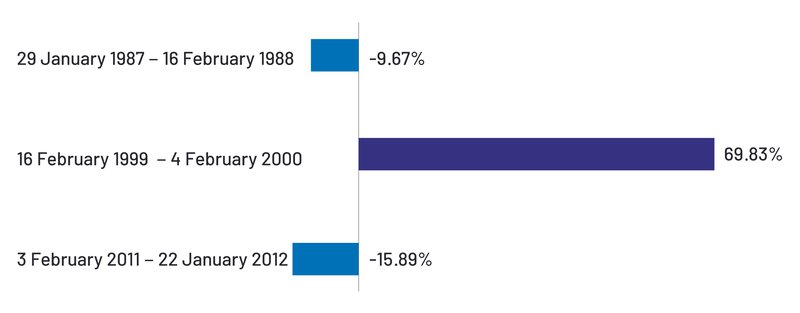

* Hong Kong Stock Market Performance with the designated period is the Hang Seng Index change within the period. Source:, “Wall Street Journal”Past returns are not indicative of future performance. The above information is for illustrative purposes only.Investment Forecast in the Year of the Rabbit 2023The investment market sentiment in the Year of Tiger was dismal. However, stock market trends always have ups and downs with crest coming after trough, as depicted in the graph above. Understanding the principles behind will allow investors to objectively deploy capital. Looking to the coming Year of the Rabbit, as global commodity prices and inflation start to ease, alongside the easing of covid restrictions in China, Hong Kong and global stock markets could emerge from the trough, and get ready for a “Bunny Jump” rebound!

* Hong Kong Stock Market Performance with the designated period is the Hang Seng Index change within the period. Source:, “Wall Street Journal”Past returns are not indicative of future performance. The above information is for illustrative purposes only.Investment Forecast in the Year of the Rabbit 2023The investment market sentiment in the Year of Tiger was dismal. However, stock market trends always have ups and downs with crest coming after trough, as depicted in the graph above. Understanding the principles behind will allow investors to objectively deploy capital. Looking to the coming Year of the Rabbit, as global commodity prices and inflation start to ease, alongside the easing of covid restrictions in China, Hong Kong and global stock markets could emerge from the trough, and get ready for a “Bunny Jump” rebound!What is the view from AllianzGI, our fund partner?Prepare for the potential equity market turnaround: in the short term, we are approaching the point when bad news for the economy could become good news for equity markets as weakening economic activity will start to lean on inflation. This could bring a slower pace of rate increases – and eventually a peak in rates in 2023 – accompanied by recession.Amid volatility in 2023, investors could consider anchoring portfolios with low-volatility multi-factor strategies that offer a possible bedrock of stability on which to build. Second, explore quality value and growth opportunities as well as income. Finally, consider high-conviction thematics around key pillars such as national security (eg, food, energy, water, cyber security), climate resilience and innovation (eg, AI) and sustainability.Source: Allianz Global Investors

How can GoWealth help?While some may believe in the Feng Shui cycles, to a certain extent it is similar to the stock market where cycles can be found. As a long term investor, the key is to create an all-weather multi-asset portfolios. Backed by AllianzGI’s investment expertise, GoWealth’s portfolios cover a wide range of global asset, aiming at diversifying the customers’ investment more efficiently, reducing the impact to investment portfolio due to market volatility.Note: This document is for information only and does not constitute any investment advice. Past returns are not indicative of future performance. The above information is for illustrative purposes only. Diversification does not guarantee a profit or eliminate the risks involved in the investments. Investment involves risks, please refer to the Important Notice herein for details. GoWealth Digital Advisory Services and fund investment are not deposit and not protected by Deposit Protection Scheme.1CNBC: As at 11 January 2023Important NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse the information or opinion provided by any information provider or fund house.Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.Allianz GI is a leading active asset manager. For details, please visit: https://hk.allianzgi.com/ .This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.