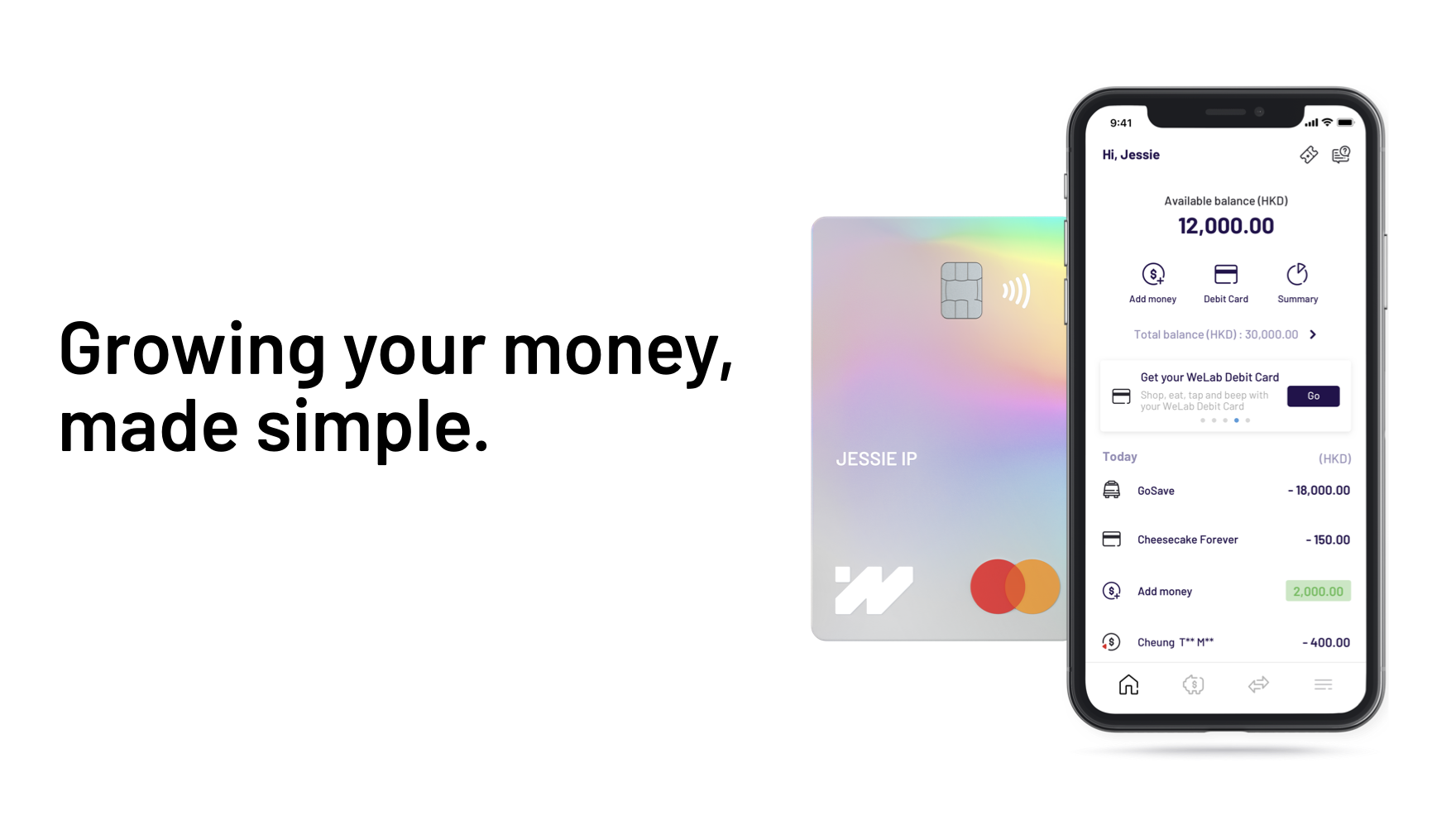

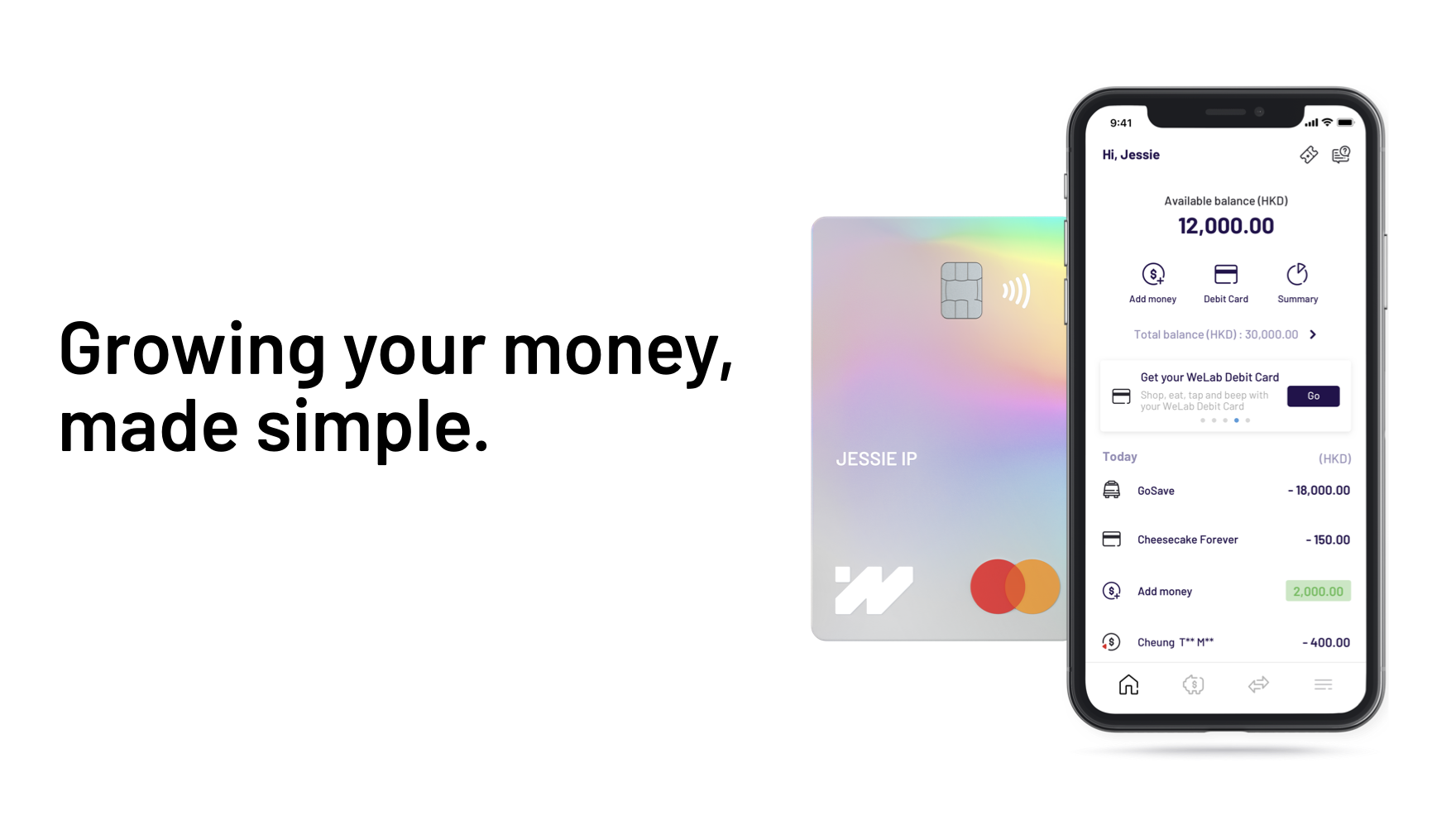

WeLab Bank Limited (“WeLab Bank” or the “Bank”) has commenced a pilot trial (“WeLab Bank Pilot”) under the Hong Kong Monetary Authority’s (“HKMA”) Fintech Supervisory Sandbox (“FSS”). During the FSS phase, WeLab Bank will be offering banking services to selected individual users prior to an official launch to the public.WeLab Bank will invite approximately 2,000 individual users from our waiting list, WeLab staff and their friends and families.During the WeLab Bank Pilot, customers will be able to access a range of fully digital services including — remote account opening, time deposits and saving accounts, virtual Debit Card, and payments with Faster Payment Services (FPS) enabled. With their HKID card ready at hand, customers can open a WeLab Bank account in less than 5 minutes. With personal data protection close at heart, WeLab Bank will also be issuing a numberless WeLab Debit Card in collaboration with Mastercard.A digital-only banking solution built around the customersAdrian Tse, Chief Executive of WeLab Bank said, “Customers will be getting a unique first peek at our banking solutions during the WeLab Bank Pilot and enjoy 24/7 seamless services with a one-stop mobile app. WeLab Bank is putting customers in control of their own financial journey and helping them manage, save and grow their money. Our message is loud and clear - we’ve got your back!”A new beginning: with GoSave, save and grow money together.

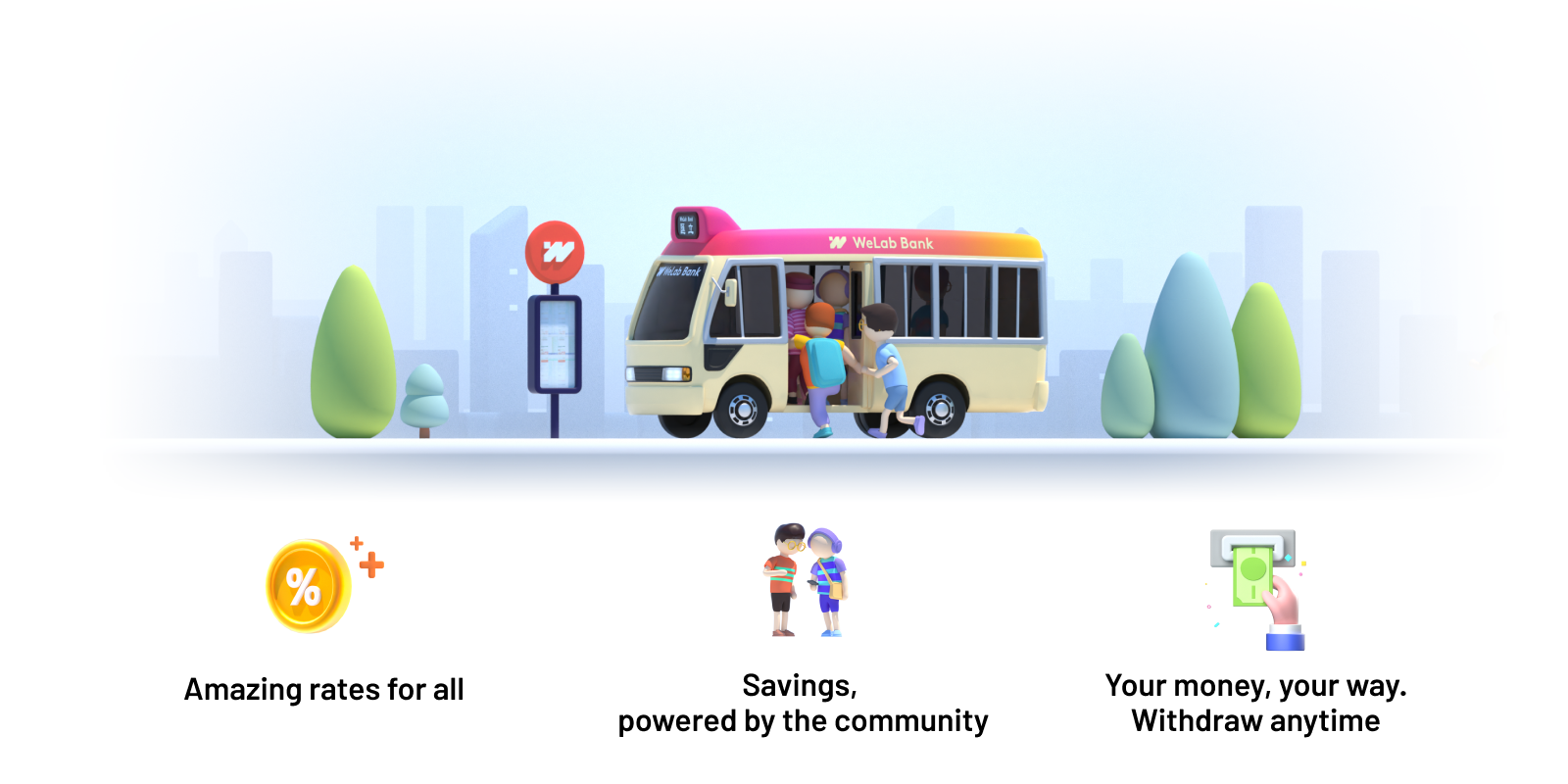

WeLab Bank Limited (“WeLab Bank” or the “Bank”) has commenced a pilot trial (“WeLab Bank Pilot”) under the Hong Kong Monetary Authority’s (“HKMA”) Fintech Supervisory Sandbox (“FSS”). During the FSS phase, WeLab Bank will be offering banking services to selected individual users prior to an official launch to the public.WeLab Bank will invite approximately 2,000 individual users from our waiting list, WeLab staff and their friends and families.During the WeLab Bank Pilot, customers will be able to access a range of fully digital services including — remote account opening, time deposits and saving accounts, virtual Debit Card, and payments with Faster Payment Services (FPS) enabled. With their HKID card ready at hand, customers can open a WeLab Bank account in less than 5 minutes. With personal data protection close at heart, WeLab Bank will also be issuing a numberless WeLab Debit Card in collaboration with Mastercard.A digital-only banking solution built around the customersAdrian Tse, Chief Executive of WeLab Bank said, “Customers will be getting a unique first peek at our banking solutions during the WeLab Bank Pilot and enjoy 24/7 seamless services with a one-stop mobile app. WeLab Bank is putting customers in control of their own financial journey and helping them manage, save and grow their money. Our message is loud and clear - we’ve got your back!”A new beginning: with GoSave, save and grow money together. GoSave offers amazing rates and unique flexibility to customers!GoSave is a time deposit where customers are in control of their own financial journey and save money in a brand new way. Customers are empowered to drive up the interest rate by saving together with family, friends or others WeLab Bank customers who want to GoSave together. More people joining GoSave means a higher interest rate, up to 4.5% p.a.[1] for everyone. It also offers unique flexibility where customers can withdraw their funds at any time[2] without having to pay extra fees.Offering our customers’ control and exceptional security – numberless Debit Card

GoSave offers amazing rates and unique flexibility to customers!GoSave is a time deposit where customers are in control of their own financial journey and save money in a brand new way. Customers are empowered to drive up the interest rate by saving together with family, friends or others WeLab Bank customers who want to GoSave together. More people joining GoSave means a higher interest rate, up to 4.5% p.a.[1] for everyone. It also offers unique flexibility where customers can withdraw their funds at any time[2] without having to pay extra fees.Offering our customers’ control and exceptional security – numberless Debit Card WeLab’s numberless Debit Card brings customers’ experience and security to new heights.WeLab’s numberless Debit Card has been engineered with obsession for customers’ experience and security. Customers’ can now take back control and only spend what they want with the Debit Card, no more credit surprises! Functionally, the Debit Card can be used for making purchases in physical stores or online and to withdraw cash from any JETCO ATMs in Hong Kong and CIRRUS ATMs that accept Mastercard. Most importantly, cardholder’s account number and CVV code are securely stored in WeLab Bank’s mobile app and won’t be printed on the physical card. Calling the hotline to report your lost card will no longer be necessary, customers can simply tap “lost card” in the mobile app to suspend the card immediately.WeLab Bank aspires to improve lives through game-changing technology and innovation. Instilling the core philosophy of the “3I” – Instant, Interactive and Intelligent, WeLab Bank is using artificial intelligence, big data and machine learning and other leading technologies to design and build products and services to bring a new digital experience for the Hong Kong public.^ Images shown above are for illustrative purpose only and are subject to change without further notice. Not all products and services are available at the moment.[1] The above interest rates are effective on 28 April, 2020. The maximum principal that is eligible for this preferential rate is HKD100,000 for a customers’ first GoSave 3-month time deposit. The rates are subject to changes as per prevailing market conditions.[2] Subject to a maximum withdrawal of 2 times during the tenor. For details, please refer to the relevant terms and conditions.About WeLab BankWeLab Bank Limited (“WeLab Bank” or the “Bank”), is a homegrown virtual bank licensed by the Hong Kong Monetary Authority (“HKMA”). Founded by a team of financial and technology experts, WeLab Bank’s mission is to understand customers’ needs and design a personalized, full-service banking experience that helps them manage and grow their money.WeLab Bank represents a 100% digital banking experience that is simple, intuitive and built around our customers. WeLab Bank is consisted of a powerful mobile app and a numberless Debit Card, both designed with obsession with customers’ experience and data security.WeLab Bank is a wholly owned subsidiary of WeLab Holdings Limited (“WeLab”), a leading fintech company in Asia.For more information, please visit: www.welab.bank or follow us on Instagram: welab.bankAbout WeLabFounded in 2013, WeLab uses game-changing technology to help customers access credit, save money, and enjoy their financial journey. Currently, WeLab serves over 42 million users and 300 enterprise customers across Hong Kong, Mainland China and Indonesia.Powered by proprietary risk management technology, patented privacy computing techniques and advanced AI capabilities, WeLab offers mobile-based consumer financing solutions and digital banking services to retail individuals and technology solutions to enterprise customers.WeLab operates in three markets under six key brands, including WeLend and WeLab Bank in Hong Kong, WeLab Digital (我来数科), Taoxinji (淘新机) and Tianmian Lab (天冕大数据实验室) in Mainland China and Maucash in Indonesia.WeLab’s investors include Malaysian sovereign wealth fund Khazanah Nasional Berhad, CK Hutchison’s TOM Group, International Finance Corporation (a member of the World Bank Group), Alibaba Entrepreneurs Fund, Sequoia Capital and ING Bank.For more information, please visit: www.welab.co

WeLab’s numberless Debit Card brings customers’ experience and security to new heights.WeLab’s numberless Debit Card has been engineered with obsession for customers’ experience and security. Customers’ can now take back control and only spend what they want with the Debit Card, no more credit surprises! Functionally, the Debit Card can be used for making purchases in physical stores or online and to withdraw cash from any JETCO ATMs in Hong Kong and CIRRUS ATMs that accept Mastercard. Most importantly, cardholder’s account number and CVV code are securely stored in WeLab Bank’s mobile app and won’t be printed on the physical card. Calling the hotline to report your lost card will no longer be necessary, customers can simply tap “lost card” in the mobile app to suspend the card immediately.WeLab Bank aspires to improve lives through game-changing technology and innovation. Instilling the core philosophy of the “3I” – Instant, Interactive and Intelligent, WeLab Bank is using artificial intelligence, big data and machine learning and other leading technologies to design and build products and services to bring a new digital experience for the Hong Kong public.^ Images shown above are for illustrative purpose only and are subject to change without further notice. Not all products and services are available at the moment.[1] The above interest rates are effective on 28 April, 2020. The maximum principal that is eligible for this preferential rate is HKD100,000 for a customers’ first GoSave 3-month time deposit. The rates are subject to changes as per prevailing market conditions.[2] Subject to a maximum withdrawal of 2 times during the tenor. For details, please refer to the relevant terms and conditions.About WeLab BankWeLab Bank Limited (“WeLab Bank” or the “Bank”), is a homegrown virtual bank licensed by the Hong Kong Monetary Authority (“HKMA”). Founded by a team of financial and technology experts, WeLab Bank’s mission is to understand customers’ needs and design a personalized, full-service banking experience that helps them manage and grow their money.WeLab Bank represents a 100% digital banking experience that is simple, intuitive and built around our customers. WeLab Bank is consisted of a powerful mobile app and a numberless Debit Card, both designed with obsession with customers’ experience and data security.WeLab Bank is a wholly owned subsidiary of WeLab Holdings Limited (“WeLab”), a leading fintech company in Asia.For more information, please visit: www.welab.bank or follow us on Instagram: welab.bankAbout WeLabFounded in 2013, WeLab uses game-changing technology to help customers access credit, save money, and enjoy their financial journey. Currently, WeLab serves over 42 million users and 300 enterprise customers across Hong Kong, Mainland China and Indonesia.Powered by proprietary risk management technology, patented privacy computing techniques and advanced AI capabilities, WeLab offers mobile-based consumer financing solutions and digital banking services to retail individuals and technology solutions to enterprise customers.WeLab operates in three markets under six key brands, including WeLend and WeLab Bank in Hong Kong, WeLab Digital (我来数科), Taoxinji (淘新机) and Tianmian Lab (天冕大数据实验室) in Mainland China and Maucash in Indonesia.WeLab’s investors include Malaysian sovereign wealth fund Khazanah Nasional Berhad, CK Hutchison’s TOM Group, International Finance Corporation (a member of the World Bank Group), Alibaba Entrepreneurs Fund, Sequoia Capital and ING Bank.For more information, please visit: www.welab.co WeLab Bank Limited (“WeLab Bank” or the “Bank”) has commenced a pilot trial (“WeLab Bank Pilot”) under the Hong Kong Monetary Authority’s (“HKMA”) Fintech Supervisory Sandbox (“FSS”). During the FSS phase, WeLab Bank will be offering banking services to selected individual users prior to an official launch to the public.WeLab Bank will invite approximately 2,000 individual users from our waiting list, WeLab staff and their friends and families.During the WeLab Bank Pilot, customers will be able to access a range of fully digital services including — remote account opening, time deposits and saving accounts, virtual Debit Card, and payments with Faster Payment Services (FPS) enabled. With their HKID card ready at hand, customers can open a WeLab Bank account in less than 5 minutes. With personal data protection close at heart, WeLab Bank will also be issuing a numberless WeLab Debit Card in collaboration with Mastercard.A digital-only banking solution built around the customersAdrian Tse, Chief Executive of WeLab Bank said, “Customers will be getting a unique first peek at our banking solutions during the WeLab Bank Pilot and enjoy 24/7 seamless services with a one-stop mobile app. WeLab Bank is putting customers in control of their own financial journey and helping them manage, save and grow their money. Our message is loud and clear - we’ve got your back!”A new beginning: with GoSave, save and grow money together.

WeLab Bank Limited (“WeLab Bank” or the “Bank”) has commenced a pilot trial (“WeLab Bank Pilot”) under the Hong Kong Monetary Authority’s (“HKMA”) Fintech Supervisory Sandbox (“FSS”). During the FSS phase, WeLab Bank will be offering banking services to selected individual users prior to an official launch to the public.WeLab Bank will invite approximately 2,000 individual users from our waiting list, WeLab staff and their friends and families.During the WeLab Bank Pilot, customers will be able to access a range of fully digital services including — remote account opening, time deposits and saving accounts, virtual Debit Card, and payments with Faster Payment Services (FPS) enabled. With their HKID card ready at hand, customers can open a WeLab Bank account in less than 5 minutes. With personal data protection close at heart, WeLab Bank will also be issuing a numberless WeLab Debit Card in collaboration with Mastercard.A digital-only banking solution built around the customersAdrian Tse, Chief Executive of WeLab Bank said, “Customers will be getting a unique first peek at our banking solutions during the WeLab Bank Pilot and enjoy 24/7 seamless services with a one-stop mobile app. WeLab Bank is putting customers in control of their own financial journey and helping them manage, save and grow their money. Our message is loud and clear - we’ve got your back!”A new beginning: with GoSave, save and grow money together. GoSave offers amazing rates and unique flexibility to customers!GoSave is a time deposit where customers are in control of their own financial journey and save money in a brand new way. Customers are empowered to drive up the interest rate by saving together with family, friends or others WeLab Bank customers who want to GoSave together. More people joining GoSave means a higher interest rate, up to 4.5% p.a.[1] for everyone. It also offers unique flexibility where customers can withdraw their funds at any time[2] without having to pay extra fees.Offering our customers’ control and exceptional security – numberless Debit Card

GoSave offers amazing rates and unique flexibility to customers!GoSave is a time deposit where customers are in control of their own financial journey and save money in a brand new way. Customers are empowered to drive up the interest rate by saving together with family, friends or others WeLab Bank customers who want to GoSave together. More people joining GoSave means a higher interest rate, up to 4.5% p.a.[1] for everyone. It also offers unique flexibility where customers can withdraw their funds at any time[2] without having to pay extra fees.Offering our customers’ control and exceptional security – numberless Debit Card WeLab’s numberless Debit Card brings customers’ experience and security to new heights.WeLab’s numberless Debit Card has been engineered with obsession for customers’ experience and security. Customers’ can now take back control and only spend what they want with the Debit Card, no more credit surprises! Functionally, the Debit Card can be used for making purchases in physical stores or online and to withdraw cash from any JETCO ATMs in Hong Kong and CIRRUS ATMs that accept Mastercard. Most importantly, cardholder’s account number and CVV code are securely stored in WeLab Bank’s mobile app and won’t be printed on the physical card. Calling the hotline to report your lost card will no longer be necessary, customers can simply tap “lost card” in the mobile app to suspend the card immediately.WeLab Bank aspires to improve lives through game-changing technology and innovation. Instilling the core philosophy of the “3I” – Instant, Interactive and Intelligent, WeLab Bank is using artificial intelligence, big data and machine learning and other leading technologies to design and build products and services to bring a new digital experience for the Hong Kong public.^ Images shown above are for illustrative purpose only and are subject to change without further notice. Not all products and services are available at the moment.[1] The above interest rates are effective on 28 April, 2020. The maximum principal that is eligible for this preferential rate is HKD100,000 for a customers’ first GoSave 3-month time deposit. The rates are subject to changes as per prevailing market conditions.[2] Subject to a maximum withdrawal of 2 times during the tenor. For details, please refer to the relevant terms and conditions.About WeLab BankWeLab Bank Limited (“WeLab Bank” or the “Bank”), is a homegrown virtual bank licensed by the Hong Kong Monetary Authority (“HKMA”). Founded by a team of financial and technology experts, WeLab Bank’s mission is to understand customers’ needs and design a personalized, full-service banking experience that helps them manage and grow their money.WeLab Bank represents a 100% digital banking experience that is simple, intuitive and built around our customers. WeLab Bank is consisted of a powerful mobile app and a numberless Debit Card, both designed with obsession with customers’ experience and data security.WeLab Bank is a wholly owned subsidiary of WeLab Holdings Limited (“WeLab”), a leading fintech company in Asia.For more information, please visit: www.welab.bank or follow us on Instagram: welab.bankAbout WeLabFounded in 2013, WeLab uses game-changing technology to help customers access credit, save money, and enjoy their financial journey. Currently, WeLab serves over 42 million users and 300 enterprise customers across Hong Kong, Mainland China and Indonesia.Powered by proprietary risk management technology, patented privacy computing techniques and advanced AI capabilities, WeLab offers mobile-based consumer financing solutions and digital banking services to retail individuals and technology solutions to enterprise customers.WeLab operates in three markets under six key brands, including WeLend and WeLab Bank in Hong Kong, WeLab Digital (我来数科), Taoxinji (淘新机) and Tianmian Lab (天冕大数据实验室) in Mainland China and Maucash in Indonesia.WeLab’s investors include Malaysian sovereign wealth fund Khazanah Nasional Berhad, CK Hutchison’s TOM Group, International Finance Corporation (a member of the World Bank Group), Alibaba Entrepreneurs Fund, Sequoia Capital and ING Bank.For more information, please visit: www.welab.co

WeLab’s numberless Debit Card brings customers’ experience and security to new heights.WeLab’s numberless Debit Card has been engineered with obsession for customers’ experience and security. Customers’ can now take back control and only spend what they want with the Debit Card, no more credit surprises! Functionally, the Debit Card can be used for making purchases in physical stores or online and to withdraw cash from any JETCO ATMs in Hong Kong and CIRRUS ATMs that accept Mastercard. Most importantly, cardholder’s account number and CVV code are securely stored in WeLab Bank’s mobile app and won’t be printed on the physical card. Calling the hotline to report your lost card will no longer be necessary, customers can simply tap “lost card” in the mobile app to suspend the card immediately.WeLab Bank aspires to improve lives through game-changing technology and innovation. Instilling the core philosophy of the “3I” – Instant, Interactive and Intelligent, WeLab Bank is using artificial intelligence, big data and machine learning and other leading technologies to design and build products and services to bring a new digital experience for the Hong Kong public.^ Images shown above are for illustrative purpose only and are subject to change without further notice. Not all products and services are available at the moment.[1] The above interest rates are effective on 28 April, 2020. The maximum principal that is eligible for this preferential rate is HKD100,000 for a customers’ first GoSave 3-month time deposit. The rates are subject to changes as per prevailing market conditions.[2] Subject to a maximum withdrawal of 2 times during the tenor. For details, please refer to the relevant terms and conditions.About WeLab BankWeLab Bank Limited (“WeLab Bank” or the “Bank”), is a homegrown virtual bank licensed by the Hong Kong Monetary Authority (“HKMA”). Founded by a team of financial and technology experts, WeLab Bank’s mission is to understand customers’ needs and design a personalized, full-service banking experience that helps them manage and grow their money.WeLab Bank represents a 100% digital banking experience that is simple, intuitive and built around our customers. WeLab Bank is consisted of a powerful mobile app and a numberless Debit Card, both designed with obsession with customers’ experience and data security.WeLab Bank is a wholly owned subsidiary of WeLab Holdings Limited (“WeLab”), a leading fintech company in Asia.For more information, please visit: www.welab.bank or follow us on Instagram: welab.bankAbout WeLabFounded in 2013, WeLab uses game-changing technology to help customers access credit, save money, and enjoy their financial journey. Currently, WeLab serves over 42 million users and 300 enterprise customers across Hong Kong, Mainland China and Indonesia.Powered by proprietary risk management technology, patented privacy computing techniques and advanced AI capabilities, WeLab offers mobile-based consumer financing solutions and digital banking services to retail individuals and technology solutions to enterprise customers.WeLab operates in three markets under six key brands, including WeLend and WeLab Bank in Hong Kong, WeLab Digital (我来数科), Taoxinji (淘新机) and Tianmian Lab (天冕大数据实验室) in Mainland China and Maucash in Indonesia.WeLab’s investors include Malaysian sovereign wealth fund Khazanah Nasional Berhad, CK Hutchison’s TOM Group, International Finance Corporation (a member of the World Bank Group), Alibaba Entrepreneurs Fund, Sequoia Capital and ING Bank.For more information, please visit: www.welab.co