【Invest with Income Ep.3】Understand High Yield Bond Funds in 3 Mins

What are high-yield bonds?As the name suggests, high-yield bonds offer higher yields relative to other fixed-income instruments. High-yield bonds are rated lower than "BBB-" and, as a result, their yields are generally more attractive than higher-rated bonds, such as U.S. Treasury bills and investment-grade corporate bonds.The high-yield bond market has expanded in size and depth over the past few decades and has become a popular asset class for investors around the world. In 2000, the market size of U.S. high-yield bonds was only US$338 billion; by June 2023, the size had risen to approximately US$1.35 trillion1. The U.S. high-yield bond market continues to grow steadily.According to the ICE BofA USD High Yield Index, U.S. high-yield bonds account for approximately 60%2 of the global high-yield bond market. The U.S. high-yield bond market is also very diversified, covering multiple industries, and investors can invest in a diverse range of bonds.Why Invest in High Yield Bonds?

What are high-yield bonds?As the name suggests, high-yield bonds offer higher yields relative to other fixed-income instruments. High-yield bonds are rated lower than "BBB-" and, as a result, their yields are generally more attractive than higher-rated bonds, such as U.S. Treasury bills and investment-grade corporate bonds.The high-yield bond market has expanded in size and depth over the past few decades and has become a popular asset class for investors around the world. In 2000, the market size of U.S. high-yield bonds was only US$338 billion; by June 2023, the size had risen to approximately US$1.35 trillion1. The U.S. high-yield bond market continues to grow steadily.According to the ICE BofA USD High Yield Index, U.S. high-yield bonds account for approximately 60%2 of the global high-yield bond market. The U.S. high-yield bond market is also very diversified, covering multiple industries, and investors can invest in a diverse range of bonds.Why Invest in High Yield Bonds?- Potential revenue returns

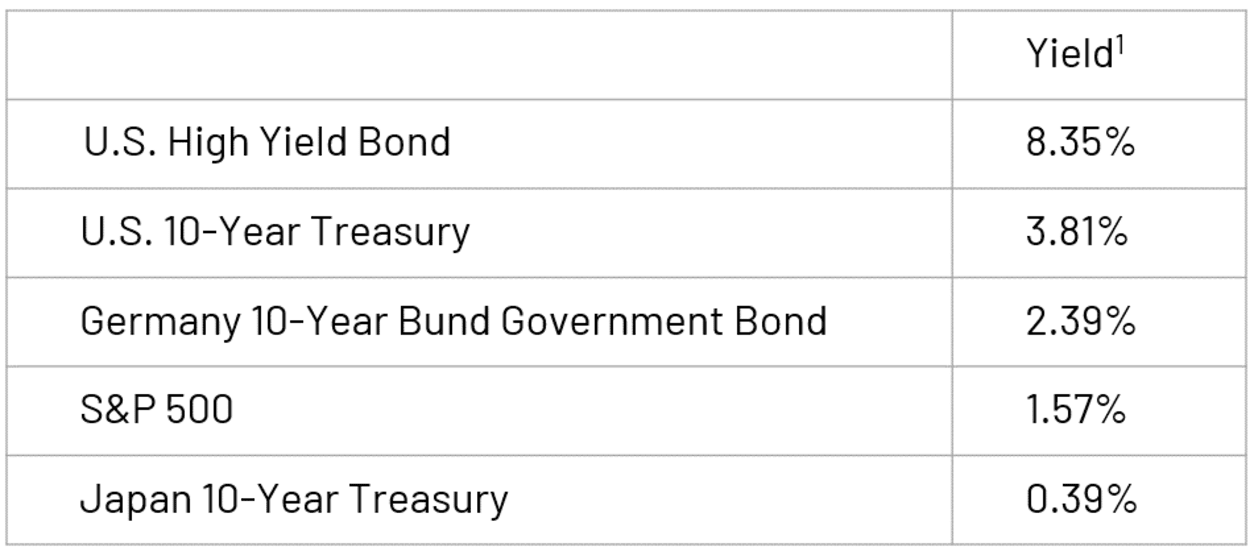

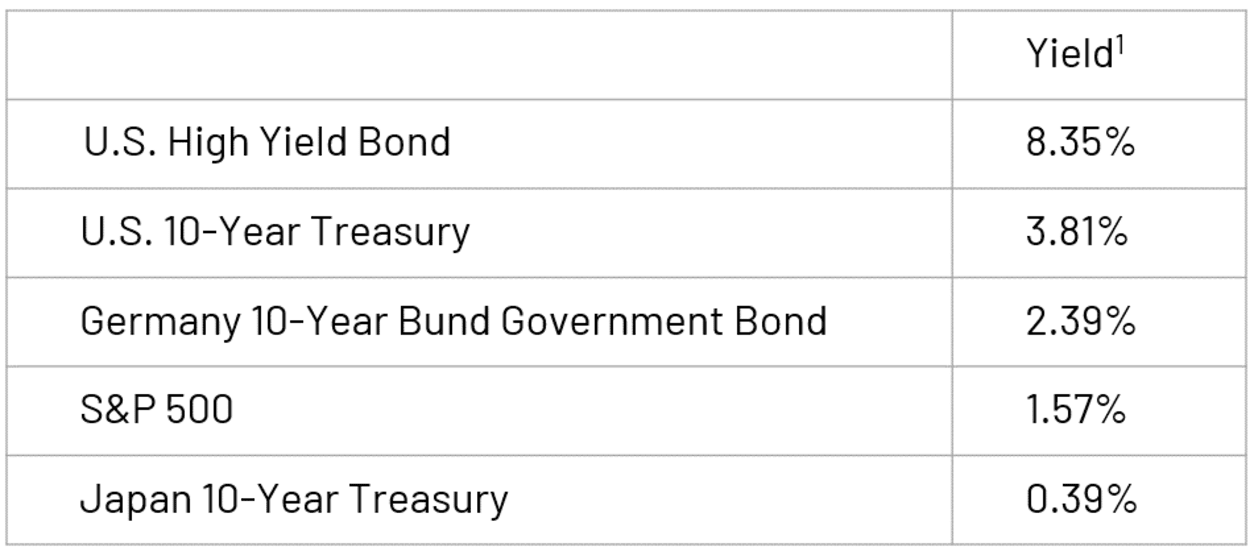

After the U.S. Federal Reserve carries out a series of interest rate hikes in 2022, the potential yield of high-yield bonds returns to very attractive levels. As of June 30, 2023, the yields on 10-year U.S. Treasury bills and investment-grade corporate bonds were 3.81% and 5.55% respectively, and the dividend rate on U.S. stocks (represented by the S&P 500 Index) was 1.57%3. However, the above yield is far lower than the 8.35%3 of US high-yield bonds, which is an attractive investment opportunity for both international and local investors. Many investors now add high-yield bonds to their investment portfolios to increase potential returns and as a hedge.2. The potential interest rates of U.S. high-yield bonds are attractive 3. Proven past performanceIn the past, U.S. high-yield bonds have recorded satisfactory investment returns, with the average annual return over the past 35 years being 7.58%4. In addition, between 1988 and 2022, the U.S. high-yield bond market recorded negative returns in only 8 years, and increased in the remaining 27 years5. It is undoubtedly an "outstanding student" in the global fixed income field, and is therefore widely favored by investors. It's also worth noting that U.S. high-yield bonds have never posted two consecutive years of declines.4. Advantages of diversification of fixed interest incomeHigh-yield bonds have historically provided returns similar to stocks, but with less volatility than stocks. Because high-yield bonds have relatively low correlations with U.S. Treasuries and other core bonds, they can provide diversification benefits from fixed-rate income. U.S. Treasury securities are very sensitive to changes in interest rates, and bond prices generally fall as interest rates rise. Conversely, U.S. high-yield bonds are driven more by issuer fundamentals than interest rate movements, so their correlation to the 10-year U.S. Treasury note is very low, currently at -0.07.Risks of High Yield Bonds

3. Proven past performanceIn the past, U.S. high-yield bonds have recorded satisfactory investment returns, with the average annual return over the past 35 years being 7.58%4. In addition, between 1988 and 2022, the U.S. high-yield bond market recorded negative returns in only 8 years, and increased in the remaining 27 years5. It is undoubtedly an "outstanding student" in the global fixed income field, and is therefore widely favored by investors. It's also worth noting that U.S. high-yield bonds have never posted two consecutive years of declines.4. Advantages of diversification of fixed interest incomeHigh-yield bonds have historically provided returns similar to stocks, but with less volatility than stocks. Because high-yield bonds have relatively low correlations with U.S. Treasuries and other core bonds, they can provide diversification benefits from fixed-rate income. U.S. Treasury securities are very sensitive to changes in interest rates, and bond prices generally fall as interest rates rise. Conversely, U.S. high-yield bonds are driven more by issuer fundamentals than interest rate movements, so their correlation to the 10-year U.S. Treasury note is very low, currently at -0.07.Risks of High Yield Bonds- Default risks are concentrated in the energy industry

The biggest risk of high-yield bonds is default risk. As credit fundamentals improve, the high-yield bond default rate fell to 1.64%6 in 2023 (as of June 2023), which is well below the historical long-term default rate of 3.56%7.2. Pay attention to market volatilityThe high-yield bond market can be volatile, and investors should be aware of market volatility when investing in the high-yield market. Positive returns appear to be elusive, and investors should expect increased volatility. The annualized volatility of U.S. high-yield bonds since 1988 has been 8.25%8, which is lower than the S&P 500 Index’s volatility of 14.74%8 during the same period.Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Bond & Money Market > High Yield】to find out more.Source:1Intercontinental Exchange Data Service, Intercontinental Exchange Bank of America U.S. High Yield Bond Index, as of June 30, 2023.2Bloomberg, as of June 30, 2023.3Bloomberg, U.S. investment grade corporate bonds are represented by the ICE BofA U.S. Corporate Bond Index, U.S. high-yield bonds are represented by the ICE BofA U.S. High Yield Bond Index, and the yield represents the index’s return to maturity. Rate; as of June 30, 2023.4 Morningstar, U.S. high-yield bonds are represented by the ICE BofA U.S. High-Yield Bond Index, with data from January 1, 1988 to June 30, 2023.5 Morningstar, ICE Data Services, Bloomberg, Allianz Investors; as of June 30, 2023. The performance of U.S. high-yield bonds is calculated using the ICE BofA U.S. High-Yield Bond Index.6Bloomberg, ICE Data Services, FactSet, Allianz Investors; as of June 30, 2023. The 10-year Treasury bill is represented by the ICE BofA Spot U.S. 10-Year Treasury Bill Index.7Intercontinental Exchange Data Services, JPMorgan Chase; as of June 30, 2023. U.S. high yield bonds are represented by the ICE BofA U.S. High Yield Bond Index.8 Morning Star; from January 1, 1988 to June 30, 2023. U.S. high yield bonds are represented by the ICE BofA U.S. High Yield Bond Index.Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong. What are high-yield bonds?As the name suggests, high-yield bonds offer higher yields relative to other fixed-income instruments. High-yield bonds are rated lower than "BBB-" and, as a result, their yields are generally more attractive than higher-rated bonds, such as U.S. Treasury bills and investment-grade corporate bonds.The high-yield bond market has expanded in size and depth over the past few decades and has become a popular asset class for investors around the world. In 2000, the market size of U.S. high-yield bonds was only US$338 billion; by June 2023, the size had risen to approximately US$1.35 trillion1. The U.S. high-yield bond market continues to grow steadily.According to the ICE BofA USD High Yield Index, U.S. high-yield bonds account for approximately 60%2 of the global high-yield bond market. The U.S. high-yield bond market is also very diversified, covering multiple industries, and investors can invest in a diverse range of bonds.Why Invest in High Yield Bonds?

What are high-yield bonds?As the name suggests, high-yield bonds offer higher yields relative to other fixed-income instruments. High-yield bonds are rated lower than "BBB-" and, as a result, their yields are generally more attractive than higher-rated bonds, such as U.S. Treasury bills and investment-grade corporate bonds.The high-yield bond market has expanded in size and depth over the past few decades and has become a popular asset class for investors around the world. In 2000, the market size of U.S. high-yield bonds was only US$338 billion; by June 2023, the size had risen to approximately US$1.35 trillion1. The U.S. high-yield bond market continues to grow steadily.According to the ICE BofA USD High Yield Index, U.S. high-yield bonds account for approximately 60%2 of the global high-yield bond market. The U.S. high-yield bond market is also very diversified, covering multiple industries, and investors can invest in a diverse range of bonds.Why Invest in High Yield Bonds? 3. Proven past performanceIn the past, U.S. high-yield bonds have recorded satisfactory investment returns, with the average annual return over the past 35 years being 7.58%4. In addition, between 1988 and 2022, the U.S. high-yield bond market recorded negative returns in only 8 years, and increased in the remaining 27 years5. It is undoubtedly an "outstanding student" in the global fixed income field, and is therefore widely favored by investors. It's also worth noting that U.S. high-yield bonds have never posted two consecutive years of declines.4. Advantages of diversification of fixed interest incomeHigh-yield bonds have historically provided returns similar to stocks, but with less volatility than stocks. Because high-yield bonds have relatively low correlations with U.S. Treasuries and other core bonds, they can provide diversification benefits from fixed-rate income. U.S. Treasury securities are very sensitive to changes in interest rates, and bond prices generally fall as interest rates rise. Conversely, U.S. high-yield bonds are driven more by issuer fundamentals than interest rate movements, so their correlation to the 10-year U.S. Treasury note is very low, currently at -0.07.Risks of High Yield Bonds

3. Proven past performanceIn the past, U.S. high-yield bonds have recorded satisfactory investment returns, with the average annual return over the past 35 years being 7.58%4. In addition, between 1988 and 2022, the U.S. high-yield bond market recorded negative returns in only 8 years, and increased in the remaining 27 years5. It is undoubtedly an "outstanding student" in the global fixed income field, and is therefore widely favored by investors. It's also worth noting that U.S. high-yield bonds have never posted two consecutive years of declines.4. Advantages of diversification of fixed interest incomeHigh-yield bonds have historically provided returns similar to stocks, but with less volatility than stocks. Because high-yield bonds have relatively low correlations with U.S. Treasuries and other core bonds, they can provide diversification benefits from fixed-rate income. U.S. Treasury securities are very sensitive to changes in interest rates, and bond prices generally fall as interest rates rise. Conversely, U.S. high-yield bonds are driven more by issuer fundamentals than interest rate movements, so their correlation to the 10-year U.S. Treasury note is very low, currently at -0.07.Risks of High Yield Bonds