1. Undervalued dividend stocks complemented with covered calls

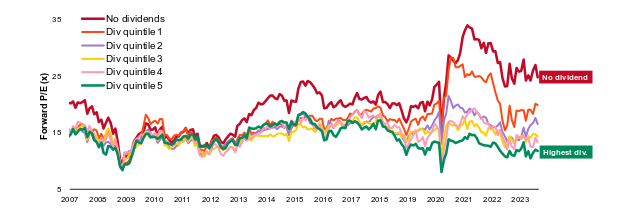

Much ink has been spilled on the concentration of this year’s equity rally, which has been led by a handful of mega-cap tech stocks. What’s gotten much less attention is the potential appeal of other types of equities. Valuations still look very reasonable for dividend stocks. One way to look at this is breaking the equity universe into dividend quintiles, which shows higher yielding stocks are cheap relative to historical valuations and relative to growth stocks (Chart 1). This means the bar to exceed expectations is much lower in these pockets of equity markets, and they should benefit more in the case of a soft landing.Chart 1: Forward P/E by Dividend Quintiles – MSCI USA Index Source: Institutional Brokers' Estimate System (IBES) as of 31/08/2023. Forward P/E multiples represented by IBES estimates, reflecting the consensus earnings per share across sell-side analyst estimates. Indexes are unmanaged and one cannot invest directly in an index.That said, BlackRock also want to make sure they have growth exposures in income portfolios, especially given the importance of tech today. One way BlackRock get access is through covered calls. This means BlackRock sells away some upside potential on individual stocks, which they think makes sense considering today’s valuations, and in exchange get a very attractive income stream. As an example, BlackRock can sell a 1-month 6% OTM call option on Microsoft and receive annualized yield of 11.0%.1

Source: Institutional Brokers' Estimate System (IBES) as of 31/08/2023. Forward P/E multiples represented by IBES estimates, reflecting the consensus earnings per share across sell-side analyst estimates. Indexes are unmanaged and one cannot invest directly in an index.That said, BlackRock also want to make sure they have growth exposures in income portfolios, especially given the importance of tech today. One way BlackRock get access is through covered calls. This means BlackRock sells away some upside potential on individual stocks, which they think makes sense considering today’s valuations, and in exchange get a very attractive income stream. As an example, BlackRock can sell a 1-month 6% OTM call option on Microsoft and receive annualized yield of 11.0%.12. Select opportunities in higher yielding credit

The current yield profile of the US high yield market continues to offer attractive carry at ~8.3% with a strong fundamental profile for the core of the market.2 However, index levels don’t tell the full story as dispersion continues to sit at elevated levels for this market. In our strategies, BlackRock are avoiding the tails. In other words, BlackRock have less exposure to the very tight names (spreads inside 200 bps) and very distressed names (spreads over 800 bps). BlackRock still think there is a lot of value in between, but investors will need to stay selective.BlackRock also think investors should consider owning a portion in European high yield. Relative to the US, it is a higher quality market on average and USD investors get the added benefit of earning approximately 2% more income when hedging back to US dollars.3 We also don’t anticipate a meaningful spike in defaults.3. Higher quality, lower duration bonds

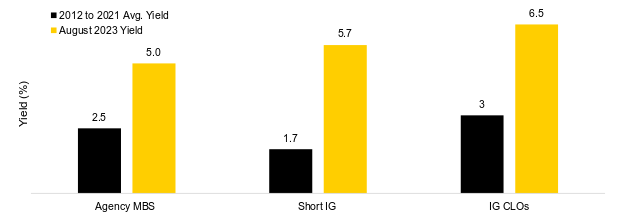

Lastly, a rise in short-term rates has led to much more attractive valuations in higher quality fixed income. A couple of areas that stand out to us, especially in BlackRock more conservative portfolios, include short-term investment grade bonds and collateralized loan obligations (CLOs). Even though BlackRock don’t expect a meaningful rise in rates from here, these markets offer compelling yields with minimal duration risk. BlackRock also like having an allocation to agency mortgage-backed securities (MBS), where valuations have become much more compelling. As the below chart shows (Chart 2), these areas have much higher yields today and may provide investors with strong downside protection versus stocks should volatility rise.Chart 2: High quality fixed income offer attractive risk-adjusted yields Past performance is not an indication of future results. It is not possible to invest directly in an index. Yields based on yield to worst. For illustration purposes only. Source: Bloomberg as of 31 August 2023. US Investment Grade bonds represented by the Bloomberg US Corporate Bond Index. US CLO represented by the JPM CLO IG Index. Agency MBS represented by Bloomberg US MBS Index.1 Reference to the company name mentioned herein is for illustrative purpose only and should not be construed as investment advice or investment recommendation of those companies.

Past performance is not an indication of future results. It is not possible to invest directly in an index. Yields based on yield to worst. For illustration purposes only. Source: Bloomberg as of 31 August 2023. US Investment Grade bonds represented by the Bloomberg US Corporate Bond Index. US CLO represented by the JPM CLO IG Index. Agency MBS represented by Bloomberg US MBS Index.1 Reference to the company name mentioned herein is for illustrative purpose only and should not be construed as investment advice or investment recommendation of those companies.2 Source: Bloomberg as of 31 August 2023. Based on the Bloomberg US High Yield Index.

3 Source: Bloomberg as of 31 August 2023. Based on the Bloomberg EUR/USD Hedging Cost Index.Want to search and invest funds with monthly dividend payout?Open the WeLab Bank App and click【GoWealth > Pick your own funds > Featured Funds > View Full Fund List > Filters > Asset Class click "Equity Fund", "Mixed Asset Fund", "Bond Fund", “Money Market Fund”; Payout type click Dividend > View Results】Do not want to miss our latest product offerings, promotions and wealth management tips? Visit the App and proceed to【Settings > Marketing preferences】to accept receiving our marketing communications as well!Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse such information or opinion.Investment involves risks. The price of an investment fund unit may go up as well as down and the investment funds may become valueless. Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.