WeLab Global Wallet Debit Card✨ One Card for Global Spending & Travel🌍

One card supports 11 major currencies🌍, offers the Best FX rate1 + $0 fee2 for currency exchange💱 + cashback3 on spending, and works at all Mastercard® merchants worldwide💳. Whether local shopping or overseas payments, it’s easy and borderless!

Want to exchange foreign currency at the Best FX rate¹?

WeLab Bank’s lowest FX rate guarantee⁴ helps you save money and time!

Exchange HKD to foreign currencies at cost price — WeLab Bank does not add any markup on the FX rate, and we do not charge any foreign currency transaction fee. With the help of AI⁵, you can easily find the Best FX rate¹ and save even more.

Multi-currency convenience🌎 Travel & manage money with one card

Supports 11 major currencies: HKD, JPY, USD, CNY, AUD, GBP, EUR, SGD, CAD, CHF, and NZD.

Enjoy zero foreign currency transaction fee6 + cashback on spending3 for overseas spending, streaming subscriptions📺, and foreign currency online purchases🛒— no hidden charges💡, save more for purchase✨!

Withdraw Cash Worldwide

Traveling and need some cash? Whenever you see an ATM with the Cirrus® logo overseas, you can use your physical card to withdraw cash from ATMs that support the Cirrus® network.

Before your trip, please activate the overseas withdrawal feature via the WeLab Bank app.

Auto FX Top up. Spend across currencies with ease

No sufficient foreign currencies in your account, NO WORRY— just spend or withdraw when you need to.

When your balance in 10 supported foreign currency falls short, Auto FX Top up automatically converts the required amount from your HKD balance in your Core Account at our prevailing exchange rate — so your transaction goes through seamlessly.

From everyday spending to cash withdrawals, enjoy smooth, hassle-free transactions anywhere.

Ready to use your WeLab Global Wallet Debit Card right after account opening

Your WeLab Bank account comes with a debit card💻. Start paying online and via Apple Pay without waiting for a physical card.

You may also apply for a physical card anytime via the App📬— Open ➡️ Activate ➡️ Use in 3 easy steps. Travel & spend faster🚀!

Stylish, practical, secure

The sleek WeLab Global Wallet Debit Card has no card number, CVV, or expiry date printed—designed to prevent data theft and let you enjoy secure digital payments.

Debit Card Name Change Announcement📣

Reminder: WeLab Mastercard® Debit Card has been renamed WeLab Global Wallet Debit Card. Whether you have the old card face or the new one, you can enjoy our new services and experience!

How to add your WeLab Global Wallet Debit Card to Apple Pay?

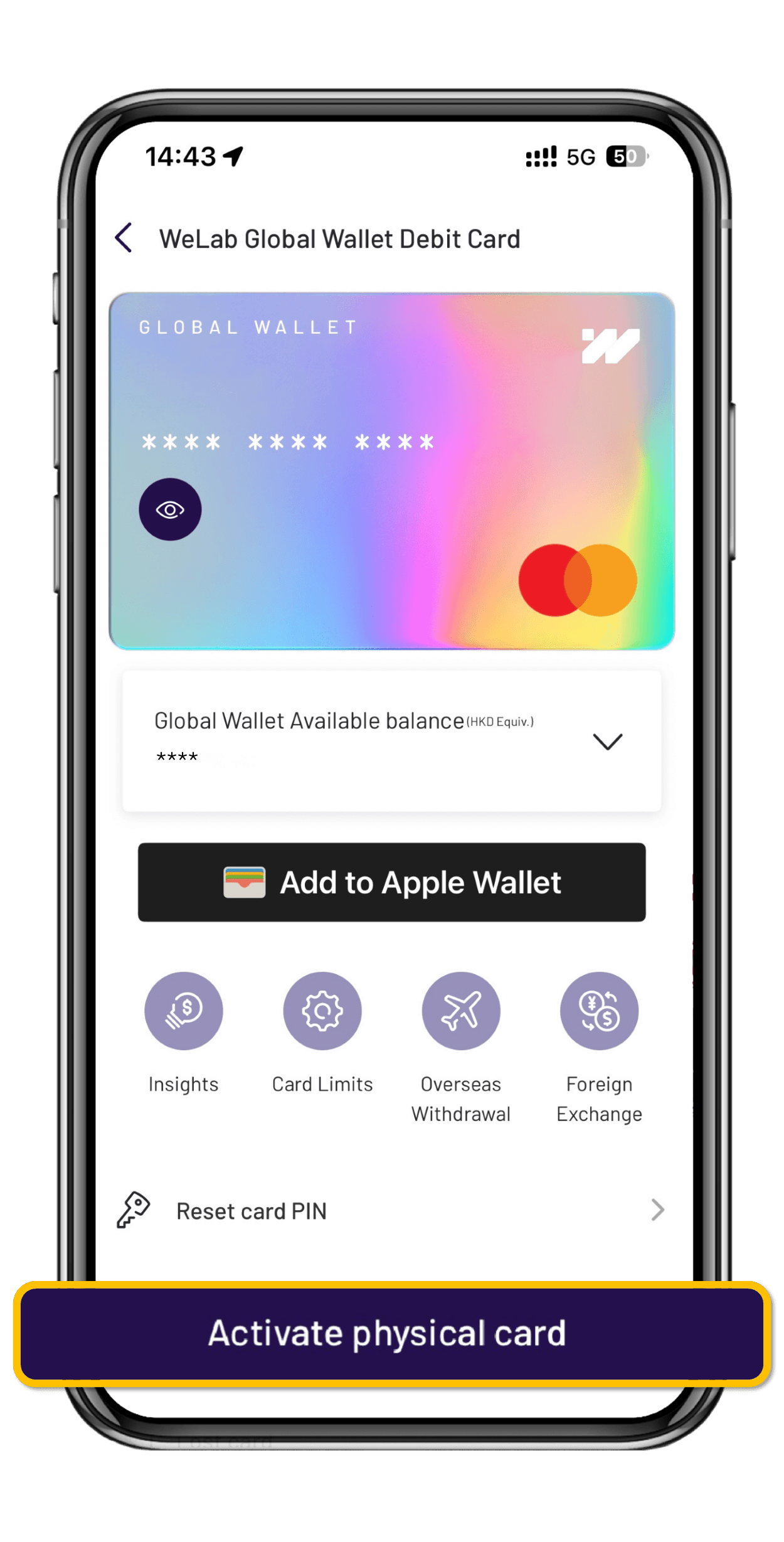

Already have the card but not activated?⤵️

Get your WeLab Global Wallet Debit Card

Download our app and experience banking built for our century.

Want to know more? We’ve got answers!

Here are some commonly asked questions about the WeLab Global Wallet Debit Card!

What's so special about a WeLab Mastercard Debit Card?

Our WeLab Mastercard Debit Card combines the best of both worlds: an ATM card and a Mastercard-branded bank card. With just one card in your wallet, you can access your money at any JETCO and CIRRUS ATM within Hong Kong (service fees may apply). You can also use it for purchases at any merchant/location that accepts Mastercard. All your transactions will be deducted / debited from your available balance in your Core Account; that way, you'll never spend more than you have!

Goodbye overspending, hello healthy budgeting👋!

What is the difference between the virtual card and physical card?

A virtual Card is just the same as any other regular debit card, only that it's virtual! You can use it to pay for online transactions through the Mastercard network.

You will be issued a virtual card as soon as your account is opened, so that you can start using your card immediately. You can also request for physical card that you can use to make card-present transactions in store locations, which will delivered to you around 5-7 business days after your request has been made (delivery time may vary due to postal carrier services).

Do I need to activate my physical Debit Card?

Yes! For security reasons, the physical you received is not usable until you have used our app to activate it.

Activate your physical card by logging into the app and go to "Card" > "Activate physical card", then scan the QR code located on your card package. Set your card PIN and voila! Your new card should be activated and you can start spending!

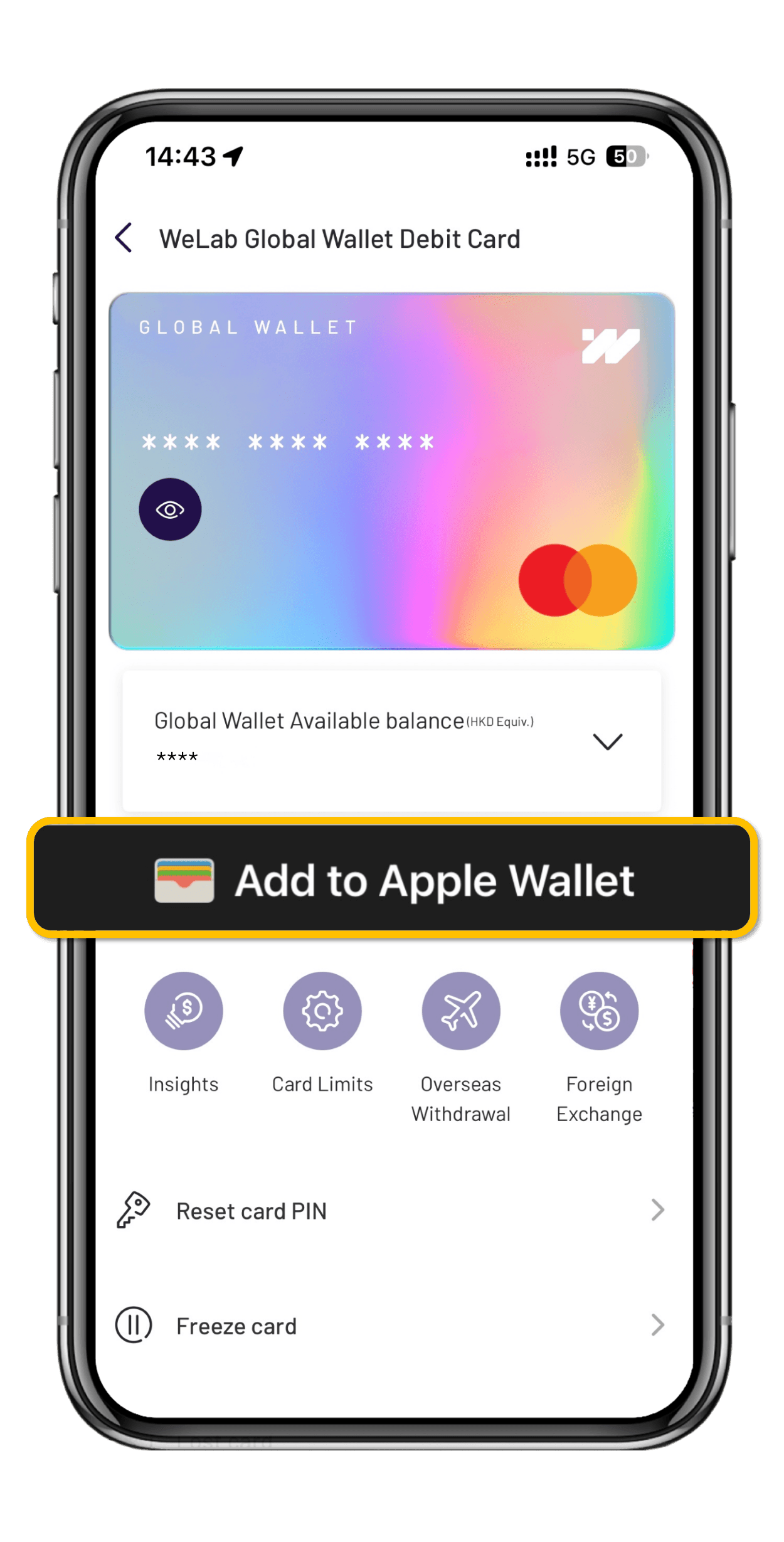

How do I connect my WeLab Mastercard Debit Card to Apple Pay?

You can add your WeLab Global Wallet Debit Card to Apple Pay in two ways:

- Via your WeLab Bank app – login to your WeLab Bank app > click on “Debit Card” > click on the “Add to Apple Wallet” button underneath your virtual card, and follow the instructions

- Via Apple’s Wallet app – you can manually input your card details. You must call WeLab Bank Customer Service Hotline 3898 6988 if you bind Apple Pay through manual key-in. After successful verification, you can bind the card and spend with Apple Pay.

Tip: You can add your WeLab Global Wallet Debit Card to Apple Pay and start making payments before you receive your physical card!

What happens if I've lost my physical Card that's also connected to Apple Pay?

Don't panic, we've got your back! If you can't find your physical Card, you can tap "Debit Card" > "Lost card" to get a new replacement.

Once we've received your lost card request, we will disable your existing card credentials to prevent any fraud attempts. For security, we will also issue a new virtual card with a new card number and CVV, which you can use immediately, while a new physical card with your new card details will be sent to your mailing address.

If you've connected your old card to Apple Pay, remember to update your card details by

(i) removing your old card from your Wallet and

(ii) adding your new card, either through the WeLab Bank app or directly in Apple Wallet.

Subject to WeLab Bank’s Account Terms, your maximum liability for WeLab Debit Card loss should not exceed HKD 500 if you have not acted fraudulently, with gross negligence or have not otherwise failed to inform WeLab Bank as soon as reasonably practical after discovering the card has been lost or stolen.

Remarks

1 The best rates in town comparison is based on the exchange rates collected from the websites, online banking or mobile banking of 28 retail banks in Hong Kong (excluding those which do not publish FX rates via the aforementioned channels) as of approximately 2:15 pm on 23 January 2026. Those rates do not include any special promotions, discounts, offers, membership programs or other preferential rates (including but not limited to volume discounts), but include any fees charged by any banks when conducting the FX transactions to facilitate the comparison. Terms and Conditions apply, please click here for promotion details.

2 Handling fee refers to the fees for foreign currency exchange fee.

3 From 1 January 2026 until 28 February 2026, enjoy 0.4% cash rebate on the Net Spending Amount of each Eligible Spending Transaction made with WeLab Global Wallet Debit Card. The Cash Rebate will be credited in the transaction settlement currency on or before 31 March 2026, capped at HKD 100 or its equivalent. Terms and conditions apply. Please click here for promotion details.

4 During the Promotion Period, if an Eligible Customer successfully converts HKD 100,000 or above to an Eligible Foreign Currency in a single transaction through the “Foreign Exchange” function via the WeLab Bank App and find a Third-Party FX Quote under which the Eligible Customer could have used less HKD to buy the same amount of Eligible Foreign Currency within 5 minutes of completing the Eligible FX Transaction, WeLab Bank will rebate the difference between the sell-HKD amount of the Eligible FX Transaction and the sell-HKD amount of the Third-Party FX Quote. Each Eligible Customer can only enjoy the rebate for one Eligible FX Transaction every 12 calendar months (based on the transaction date of the Eligible FX Transaction). The maximum Rebate Amount is HKD 100. Offer is subject to terms and conditions, please click here for promotion details.

5 We collect the exchange rates from the websites or apps of the banks set out above using AI (Artificial Intelligence) and determine the best exchange rate for each currency among those banks. These exchange rates do not include any special promotions, discounts, offers, membership programs or other preferential rates (including but not limited to volume discounts), but include any fees charged by any banks when conducting the FX transactions, to facilitate the comparison. The information is for reference only, and the exchange rates are rounded off to 4 decimal places (5 decimal places for JPY). Exchange rates fluctuate according to market conditions. Exchange rates may vary upon conducting actual transactions.

6 Overseas spending may be settled either in the local currency of the country/region where the transaction takes place or in Hong Kong Dollar: (A) For transaction settled in the local currency, (i) foreign currency transaction fee waiver will apply if the transaction is settled in any of the 10 eligible foreign currencies (including Japanese Yen, US Dollar, Renminbi, Australian Dollar, Sterling Pound, Euro, Singapore Dollar, Canadian Dollar, Swiss Franc and New Zealand Dollar), and (ii) if a foreign currency exchange is required to complete the transaction, the exchange will be carried out at our prevailing exchange rate, and no foreign currency exchange handling fee will be charged. (B) For transaction settled in Hong Kong Dollar, the transaction will not be treated as a foreign currency transaction and will be subject to the exchange rate, fees, and charges determined by the merchant bank, rather than by us.

Note: Dynamic Currency Conversion (DCC) may occur when withdrawing cash overseas, making online or overseas transactions. If you see an exchange rate displayed or are offered an option to convert Hong Kong dollars into foreign currency or settle in Hong Kong dollars, such withdrawals or purchases are considered DCC and may involve higher fees. WeLab Bank shall not be responsible for any charges or fees imposed by merchants in relation to such transactions.

Disclaimer

FX involves risks. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses.

Apple, the Apple Logo, Apple Pay, iPhone, iPad and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries / regions.