Actually, there’s a tool that can help! It’s GoWealth Digital Wealth Advisory!Can financial goals be achieved easily with just one solution?Major life events – such as a down payment on a house, a wedding fund, or preparing education savings for a newborn – require significant funds.

Traditional savings methods, like putting money in a bank for a time deposit, are safe but usually offer relatively low returns. Saving the ideal amount could take many years.

Now you can use a smarter method: GoWealth Digital Wealth Advisory. GoWealth Digital Wealth Advisory is like a personal investment advisor, helping you choose the right investment portfolio to help you reach your financial goals!What is GoWealth Digital Wealth Advisory? How does it help me achieve my goals?GoWealth Digital Wealth Advisory is jointly developed by WeLab Bank and Allianz Global Investors. It is not help you pick individual stocks or funds, but uses financial technology and data analysis to choose the most suitable diversified investment portfolio2 for you, based on your risk tolerance, target amount, and investment time.

In short, GoWealth Digital Wealth Advisory helps you diversify your investment risk while pursuing higher returns.How does GoWealth Digital Wealth Advisory work?The operating principle are actually very simple:

- Risk Assessment: GoWealth Digital Wealth Advisory assesses your investment experience, financial situation, and your tolerance for risk.

- Goal Setting: Set your financial goals (e.g., down payment on a house, wedding fund) and when you want to achieve them.

- Portfolio Allocation: Based on your risk assessment and goals, GoWealth Digital Wealth Advisory provides portfolio recommendations2, such as stock funds, bond funds, etc.

- Adjust at any time: GoWealth Digital Wealth Advisory regularly monitors your investment portfolio and alert you if it's not on track, ensuring you can adjust your portfolio as needed2.

Step 2: Set initial principal and monthly investment amount – there’s no lock-up period, and entry fees start as low as HKD 100.

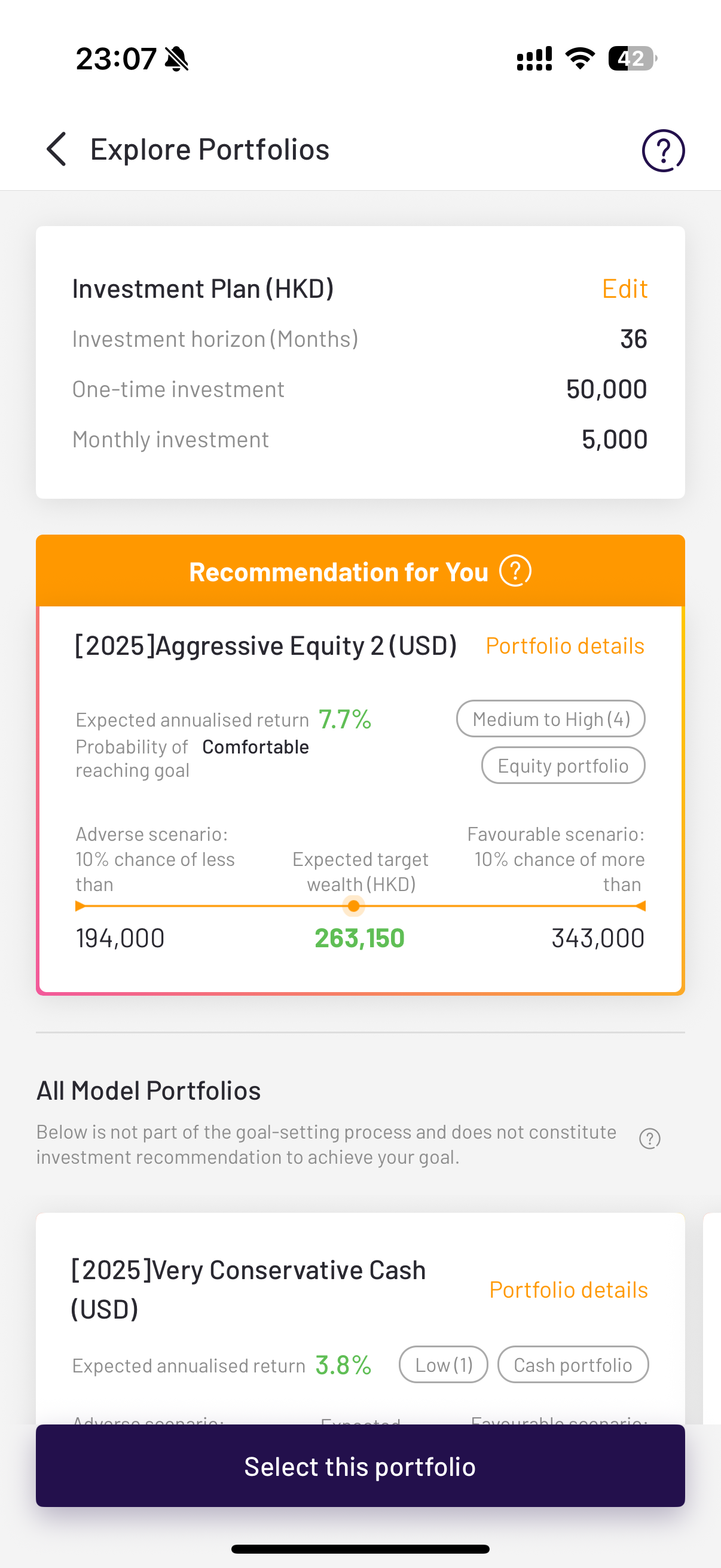

Step 3: Choose a suitable investment portfolio – We offer customized investment portfolio recommendations2, alongside a comprehensive list of other portfolios for you to choose from, designed to meet diverse goals and financial circumstances.A common client example:

Suppose I want to establish an investment habit and save money to get married, investing a one-time amount of HKD 50,000 and setting a monthly investment amount of HKD 5,000 and an investment period of 39 years.GoWealth Digital Wealth Advisory will recommend a suitable investment portfolio based on your situation and list all available portfolios for you to choose from, detailing the expected annualized rate of return, risk level, and portfolio details. You can then choose the portfolio that's right for you.

(The images displayed on the screen are for reference and illustrative purposes only.)In this example, the investment portfolio recommended by GoWealth Digital Wealth Advisory is expected to have a 7.7% annualized return, and the wealth target after 3 years is expected to reach HKD 263,150. If the market investment environment is favorable, the wealth target could reach HKD 343,0002.Why choose GoWealth Digital Wealth Advisory?

(The images displayed on the screen are for reference and illustrative purposes only.)In this example, the investment portfolio recommended by GoWealth Digital Wealth Advisory is expected to have a 7.7% annualized return, and the wealth target after 3 years is expected to reach HKD 263,150. If the market investment environment is favorable, the wealth target could reach HKD 343,0002.Why choose GoWealth Digital Wealth Advisory?- Ground-breaking projections- GoWealth Digital Wealth Advisory uses advanced algorithm to project market trends in the next 52 years1. Detailed simulations and analysis can help you adjust your goals according to any market changes.

- Stay on track with smart alerts – Too busy to keep track of your goals? Our smart alerts will help you to stay on track, so you can glide through any market conditions and manage your portfolio at fingertips2.

- Sustainable investment (ESG) – Our professional team is commits to integrating environmental, social, and governance factors into the process of product selection3 to create a better future together.

Whether you want to buy a house, get married, or retire early, GoWealth Digital Wealth Advisory is your ideal partner to achieve your financial goals! Easily manage your wealth and build a foundation for your future!Download the WeLab Bank App now and start your smart investment journey!

Download Now | WeLab BankRemarks:

1 The algorithm in the GoWealth Digital Wealth Advisory Services relies on the portfolio simulation database containing 7,488,000 simulation paths for the model portfolios projected over the next 52 years (i.e. 624 months), which reflects our capital market forecast on various asset classes and the model portfolios in terms of risk, return and correlations.

2 You may set up your investment goal via our Wealth Management Services on the WeLab Bank app, including the relevant investment horizon and one-time investment and monthly investment amounts. Our algorithm will recommend you a model portfolio based on your investment goal as well as your relevant personal circumstances. If you accept the recommendation, we will follow your instruction to process your one-time investment, and invest the monthly investment amount set by you in the model portfolio each month automatically. We will provide you various types of alerts/notifications, including but not limited to alerts/notifications about the status of your investment goal. However, such alerts/notifications are not investment advice. You may view the status of your investment goal and edit your investment goal on the WeLab Bank app according to your needs. The services are not discretionary asset management services. Any recommendation provided under the services is not a guarantee that you will achieve your investment goal. The target success rate does not reflect or predict the actual performance of the recommended investment portfolio or any single fund, nor is it a guarantee or assurance of future performance. Before investing, you need to carefully consider the investment purpose, risks, fees and expenses, and seek independent professional advice if necessary.

3 Professional team will perform product diligence on each constituent fund of the model portfolios, in which ESG factors will form part of the consideration factors.Important Disclaimer:

This webpage is for reference only and does not constitute an offer, solicitation, advice, opinion, or any guarantee to anyone to buy, subscribe or trade any investment product or service. Investment products or services are not the same as, nor should they be considered a substitute for, fixed deposits.

Investment involves risk, fund prices can go up or down, and may even become worthless. Some investments may not be immediately realizable based on market conditions. Please read our financial service terms and conditions (including risk disclosure), and related fund sales documents to understand our financial services and more information about the funds, including their risk factors.

Investment decisions are made by you independently, but you should not invest in the products or services mentioned on this webpage unless an intermediary has explained to you, after considering your financial situation, investment experience and objectives, that the relevant products or services are suitable for you.

Before making any investment decisions, you must assess your own financial situation, investment goals and experience, willingness and ability to take risks, and understand the nature and risks of the product.

If you have any questions about the products or services mentioned on this webpage, trading or the nature and risks of the funds, you should seek independent financial advice.

Any content on this webpage should not be construed as a distribution, offer for sale or solicitation to purchase any securities or investment products in any jurisdiction, where such acts would be illegal under the laws of that jurisdiction.

If you are outside of Hong Kong, please understand and comply with any relevant restrictions. Continuing to purchase means you represent and warrant that you are a Hong Kong resident, or that the applicable law or regulations in your jurisdiction permit you to access the information on this website or our application and make a purchase.

This webpage is published by WeLab Bank and has not been reviewed by the Securities and Futures Commission.

This Chinese webpage is a translation of the English version. In the event of any conflict or inconsistency between the Chinese and English versions, the English version shall prevail.