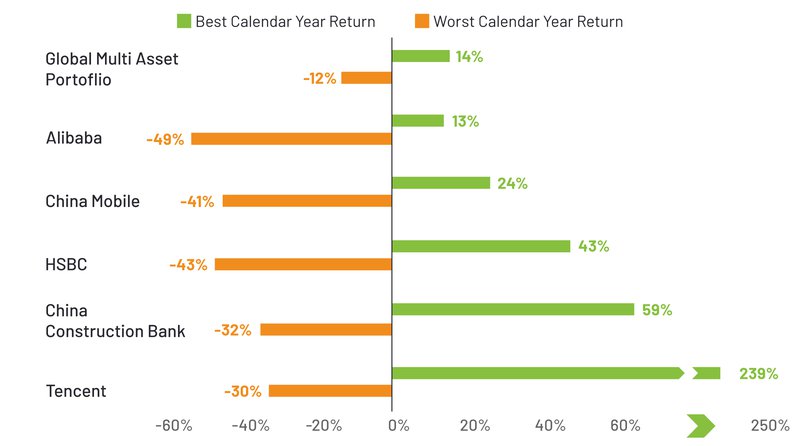

Performance information of global mixed asset portfolio is based on the NAV-to-NAV of the following relevant benchmark index in US dollar from 2008 to 2022 according to the following proportion: Composition of index are: 30% Global Equity MSCI ACWI NR USD; 60% Global Bond Bloomberg Gbl Agg Corp TR USD; 10% Asia Bond JPM GBI Asia Pacific Div 1-10Y TR USDPerformance information of 5 Hong Kong stocks with largest current market capitalisation (Alibaba, China Mobile, HSBC Holdings, CCB and Tencent Holdings) are based on the NAV-to-NAV in US dollar from 2008 to 2022.Past performance is not indicative of future results. The above information is for illustrative purposes only.Bank saving rate is starting to fall from the peak we see last year. Many investors are very clear that its impossible to just rely on time deposit to fight against inflation. Invest in global multi asset portfolio will auto invest your return. In the long run, outperform the return of TD and inflation1.How can GoWealth help?Leveraging on AllianzGI’s data base2, the portfolio recommendation prepared by GoWealth, has already considered the correlation between asset classes. The key objective is to assist you in capturing market opportunities automatically in different markets!GoWealth, One-stop Fund Investment Advisory SolutionCapitalising on the power of technology and the investment expertise of AllianzGI, GoWealth offers our customers professional wealth advice in the most seamless way. From financial planning and investment portfolio recommendations, to fund transactions and financial goal tracking, all you need is WeLab Bank app, and it will bring you to your goals on autopilot3!How to use GoWealth Digital Wealth Advisory?Additional: New Featured FundsNote: This article is for information only and does not constitute any investment advice. Investment involves risks, please refer to the Important Notice herein for details. GoWealth Digital Advisory Services and fund investment are not deposit and not protected by Deposit Protection Scheme.1Diversification does not guarantee a profit or eliminate the risks involved in the investments. Past performance is not indicative of future results. We makes no representation or warranty regarding future performance.2The algorithm in the GoWealth Digital Wealth Advisory Services relies on the portfolio simulation database containing 12,000 simulation paths for the model portfolios projected over the next 50 years (i.e. 600 months), which reflects our capital market forecast on various asset classes and the model portfolios in terms of risk, return and correlations.3You may set up your investment goal via our Wealth Management Services on the WeLab Bank app, including the relevant investment horizon and one-time investment and monthly investment amounts. Our algorithm will recommend you a model portfolio based on your investment goal as well as your relevant personal circumstances. If you accept the recommendation, we will follow your instruction to process your one-time investment, and invest the monthly investment amount set by you in the model portfolio each month automatically. We will provide you various types of alerts/notifications, including but not limited to alerts/notifications about the status of your investment goal. However, such alerts/notifications are not investment advice. You may view the status of your investment goal and edit your investment goal on the WeLab Bank app according to your needs. The services are not discretionary asset management services. Any recommendation provided under the services is not a guarantee that you will achieve your investment goal.Importance Notice

Performance information of global mixed asset portfolio is based on the NAV-to-NAV of the following relevant benchmark index in US dollar from 2008 to 2022 according to the following proportion: Composition of index are: 30% Global Equity MSCI ACWI NR USD; 60% Global Bond Bloomberg Gbl Agg Corp TR USD; 10% Asia Bond JPM GBI Asia Pacific Div 1-10Y TR USDPerformance information of 5 Hong Kong stocks with largest current market capitalisation (Alibaba, China Mobile, HSBC Holdings, CCB and Tencent Holdings) are based on the NAV-to-NAV in US dollar from 2008 to 2022.Past performance is not indicative of future results. The above information is for illustrative purposes only.Bank saving rate is starting to fall from the peak we see last year. Many investors are very clear that its impossible to just rely on time deposit to fight against inflation. Invest in global multi asset portfolio will auto invest your return. In the long run, outperform the return of TD and inflation1.How can GoWealth help?Leveraging on AllianzGI’s data base2, the portfolio recommendation prepared by GoWealth, has already considered the correlation between asset classes. The key objective is to assist you in capturing market opportunities automatically in different markets!GoWealth, One-stop Fund Investment Advisory SolutionCapitalising on the power of technology and the investment expertise of AllianzGI, GoWealth offers our customers professional wealth advice in the most seamless way. From financial planning and investment portfolio recommendations, to fund transactions and financial goal tracking, all you need is WeLab Bank app, and it will bring you to your goals on autopilot3!How to use GoWealth Digital Wealth Advisory?Additional: New Featured FundsNote: This article is for information only and does not constitute any investment advice. Investment involves risks, please refer to the Important Notice herein for details. GoWealth Digital Advisory Services and fund investment are not deposit and not protected by Deposit Protection Scheme.1Diversification does not guarantee a profit or eliminate the risks involved in the investments. Past performance is not indicative of future results. We makes no representation or warranty regarding future performance.2The algorithm in the GoWealth Digital Wealth Advisory Services relies on the portfolio simulation database containing 12,000 simulation paths for the model portfolios projected over the next 50 years (i.e. 600 months), which reflects our capital market forecast on various asset classes and the model portfolios in terms of risk, return and correlations.3You may set up your investment goal via our Wealth Management Services on the WeLab Bank app, including the relevant investment horizon and one-time investment and monthly investment amounts. Our algorithm will recommend you a model portfolio based on your investment goal as well as your relevant personal circumstances. If you accept the recommendation, we will follow your instruction to process your one-time investment, and invest the monthly investment amount set by you in the model portfolio each month automatically. We will provide you various types of alerts/notifications, including but not limited to alerts/notifications about the status of your investment goal. However, such alerts/notifications are not investment advice. You may view the status of your investment goal and edit your investment goal on the WeLab Bank app according to your needs. The services are not discretionary asset management services. Any recommendation provided under the services is not a guarantee that you will achieve your investment goal.Importance NoticeThis document is for general information only. The information or opinion herein is not to be construed as professional investment advice or any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons.The information or opinion presented has been taken from sources (including but not limited to information providers and fund houses) believed to be reliable by WeLab Bank, but WeLab Bank makes no warranties or representation as to the accuracy, correctness, reliabilities or otherwise with respect to such information or opinion, and assume no responsibility for any omissions or errors in the content of this document. WeLab Bank does not take responsibility for nor does WeLab Bank endorse the information or opinion provided by any information provider or fund house.Past performance is not indicative of future results. WeLab Bank makes no representation or warranty regarding future performance. Any forecast contained herein as to likely future movements in interest rates, foreign exchange rates or market prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in interest rates, foreign exchange rates or market prices or actual future events or occurrences (as the case may be).You should not make any investment decision purely based on this document. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product(s). WeLab Bank accepts no liability for any direct, special, indirect, consequential, incidental damages or other loss or damages of any kind arising from any use of or reliance on the information or opinion herein. You should seek advice from independent financial adviser if needed.WeLab Bank is an authorised institution under Part IV of the Banking Ordinance and a registered institution under the Securities and Futures Ordinance (CE Number: BOJ558) to conduct Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities.This document is issued by WeLab Bank. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.