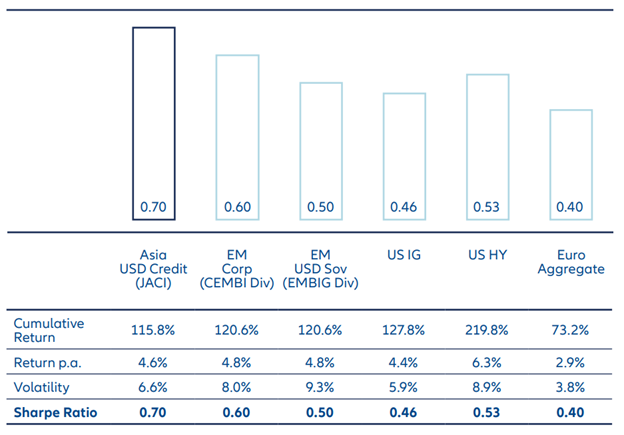

Source: Bloomberg, JP Morgan, AllianzGI as at 31 March 2023. Return figures are shown in USD. Calculation based on monthly data from 2006-2022.Asian investment grade (IG) bonds in particular have shown greater resilience than their US and global counterparts, with lower drawdowns during recent market crises (as shown by Exhibit 2).Exhibit 2: Asian IG has shown lower drawdowns during crises

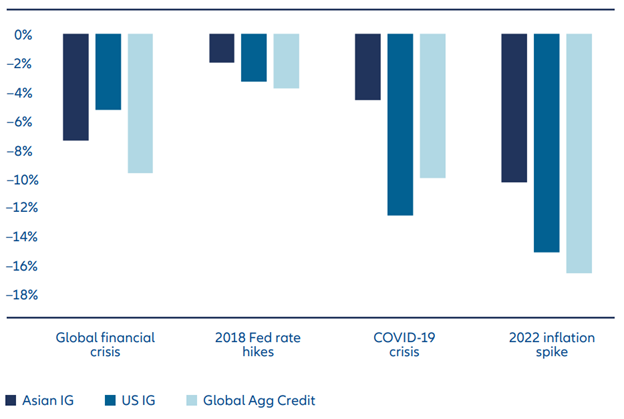

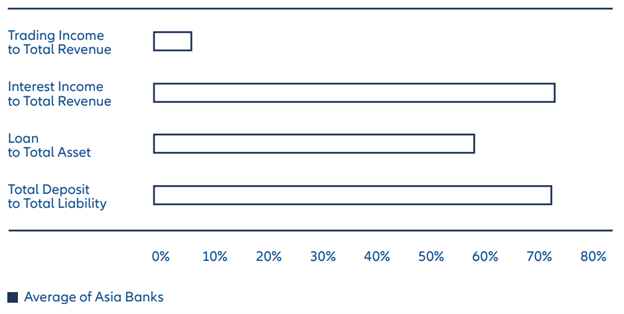

Source: Bloomberg, JP Morgan, AllianzGI as at 31 March 2023. Return figures are shown in USD. Calculation based on monthly data from 2006-2022.Asian investment grade (IG) bonds in particular have shown greater resilience than their US and global counterparts, with lower drawdowns during recent market crises (as shown by Exhibit 2).Exhibit 2: Asian IG has shown lower drawdowns during crises Source: Bloomberg, AllianzGI, as of 31 March 2023. Asian IG is based on the JPM Asia Credit – Investment Grade Index, US IG is based on the Bloomberg US Corporate Total Return and Glbl Agg Credit is based on the Bloomberg Global Aggregate Credit Total Return. GFC/Lehman Crisis (16/09/2008-09/03/2009), 2018 Fed Rate Hikes (02/01/2018 – 08/11/2018), Covid-19 Pandemic (19/02/2020 – 23/03/2020), 2022 Global Monetary Tightening (03/01/2022 – 30/12/2022).Asian IG corporates demonstrate solid credit fundamentals, with low leverage (an average net debt/ EBITDA1 ratio of 1.8) and healthy liquidity (an average cash/short term debt ratio of 114%)2. With the major developed economies looking unlikely to avoid recession, markets could be volatile in the coming months and the resilience of Asian IG could offer some stability to investors’ portfolios.We also regard Asian banks as well capitalised institutions with strong liquidity. The Asian banking sector’s average liquidity coverage ratio (LCR) 3 is 168%4, for example, compared to around 150% for the largest European banks and around 120% for the largest US banks5. Asian banks’ relatively low trading income as a proportion of total revenue, and relatively high proportion of deposits to liabilities (as shown by Exhibit 3), also compare favourably, and in our view reflect their historically more conservative model of deposit-taking and lending when compared to many Western banks.Exhibit 3: Asian banks show solid fundamentals

Source: Bloomberg, AllianzGI, as of 31 March 2023. Asian IG is based on the JPM Asia Credit – Investment Grade Index, US IG is based on the Bloomberg US Corporate Total Return and Glbl Agg Credit is based on the Bloomberg Global Aggregate Credit Total Return. GFC/Lehman Crisis (16/09/2008-09/03/2009), 2018 Fed Rate Hikes (02/01/2018 – 08/11/2018), Covid-19 Pandemic (19/02/2020 – 23/03/2020), 2022 Global Monetary Tightening (03/01/2022 – 30/12/2022).Asian IG corporates demonstrate solid credit fundamentals, with low leverage (an average net debt/ EBITDA1 ratio of 1.8) and healthy liquidity (an average cash/short term debt ratio of 114%)2. With the major developed economies looking unlikely to avoid recession, markets could be volatile in the coming months and the resilience of Asian IG could offer some stability to investors’ portfolios.We also regard Asian banks as well capitalised institutions with strong liquidity. The Asian banking sector’s average liquidity coverage ratio (LCR) 3 is 168%4, for example, compared to around 150% for the largest European banks and around 120% for the largest US banks5. Asian banks’ relatively low trading income as a proportion of total revenue, and relatively high proportion of deposits to liabilities (as shown by Exhibit 3), also compare favourably, and in our view reflect their historically more conservative model of deposit-taking and lending when compared to many Western banks.Exhibit 3: Asian banks show solid fundamentals Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Bond & Money Market > Asia Bond】to find out more!Source:1. EBITDA – earnings before interest, taxes, depreciation, and amortisation – is a widely used measure of cash profit derived from a firm’s core operations.

Want to search and invest in related funds?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Bond & Money Market > Asia Bond】to find out more!Source:1. EBITDA – earnings before interest, taxes, depreciation, and amortisation – is a widely used measure of cash profit derived from a firm’s core operations.2. JP Morgan, AllianzGI as at 31 March 2023.

3. The Liquidity Coverage Ratio (LCR) is a measure of banks’ short-term liquidity which measures a bank’s unencumbered high quality liquid assets relative to the net cash outflows it could encounter under a severe 30-day stress scenario.

4. Moody’s as at 31 March 2023.

5. Fitch Ratings as at 31 December 2022.Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.