How Do Psychological Factors Affect Currency Exchange Decisions?

Foreign currency transactions should ideally be based on rational analysis — such as exchange rate trends and economic data. However, Hongkongers don’t always make decisions this way.From a psychological perspective, this is known as behavioural biases — irrational beliefs that subconsciously influence our judgment, leading to impulsive or poor decisions. For example, when the market fluctuates and exchange rates suddenly rise or fall, people may rush to exchange currency. But these actions are often driven by psychological biases, not data1.Common Behavioural Biases Include:

- Fear of Missing Out (FOMO): Seeing others exchange currency and fearing you’ll miss the opportunity.

- Herding Behaviour: Following the crowd — “Everyone says it’s a good time to exchange, so I’ll do it too,” without checking the actual data.

“My Friend Said It’s a Good Deal” — But Is It Really? The Ideal Time to Exchange Depends on Your Purpose!

“My friend said it’s a great time to buy euros,” or “Everyone in the group is exchanging now” — these might sound convincing, but they’re not necessarily based on market analysis. The ideal time to exchange currency should be based on your personal goals and usage.If You’re Exchanging for Personal Use — Such as Travel, Online Shopping, or Overseas Education:

✅ Exchange when the bank’s selling rate is low: That means the lower the rate when you buy foreign currency with HKD, the better.✅ Watch out for exchange spreads and service fees: Some banks add a markup or charge a fee for currency exchange — always compare carefully.✅ Plan ahead and avoid peak seasons: Travel seasons and overseas back-to-school seasons may drive up demand for foreign currency. If you need to exchange a large amount, plan early to avoid sudden rate spikes or increased costs.If You’re Looking to Profit from Exchange Rate Differences, Keep These in Mind:

✅ Monitor macroeconomic factors: Changes in U.S. interest rates, ECB policies, and economic indicators (like CPI, GDP, unemployment rates) can all impact currency values.✅ Stay updated on political developments: Elections, wars, and trade policies can cause short-term currency volatility.✅ Use technical analysis tools: Consider exchange rate charts such as:- Candlestick Charts (K-line): Show trends in exchange rate movements, including opening, closing, high, and low prices.

- Moving Averages (MA): Help identify the overall trend and strength of exchange rates over a specific period.

- Relative Strength Index (RSI): Estimates the strength of buying vs. selling pressure in the currency market — useful for spotting overbought or oversold conditions.

💡WeLab Bank Money-Saving Tips + 3 Key Features You Should Know:

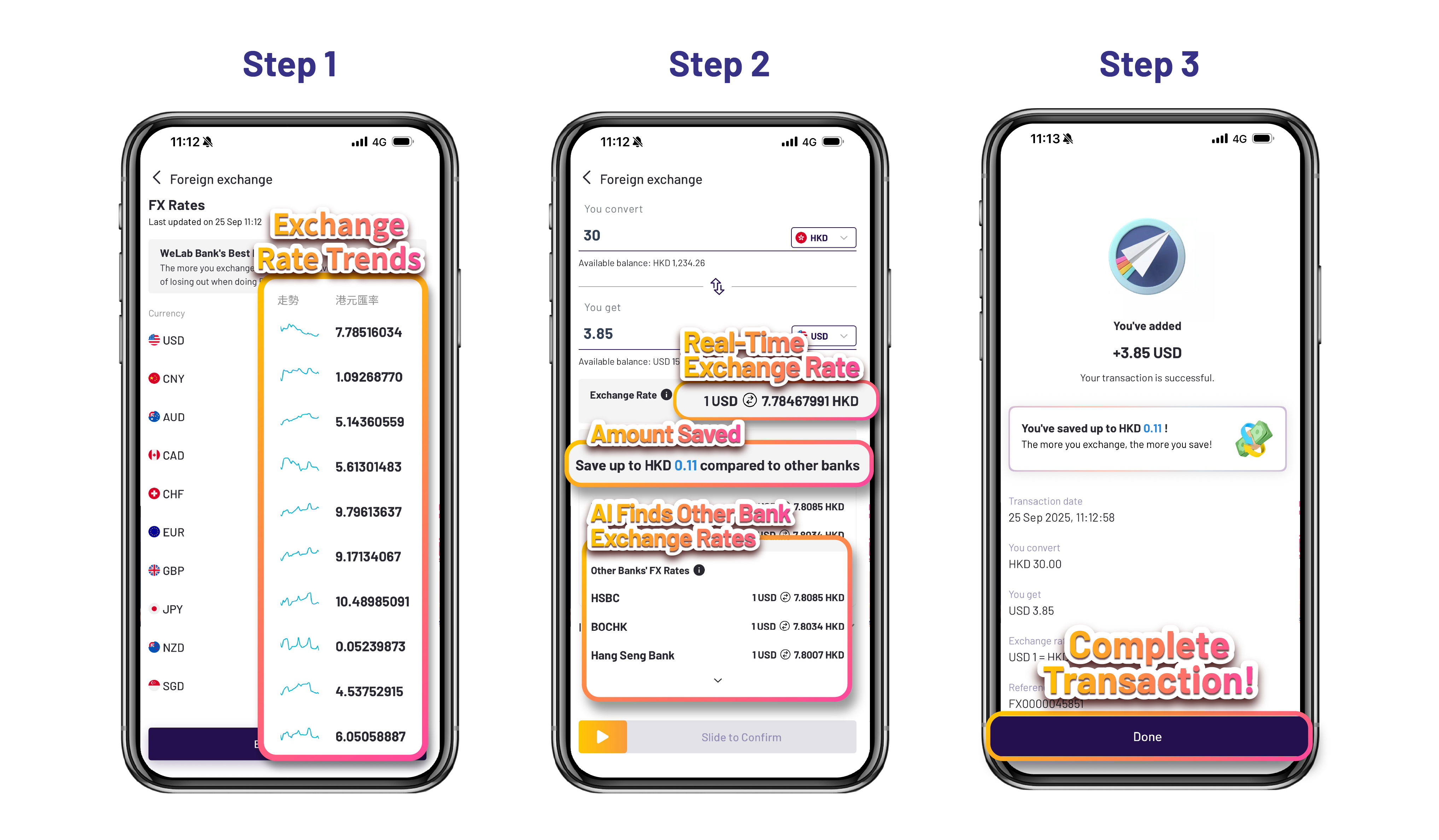

Want to exchange currency at the best rate? With the WeLab Bank App, you can check real-time exchange rates and complete transactions in just 3 steps! Plus, our AI compares rates from major local banks² — making foreign exchange easier than ever.Feature 1|Real-Time Exchange Rates in Just 2 Steps!Open WeLab Bank App, choose “Transfer & FX,” then select “Foreign Exchange” to instantly view the latest rates! The app supports 11 major currencies, including HKD, USD, CNY, AUD, CAD, CHF, EUR, GBP, JPY, NZD, and SGD — giving you the flexibility to manage your currency needs anytime, anywhere.👉 Learn more about foreign exchangeFeature 2|Exchange Rate Trend ChartsAfter selecting “Foreign Exchange,” the app displays a 30-day trend chart in available currencies. You can see whether the current rate is near a high or low and make more informed decisions based on your purpose — whether it’s for travel or investment.Feature 3|AI-Powered Rate Compare²Once you select your currency, the app shows the latest rate and uses AI to compare it with other banks² — so you can instantly see the lowest rate available! Just enter the amount you want to exchange, and the app will even calculate how much you can save.Example: If you want to exchange HKD 100,000 to CAD, and WeLab Bank’s exchange rate is 5.5466, you’ll get approximately CAD 18,029.05. The app will also compare this with other banks and show that you could save HKD 904.123 by choosing WeLab Bank over the most expensive option! The screen displays and the images of the website are for illustrative purpose only.👉 Learn more about AI Foreign Exchange LeaderboardThe ideal time to exchange currency depends on your needs! Avoid psychological traps, make data-driven decisions, and use WeLab Bank to exchange at the best possible rate!🔥 Download the WeLab Bank App now — open an account in as little as 5 minutes⁴ and start exchanging smart!

The screen displays and the images of the website are for illustrative purpose only.👉 Learn more about AI Foreign Exchange LeaderboardThe ideal time to exchange currency depends on your needs! Avoid psychological traps, make data-driven decisions, and use WeLab Bank to exchange at the best possible rate!🔥 Download the WeLab Bank App now — open an account in as little as 5 minutes⁴ and start exchanging smart!Remarks:(1) Source: Consumer Council Issued Journal, Issue No. 583 (May 2025), titled “了解4大行為偏見,減少投資盲點”(2) We collect the exchange rates from the websites or apps of the banks set out above using AI (Artificial Intelligence) and determine the best exchange rate for each currency among those banks. These exchange rates do not include any special promotions, discounts, offers, membership programs or other preferential rates (including but not limited to volume discounts), but include any fees charged by any banks when conducting the FX transactions, to facilitate the comparison. Exchange rates fluctuate according to market conditions. Exchange rates may vary upon conducting actual transactions.(3) Maximum savings amount is calculated based on the differences in exchange rates between WeLab Bank and Bank S as of 10:09 AM on October 20, 2025. For example, customers who choose WeLab Bank for converting HKD 100,000 to CAD can save approximately HKD 904.12. Actual exchange rates and interest rates may vary due to market fluctuations. Please refer to the rates and interest displayed in the WeLab Bank App on the transaction day.(4) Account opening time may vary depending on network conditions, mobile device, and required documents.Disclaimer: The content is for information only. Currency exchange involves risks. Foreign exchange markets are subject to unpredictable fluctuations. If you choose to convert your HKD or foreign currency deposit to other currencies, such foreign exchange transactions will be subject to risk arising from exchange rates fluctuation. As a result, you may suffer losses. The information above is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction.