GoWealth portfolios' recorded great performance in 2022 Q4; Moderate Multi-Asset portfolio outperformed the US stock(2)! | 3-min read

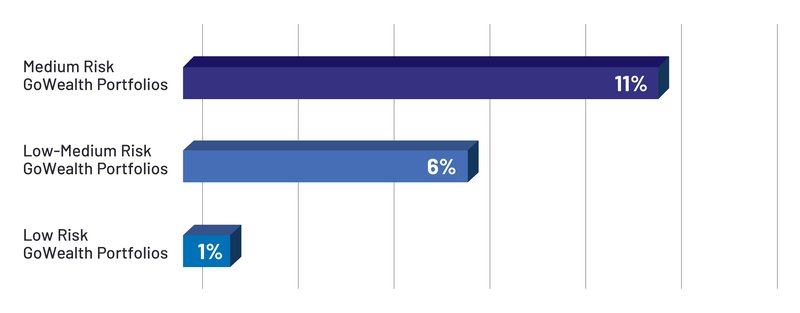

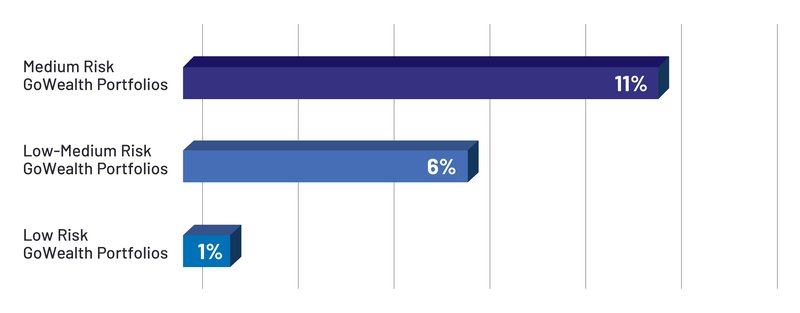

2022 has been a special year for investors: First, the Hang Seng Index fell over 10,000 points from the highest point (a drop of 40%!). Then in November, the Hang Seng Index achieved the highest single-month increase since October 1998. The key to success in a volatile market is to closely monitor the market. If you can’t do it yourself or have an investment advisor to help you, GoWealth is a very good choice for you.In only 6 months since launched, there have already been close to 100,000 userswho have tried3. GoWealth’s services. Want to know why the overwhelming trust and support for GoWealth? Let’s take a look at the performance of GoWealth's portfolios in the last quarter!100% Positive returns for the portfolios in 2022 Q41 Note: The figures above are the average returns of GoWealth's model portfolios rated as low risk, low to medium risk and medium risk respectively, which are calculated based on the NAV-to-NAV of the constituent funds in the relevant model portfolios in US dollar from 1 October to 31 December 2022. Past performance is not indicative of future results. The above information is for illustrative purposes only.Despite facing a volatile market, through AllianzGI’s expertise in risk management and asset allocation, GoWealth Multi-asset portfolio is able to capture supreme return.

Note: The figures above are the average returns of GoWealth's model portfolios rated as low risk, low to medium risk and medium risk respectively, which are calculated based on the NAV-to-NAV of the constituent funds in the relevant model portfolios in US dollar from 1 October to 31 December 2022. Past performance is not indicative of future results. The above information is for illustrative purposes only.Despite facing a volatile market, through AllianzGI’s expertise in risk management and asset allocation, GoWealth Multi-asset portfolio is able to capture supreme return. Note:

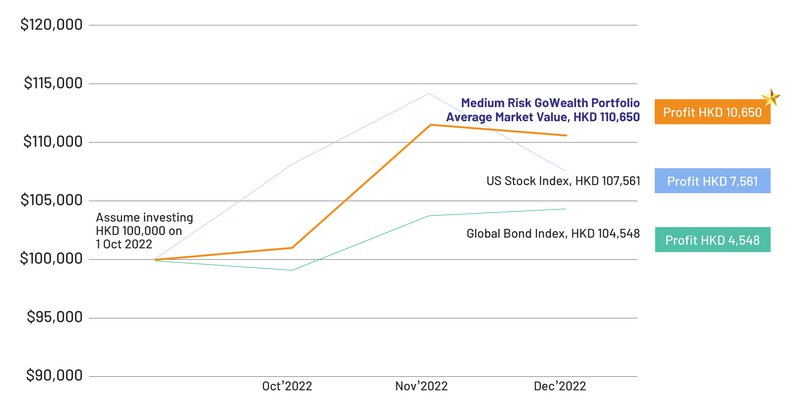

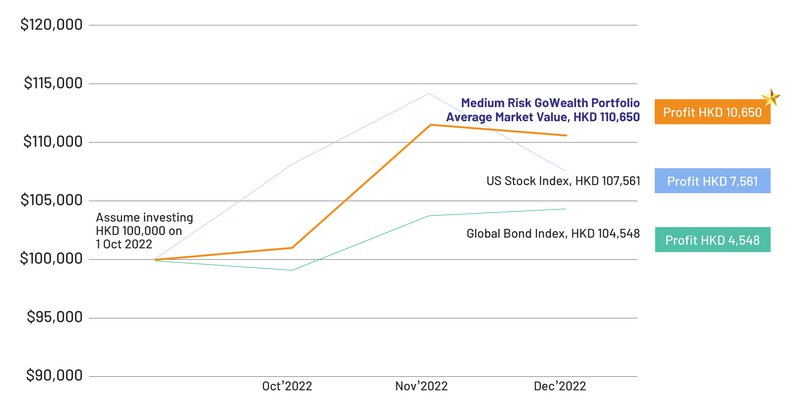

Note:- The investment return assumption show in “Medium Risk GoWealth Portfolio Average Return” is linked to the average NAVs of all the GoWealth’s model portfolios rated as Medium risk, which is calculated based on the HKD equivalent of the NAVs of the constituent funds in the relevant model portfolios. “Medium Risk GoWealth Portfolio Average Return” is only for the purpose of illustrating the average investment return of all the GoWealth’s model portfolios rated as Medium risk. You cannot directly invest in “Medium Risk GoWealth Portfolio”. The average return assumption does not include (i) any subscription fee incurred in the subscription of the portfolio and (ii) any foreign currency exchange costs and charges involved in the subscription and redemption of the portfolio.

- The investment return assumption shown in the "US Stock Index" is linked to the performance of the U.S. S&P 500 Total Return Index (USD). The investment return shown in the "Global Bond Index”is linked to the performance of the Bloomberg Global Aggregate Index (Total Return) (USD)). You cannot invest directly in the above indices. The investment returm assumption excludes all fees and taxes, and any foreign currency conversion costs and charges.

- Past returns are not indicative of future performance. The above assumptions are for illustrative purposes only.

Why GoWealth?GoWealth's intelligent investment engine integrates the power of financial technology and Allianz Global Investment’s management expertise, so that customers can invest in global investment portfolios at the fingertips. Investment has never been this intelligent and easy! Want to experience the powerful investment engine? Head to GoWealth page in the app now, and activate your investment account in just a few steps!Note: This is for information only and does not constitute any investment advice. Investment involves risks, please refer to the Important Notice herein for details. GoWealth Digital Advisory Services and fund investment are not deposit and not protected by Deposit Protection Scheme.1Based on the NAV-to-NAV of the constituent funds in the relevant GoWealth portfolios in US dollar from 1 October to 30 November 2022 and is for illustration purposes only. Past performance is not indicative of future results.2“Moderate Multi-Asset portfolio” is one of the GoWealth model portolios. “Outperformed the US Stocks” means the investment return of “Moderate Multi-Asset portfolio” from 1 October to 30 November 2022 calculated based on the NAV-to-NAV of its constituent funds in US dollars (11%) is higher than the increase of the U.S. S&P 500 Total Return Index (USD) in the same period (8%). Information is for illustration purposes only. Past performance is not indicative of future results.3This is number of access to GoWealth page from WeLab Bank app counted since 30 June 2022 to 31 Dec 2022.Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons.The information or opinion presented has been taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse the information or opinion provided by any information provider or fund house.Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.  Note: The figures above are the average returns of GoWealth's model portfolios rated as low risk, low to medium risk and medium risk respectively, which are calculated based on the NAV-to-NAV of the constituent funds in the relevant model portfolios in US dollar from 1 October to 31 December 2022. Past performance is not indicative of future results. The above information is for illustrative purposes only.Despite facing a volatile market, through AllianzGI’s expertise in risk management and asset allocation, GoWealth Multi-asset portfolio is able to capture supreme return.

Note: The figures above are the average returns of GoWealth's model portfolios rated as low risk, low to medium risk and medium risk respectively, which are calculated based on the NAV-to-NAV of the constituent funds in the relevant model portfolios in US dollar from 1 October to 31 December 2022. Past performance is not indicative of future results. The above information is for illustrative purposes only.Despite facing a volatile market, through AllianzGI’s expertise in risk management and asset allocation, GoWealth Multi-asset portfolio is able to capture supreme return. Note:

Note: