AllianzGI Academy: Fund Investment Basics

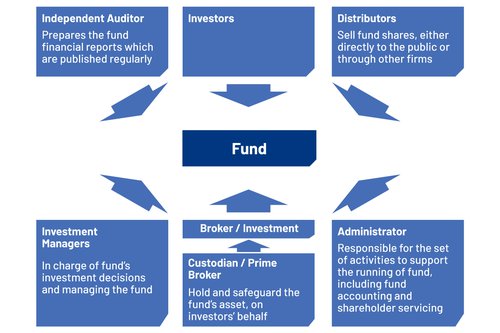

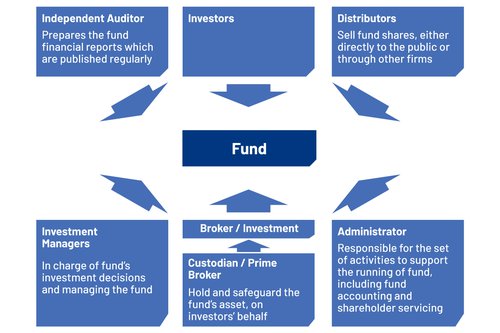

Mutual FundsMutual funds, or unit trusts, are a pool of money from a number of investors. You are essentially able to buy a small stake in the mutual fund's underlying assets. By investing as a group with other investors, you may access a larger and more diversified pool of assets than you would as an individual.Because the various expenses of investing (such as brokerage commissions, custodian's fees etc.) are spread over a larger pool of assets and effectively shared with all the other investors, mutual funds may provide you with a cost effective investment solution.Another key benefit of mutual funds is that it is professionally managed. You have access to the same expertise as a large institutional investor. Your minimum investable money need only be a few thousand dollars, or even less.Equity FundsThese focus mainly or exclusively on stock market investments, looking to achieve capital appreciation over the long term. Most equity funds seek to achieve defined capital growth objective in particular ways. Some focus on one particular stock market – such as Hong Kong. Others will invest in stock markets throughout a particular region of the world – such as the Asia Pacific – or worldwide.Sometimes equity funds will be defined by the sort of companies that they invest in, rather than the part of the world that they are focusing on. Growth stocks, for instance, are investments in companies whose businesses and earnings are likely to expand at a relatively rapid rate. Value stocks, by contrast, are investments in companies that may pay attractive potential dividends and in turn appear to be cheap in terms of the valuations.Bond FundsBond funds tend to focus mainly on fixed income investments, looking for long term capital appreciation and income. Many bond funds can and do provide some capital growth, and they are normally less risky than equity funds.Bond funds are usually defined by the part of the world in which they invest, or the type of bonds in which they invest in. For instance, they may focus on government bonds. Alternatively, they may invest in corporate bonds, which are issued by large companies.Most bonds are assessed for riskiness by major ratings agencies such as Standard & Poor’s or Moody's. Some bonds are seen by the agencies as being sufficiently risky that they are "below investment grade". Such bonds usually include high yield bonds and emerging markets debt.Multi-asset FundsMulti-asset funds combine a stock component, a bond component and, sometimes, a money market component, in a single portfolio. They look for a mixture of potential income and modest capital appreciation.Cash or Liquidity FundsCash or liquidity funds are the least volatile of mutual funds. They invest in bank deposits and, sometimes, short-term bonds of very high quality. They usually carry no risk of capital losses, but offer no prospect of capital gain. Returns to investors come entirely from interest income.Cash or liquidity funds are often attractive to investors who are very risk averse. Whilst they can also be useful as a place to park spare cash for a short period, it is not same as placing monies on deposit with a bank or deposit-taking company.DiversificationInvesting in funds provide you with the ability to build an enormous variety of portfolios. It is possible to spread your investments across stocks, bonds or cash or liquidity – or across a number of countries/locations, industries and sectors.This diversification may reduce risk level, reduce volatility and increase the likelihood that your investments may produce a steady potential return over time.By using mutual funds, you can build an investment portfolio that matches your investment objectives, risk tolerance and personal financial situation.Fund Structure * It may vary from fund to fund.

* It may vary from fund to fund.

Source: Allianz Global InvestorsImportant NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons.The information or opinion presented has been developed internally and/or taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse the information or opinion provided by any information provider or fund house.Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.Allianz GI is a leading active asset manager. For details, please visit: https://hk.allianzgi.com/ .This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.  * It may vary from fund to fund.

* It may vary from fund to fund.