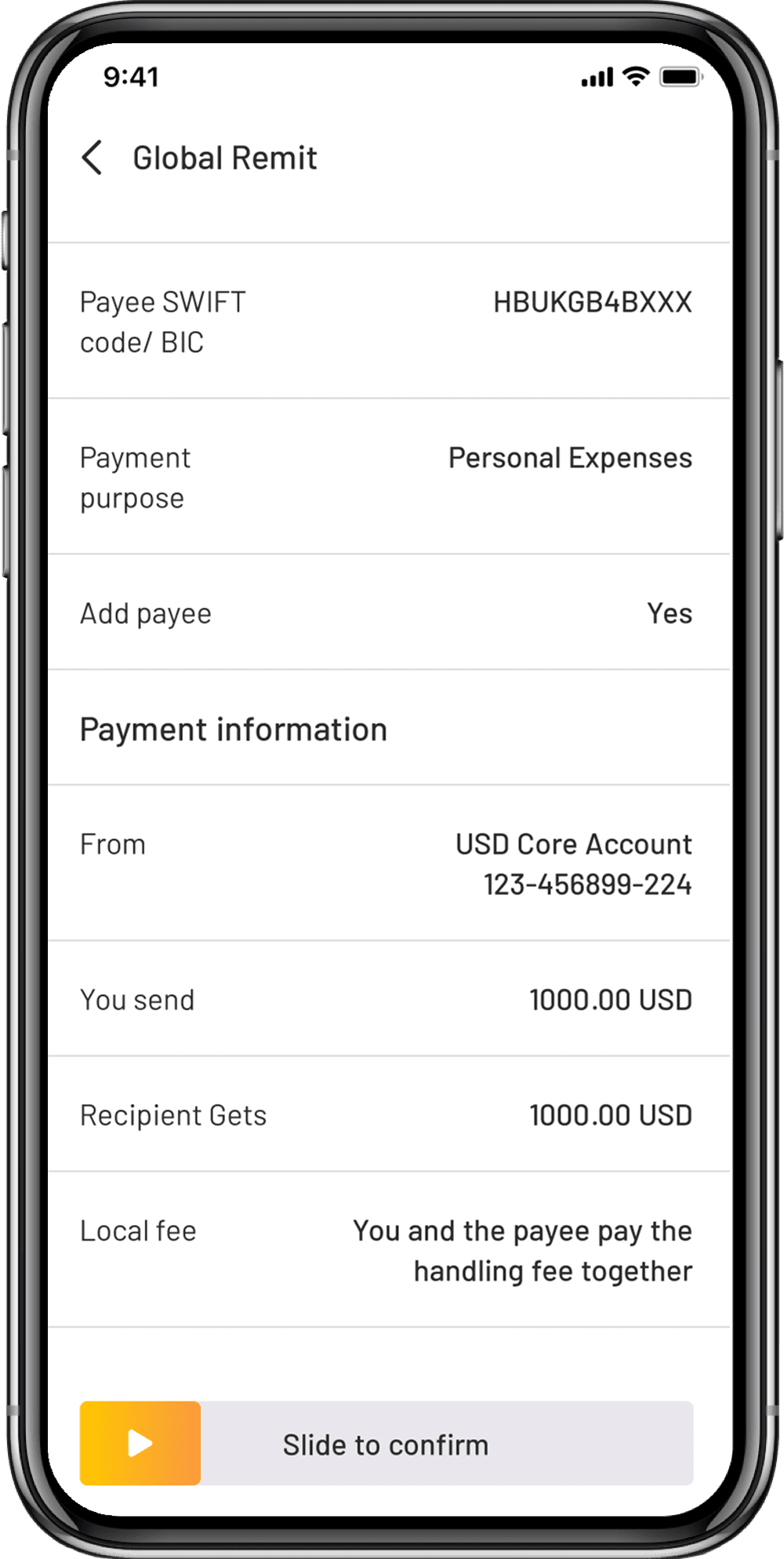

What you need and ensure are the sufficient foreign currency deposit and Payee’s information, then you can transfer foreign currency from your WeLab Bank account to anywhere in the world with just 4 Steps:

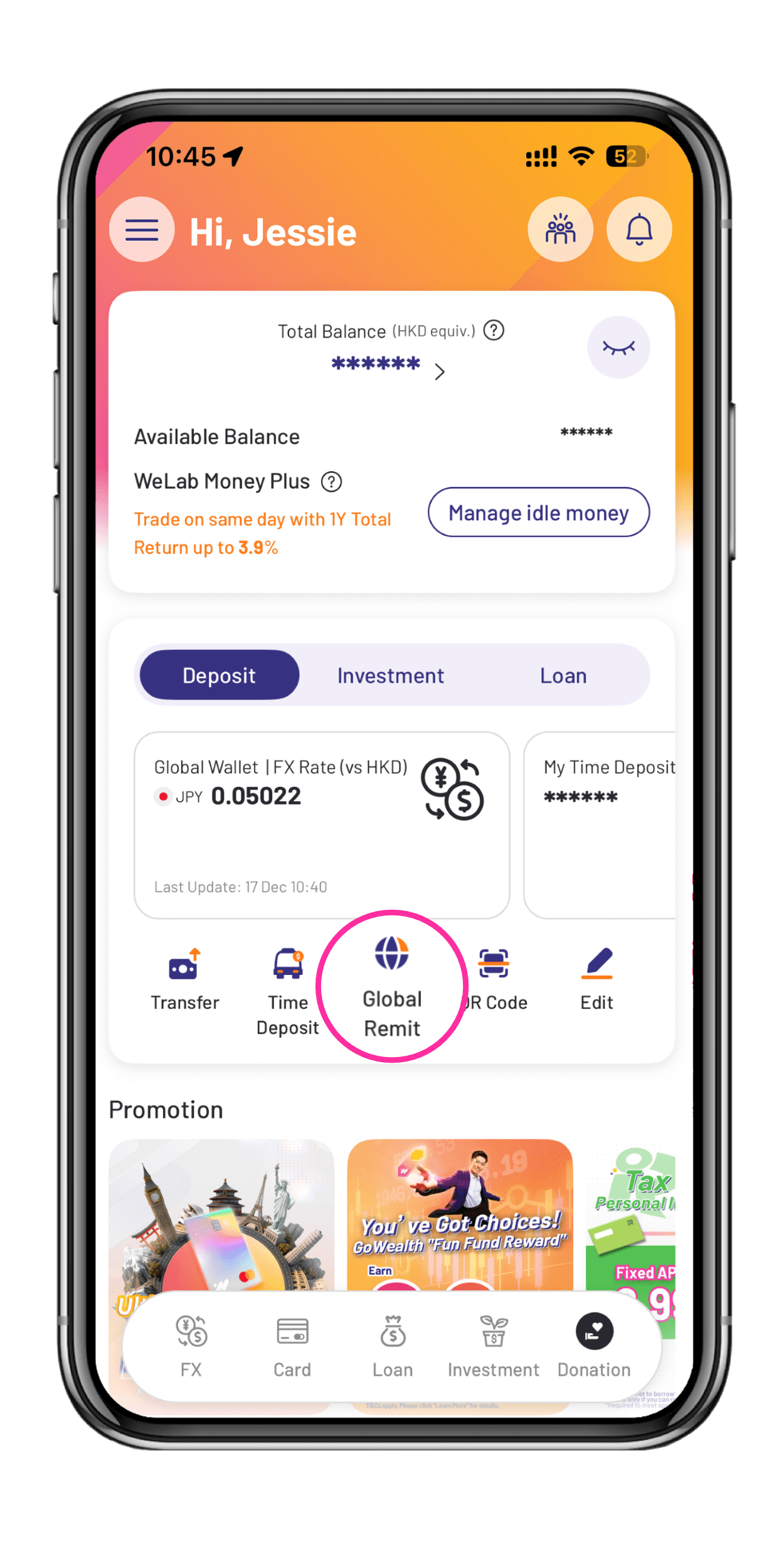

Click Global Remit

Open WeLab Bank App, enter ‘Transfer’ page, and click Global Remit

1

2

3

4

The screen displays and images on this website are for illustrative purpose only. Please refer to the information displayed in the WeLab Bank App on the transaction day.

Get started!

Download our app and experience banking built for our century.

Disclaimers:

- The information provided on the website is for general information only without warranty of any kind and may be changed at any time without prior notice.

- Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction.

- The actual processing time of Global Remit may vary depending on the operations of the overseas banks and foreign currency holiday.

- Counterparty Risk: We enter into FX Transactions under the FX Terms on a principal-to-principal basis and you are therefore subject to the risk that we fail to perform our obligations under the FX Terms.

- WeLab Bank exchange rates and remittance fees are determined based on the exchange rates and remittance fees provided and displayed in the WeLab Bank App each time.