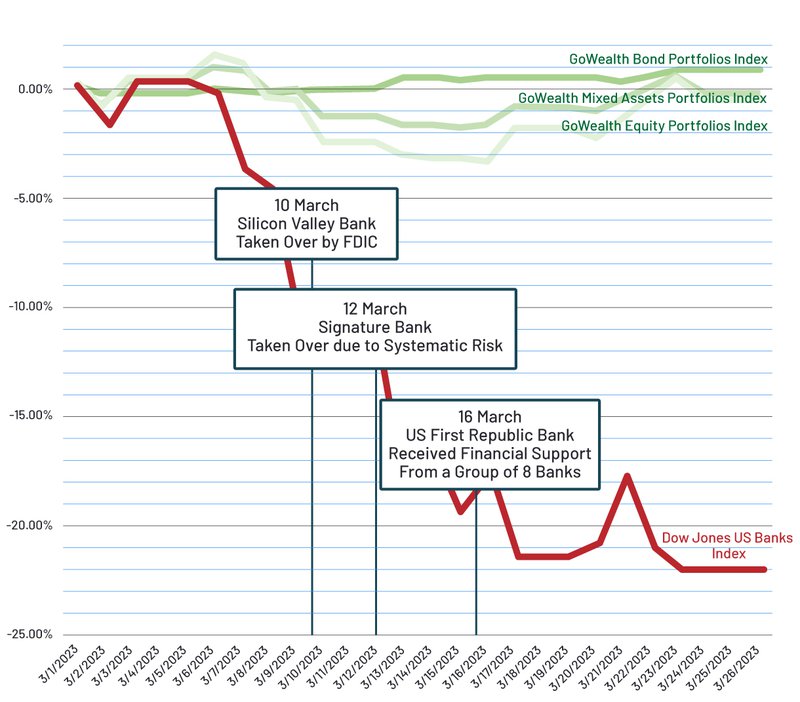

* Past performance is not indicative of future results. The above information is for illustrative purposes only.Average performance of GoWealth Bond Portfolios, GoWealth Mixed Asset Portfolios and GoWealth Equity Portfolios are calculated based on the average return of the respective asset class portfolios in GoWealth, and the return of a portfolio is calculated based on the NAV-to-NAV of the relevant constituent funds in US dollar by composition ratio from 1 March to 26 March 2023Dow Jones US Bank Index return is calculated based on the NAV-to-NAV in US dollar from 1 March to 26 March 2023Dynamic underlying holding in constituent funds increases resilienceGoWealth’s portfolios consist of funds managed by asset management firms with larger scale. Most of the funds do not have any exposure to Silicon Valley Bank, Signature Bank, and Republic Bank. Even for funds with such exposure, it is only less than 0.5% of the funds’ AUM.In order to achieve long term return, the most importance element is to diversify risk and increase the resilience of your portfolio during stressed market. This will help you to capture potential return in a volatile market1. On the flipside, short term trading may result in “Buy High, Sell Low”, resulting in higher loss.We understand market fluctuation may worry you, but we still want to remind you GoWealth’s portfolios are composed of funds, which are investment tool for longer investment term. When judging the performance of the GoWealth’s portfolio, you are advised not to only focus on short-term market fluctuations. Please keep claim when making any investment decision.Know more about GoWealth Digital Wealth AdvisoryRecap on what happened in the US and European BanksWith the aggressive rate hike from the US Fed, the bond price has taken a big hit since last year. Additionally, the borrowing cost has risen, resulting in a lower liquidity in the financial market. Several companies start to withdraw deposits from banks. Hence a few of the banks such as Silicon Valley Bank, Signature Bank, Republic Bank has suffered from the loss in their bond investment, at the same time facing issues with deposit shortage. Market began to panic further once the news came out, causing banking related stock to fall in March.1 Diversification does not guarantee a profit or eliminate the risks involved in the investments. Past performance is not indicative of future results. We make no representation or warranty regarding future performance..Importance Notice

* Past performance is not indicative of future results. The above information is for illustrative purposes only.Average performance of GoWealth Bond Portfolios, GoWealth Mixed Asset Portfolios and GoWealth Equity Portfolios are calculated based on the average return of the respective asset class portfolios in GoWealth, and the return of a portfolio is calculated based on the NAV-to-NAV of the relevant constituent funds in US dollar by composition ratio from 1 March to 26 March 2023Dow Jones US Bank Index return is calculated based on the NAV-to-NAV in US dollar from 1 March to 26 March 2023Dynamic underlying holding in constituent funds increases resilienceGoWealth’s portfolios consist of funds managed by asset management firms with larger scale. Most of the funds do not have any exposure to Silicon Valley Bank, Signature Bank, and Republic Bank. Even for funds with such exposure, it is only less than 0.5% of the funds’ AUM.In order to achieve long term return, the most importance element is to diversify risk and increase the resilience of your portfolio during stressed market. This will help you to capture potential return in a volatile market1. On the flipside, short term trading may result in “Buy High, Sell Low”, resulting in higher loss.We understand market fluctuation may worry you, but we still want to remind you GoWealth’s portfolios are composed of funds, which are investment tool for longer investment term. When judging the performance of the GoWealth’s portfolio, you are advised not to only focus on short-term market fluctuations. Please keep claim when making any investment decision.Know more about GoWealth Digital Wealth AdvisoryRecap on what happened in the US and European BanksWith the aggressive rate hike from the US Fed, the bond price has taken a big hit since last year. Additionally, the borrowing cost has risen, resulting in a lower liquidity in the financial market. Several companies start to withdraw deposits from banks. Hence a few of the banks such as Silicon Valley Bank, Signature Bank, Republic Bank has suffered from the loss in their bond investment, at the same time facing issues with deposit shortage. Market began to panic further once the news came out, causing banking related stock to fall in March.1 Diversification does not guarantee a profit or eliminate the risks involved in the investments. Past performance is not indicative of future results. We make no representation or warranty regarding future performance..Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons.The information or opinion presented has been taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse the information or opinion provided by any information provider or fund house.Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.